Brown-Forman (NYSE:BF.B) Misses Q2 Revenue Estimates, Stock Drops

Alcohol company Brown-Forman (NYSE:BF.B) fell short of analysts' expectations in Q2 FY2024, with revenue up 1.2% year on year to $1.11 billion. It made a GAAP profit of $0.50 per share, improving from its profit of $0.47 per share in the same quarter last year.

Is now the time to buy Brown-Forman? Find out by accessing our full research report, it's free.

Brown-Forman (BF.B) Q2 FY2024 Highlights:

Revenue: $1.11 billion vs analyst estimates of $1.15 billion (3.7% miss)

EPS: $0.50 vs analyst expectations of $0.50 (small miss)

Free Cash Flow of $29 million is up from -$11 million in the previous quarter

Gross Margin (GAAP): 60.6%, up from 56% in the same quarter last year

Organic Revenue was down 1% year on year

Brown-Forman’s President and Chief Executive Officer Lawson Whiting stated, “Our first half fiscal 2024 results illustrate Brown-Forman’s ability to deliver continued growth, even amid dynamic market conditions and very strong comparisons from the prior-year period. While we grew at a slower pace than anticipated, we delivered strong gross margin expansion and continued to invest strongly behind our brands. We continue to believe our premium portfolio and broad geographic footprint will position us for accelerated growth in the second half of the fiscal year.”

Best known for its Jack Daniel’s whiskey, Brown-Forman (NYSE:BF.B) is an alcoholic beverage company with a broad portfolio of brands in wines and spirits.

Beverages and Alcohol

The beverages and alcohol category encompasses companies engaged in the production, distribution, and sale of refreshments like beer, wine, and spirits, along with soft drinks, juices, and bottled water. These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the explosion of alcoholic craft beer drinks or the steady decline of non-alcoholic sugary sodas. The industry is highly competitive, with a diverse range of products from large multinational corporations, niche brands, and startups vying for market share. It's also subject to varying degrees of government regulation and taxation, especially for alcoholic beverages.

Sales Growth

Brown-Forman is larger than most consumer staples companies and benefits from economies of scale, giving it an edge over its smaller competitors.

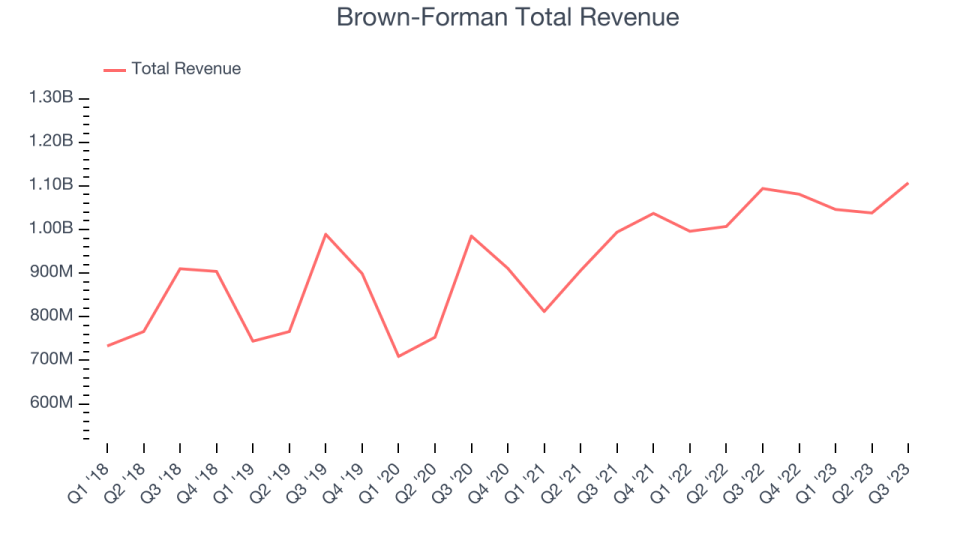

As you can see below, the company's annualized revenue growth rate of 8.5% over the last three years was decent for a consumer staples business.

This quarter, Brown-Forman's revenue grew 1.2% year on year to $1.11 billion, falling short of Wall Street's estimates. Looking ahead, analysts expect sales to grow 7% over the next 12 months.

While most things went back to how they were before the pandemic, a few consumer habits fundamentally changed. One founder-led company is benefiting massively from this shift and is set to beat the market for years to come. The business has grown astonishingly fast, with 40%+ free cash flow margins, and its fundamentals are undoubtedly best-in-class. Still, its total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

Organic Revenue Growth

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business's performance excluding the impacts of foreign currency fluctuations and one-time events such as mergers, acquisitions, and divestitures.

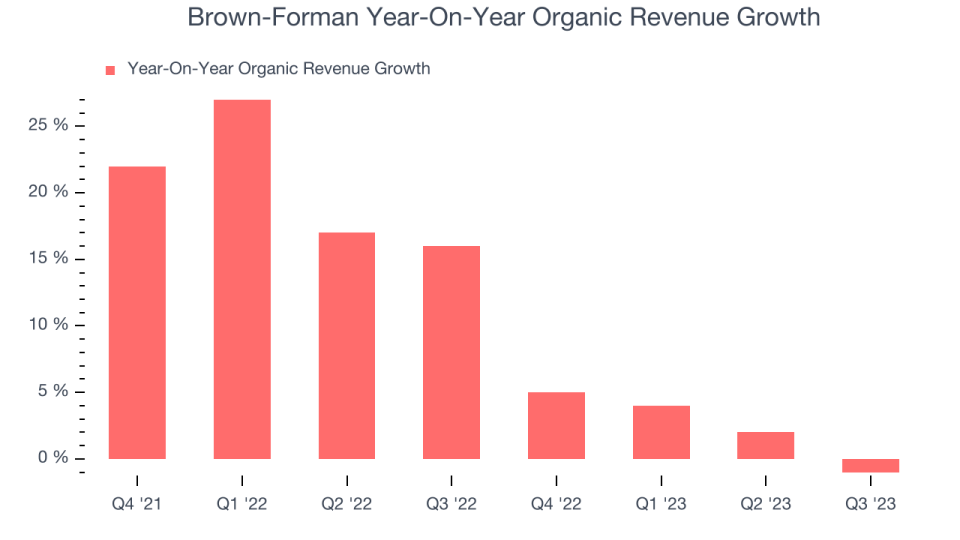

Brown-Forman's demand has outpaced the broader consumer staples sector over the last eight quarters. On average, the company has posted year-on-year organic revenue growth of 11.5%.

In the latest quarter, Brown-Forman's year on year organic sales were flat. By the company's standards, this growth was a meaningful deceleration from the 16% year-on-year increase it posted 12 months ago. We'll be watching Brown-Forman closely to see if it can reaccelerate growth.

Key Takeaways from Brown-Forman's Q2 Results

Sporting a market capitalization of $29.16 billion, more than $373 million in cash on hand, and positive free cash flow over the last 12 months, we believe that Brown-Forman is attractively positioned to invest in growth.

We enjoyed seeing Brown-Forman exceed analysts' gross margin expectations this quarter. That stood out as a positive in these results. On the other hand, its revenue missed Wall Street's estimates, and management lowered its full-year revenue and operating income guidance, citing that "global macroeconomic conditions continue to create a challenging operating environment tempering expectation[s]". Overall, this was a mixed quarter for Brown-Forman. The company is down 9.7% on the weak outlook and currently trades at $54.36 per share.

Brown-Forman may not have had the best quarter, but does that create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.