Brown-Forman's (BF.B) Brands & Strategies Provide Growth Impetus

Brown-Forman Corporation (BF.B) has been in a good spot, courtesy of strength in its brands, mainly Jack Daniel’s Tennessee Whiskey. The company has been gaining from the premiumization of its portfolio and aggressive brand investments. The gains of these efforts have been well reflected in its share price.

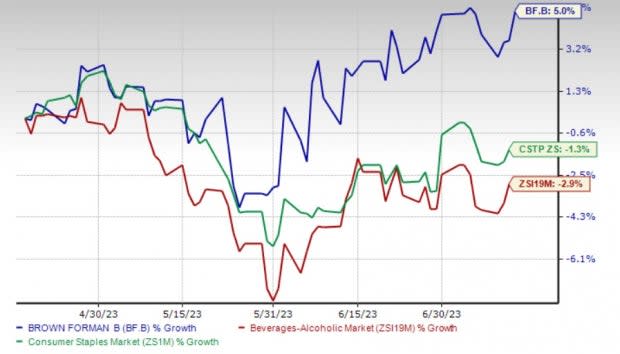

Shares of the Zacks Rank #3 (Hold) company have risen 5% in the past three months against the industry and the sector’s declines of 2.9% and 1.3%, respectively.

BF.B also remains on track with its long-term pricing strategy, which aims to increase prices year over year to grow sales as part of its revenue growth management initiatives. Consequently, management has issued an upbeat fiscal 2024 view.

Brown-Forman anticipates organic sales growth of 5-7% for fiscal 2024. The company remains optimistic about organic sales and organic operating income growth. It predicts trends to normalize after two consecutive years of double-digit organic sales growth. Based on the aforementioned assumptions, Brown-Forman expects the organic operating income to increase 6-8%, driven by lower supply-chain disruption costs, partly offset by continued input cost pressures.

The Zacks Consensus Estimate for BF.B’s fiscal 2024 sales and earnings suggests growth of 6.6% and 8.5%, respectively, from the year-ago period’s reported numbers.

Image Source: Zacks Investment Research

Robust Trends in Place

Brown-Forman has been displaying portfolio strength thanks to its ongoing premiumization efforts. The company’s underlying sales for fiscal 2023 were aided by its strong brand portfolio and growth across all geographic regions. Premium bourbon brands reported sales growth of 23% and organic sales growth of 24% in fiscal 2023, driven by double-digit growth in Woodford Reserve and Old Forester. An estimated rise in distributor inventories, along with higher volumes and pricing, boosted sales for Woodford Reserve and Old Forester.

New Mix reported sales growth of 53% and organic sales growth of 45%, driven by market share gains in Mexico, as well as higher volumes and prices. Brown-Forman’s tequila portfolio witnessed year-over-year sales growth of 10% each on a reported basis and organic basis. This was driven by double-digit sales growth for the el Jimador and Herradura brands.

Another key contributor to the company’s growth story has been the continued momentum of its Jack Daniel family of brands. Jack Daniel’s RTDs/Ready-to-Pours have been benefiting from the introduction of the Jack Daniel’s and Coca-Cola RTD, as well as the launch of Jack Daniel’s Bonded Tennessee Whiskey, resulting in year-over-year sales growth of 11% and 16% on an organic basis in fiscal 2024.

In fiscal 2023, net sales for Jack Daniel’s family of brands were up 4% on a reported basis and 9% on an organic basis. The brand’s sales were driven by solid demand, higher pricing and the estimated increase in distributor inventories. The upside in sales was also driven by the strength in Jack Daniel’s Tennessee Whiskey in the international markets and the Travel Retail channel.

What Holds Back the Stock

What could be a potential threat to Brown-Forman’s performance is the higher input costs and supply chain disruptions. Brown-Forman has witnessed several headwinds in fiscal 2023, including supply chain challenges, higher input costs due to inflation, the significant impact of negative foreign exchange and the impacts of the Russia-Ukraine war. Going ahead into fiscal 2024, inflation is likely to continue to negatively impact input costs.

Brown-Forman is also likely to continue witnessing higher advertising expenses due to continued investments in its brands.

Conclusion

Despite the threats, we believe that strength in Jack Daniel’s Tennessee Whiskey portfolio premiumization and pricing strategy are likely to offset inflation and cost woes.

Stocks to Consider

We highlighted some better-ranked stocks from the beverages space, namely The Duckhorn Portfolio NAPA, Molson Coors TAP and Coca-Cola FEMSA KOF.

Duckhorn currently carries a Zacks Rank #2 (Buy). NAPA has a trailing four-quarter earnings surprise of 14.2%, on average. Shares of NAPA have declined 13.1% in the past three months. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Duckhorn’s current financial-year sales and earnings suggests growth of 8.3% and 4.8%, respectively, from the year-ago period's reported figures. NAPA has an expected earnings per share (EPS) growth rate of 6.6% for three to five years.

Molson Coors currently carries a Zacks Rank #2. The company has an expected EPS growth rate of 4.3% for three to five years. Shares of TAP have rallied 17.1% in the past three months.

The Zacks Consensus Estimate for Molson Coors’ sales and EPS for the current financial year suggests growth of 5.3% and 10.2%, respectively, from the year-ago period’s reported figures. TAP has a trailing four-quarter earnings surprise of 32.1%, on average.

Coca-Cola FEMSA has a trailing four-quarter earnings surprise of 33.8%, on average. It currently carries a Zacks Rank #2. Shares of KOF have risen 1.7% in the past three months.

The Zacks Consensus Estimate for Coca-Cola FEMSA’s current financial-year sales and earnings suggests growth of 19.5% and 14.6%, respectively, from the year-ago period's reported figures. KOF has an expected EPS growth rate of 13.5% for three to five years.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Brown-Forman Corporation (BF.B) : Free Stock Analysis Report

Molson Coors Beverage Company (TAP) : Free Stock Analysis Report

Coca Cola Femsa S.A.B. de C.V. (KOF) : Free Stock Analysis Report

The Duckhorn Portfolio, Inc. (NAPA) : Free Stock Analysis Report