Brown-Forman (NYSE:BF.B) Reports Sales Below Analyst Estimates In Q3 Earnings, Stock Drops

Alcohol company Brown-Forman (NYSE:BF.B) fell short of analysts' expectations in Q3 FY2024, with revenue down 1.1% year on year to $1.07 billion. It made a GAAP profit of $0.60 per share, improving from its profit of $0.21 per share in the same quarter last year.

Is now the time to buy Brown-Forman? Find out by accessing our full research report, it's free.

Brown-Forman (BF.B) Q3 FY2024 Highlights:

Revenue: $1.07 billion vs analyst estimates of $1.12 billion (4.5% miss)

EPS: $0.60 vs analyst estimates of $0.57 (5.1% beat)

Full year guidance calls for "organic net sales to be flat, reflecting the slower than anticipated growth for the nine months" (below expectations)

Free Cash Flow of $196 million, up from $29 million in the previous quarter

Gross Margin (GAAP): 59.4%, up from 57.7% in the same quarter last year

Organic Revenue was down 2% year on year

Market Capitalization: $28.96 billion

Best known for its Jack Daniel’s whiskey, Brown-Forman (NYSE:BF.B) is an alcoholic beverage company with a broad portfolio of brands in wines and spirits.

Beverages and Alcohol

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the explosion of alcoholic craft beer drinks or the steady decline of non-alcoholic sugary sodas. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Sales Growth

Brown-Forman is larger than most consumer staples companies and benefits from economies of scale, giving it an edge over its smaller competitors.

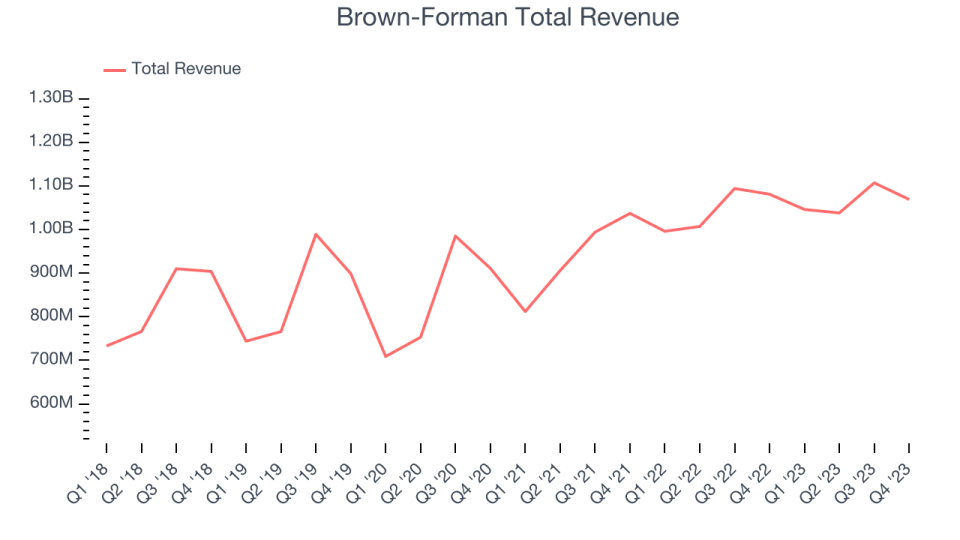

As you can see below, the company's annualized revenue growth rate of 8.3% over the last three years was decent for a consumer staples business.

This quarter, Brown-Forman missed Wall Street's estimates and reported a rather uninspiring 1.1% year-on-year revenue decline, generating $1.07 billion in revenue. Looking ahead, Wall Street expects sales to grow 4.3% over the next 12 months, an acceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Organic Revenue Growth

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business's performance excluding the impacts of foreign currency fluctuations and one-time events such as mergers, acquisitions, and divestitures.

Brown-Forman has generated solid demand for its products over the last two years. On average, the company's organic sales have grown by 8.5% year on year.

In the latest quarter, Brown-Forman's organic sales fell 2% year on year. This decline was a reversal from the 5% year-on-year increase it posted 12 months ago. We'll be keeping a close eye on the company to see if this turns into a longer-term trend.

Key Takeaways from Brown-Forman's Q3 Results

It was encouraging to see Brown-Forman slightly top analysts' EPS expectations this quarter. On the other hand, its revenue unfortunately missed analysts' expectations and its organic revenue missed Wall Street's estimates. The company's outlook for the full year was also weak. Specifically, Brown-Forman sees "organic net sales to be flat, reflecting the slower than anticipated growth for the nine months" and 0-2% operating profit growth, below expectations. Overall, this was a weaker quarter for Brown-Forman. The company is down 9.1% on the results and currently trades at $55.19 per share.

Brown-Forman may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.