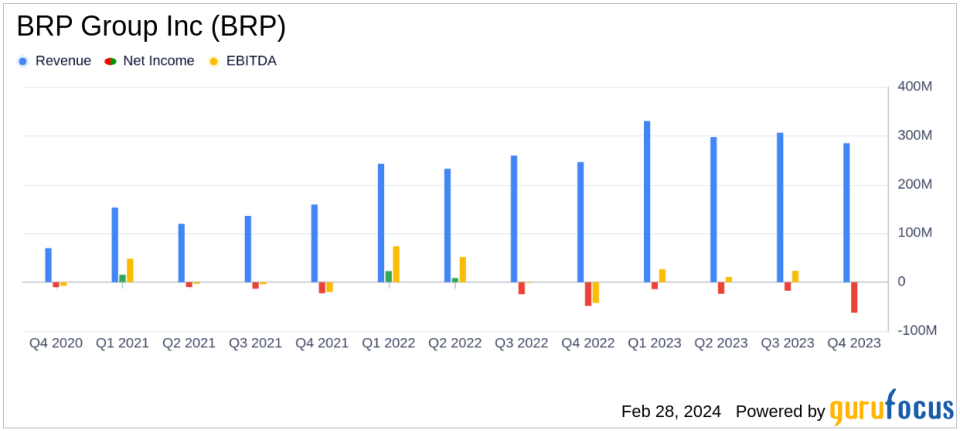

BRP Group Inc (BRP) Reports Strong Revenue Growth Amidst Net Losses in Q4 and Full Year 2023

Total Revenues: Increased by 16% in Q4 and 24% for the full year, reaching $284.6 million and $1.2 billion respectively.

Organic Revenue Growth: Achieved 15% growth in Q4 and 19% for the full year, showcasing robust underlying business health.

GAAP Net Loss: Reported a GAAP net loss of $62.5 million in Q4 and $164.0 million for the full year.

Adjusted Net Income: Adjusted Net Income stood at $16.2 million for Q4 and $131.1 million for the full year.

Adjusted EBITDA: Grew by 16% in Q4 to $45.6 million and 27% for the full year to $250.2 million, with margins expanding.

Liquidity: Cash and cash equivalents were $116.2 million with $259.0 million of borrowing capacity available.

On February 28, 2024, BRP Group Inc (NASDAQ:BRP), a leading insurance distribution firm, released its 8-K filing, disclosing its financial results for the fourth quarter and full year ended December 31, 2023. The company, which operates through segments including Middle Market, Specialty, Mainstreet, and Medicare, saw a significant increase in total revenues, driven by robust organic growth. Despite this, BRP Group reported a GAAP net loss for both the quarter and the full year.

Financial Performance and Challenges

BRP Group's revenue growth is a testament to the company's ability to expand its market share and enhance its service offerings. However, the reported GAAP net losses highlight the challenges faced in terms of expenses outpacing revenue growth. CEO Trevor Baldwin emphasized the company's focus on expense rationalization and the drive towards profitable organic growth and margin expansion. The company's ability to manage its expenses and improve its free cash flow will be crucial in strengthening its balance sheet and delivering long-term shareholder value.

Financial Achievements and Industry Significance

The insurance industry is highly competitive, and BRP Group's ability to achieve double-digit organic revenue growth is significant. This growth, coupled with a 27% year-over-year increase in Adjusted EBITDA, indicates the company's operational efficiency and its success in capitalizing on market opportunities. The Adjusted EBITDA Margin of 21% for the full year reflects the company's focus on profitability and is a critical metric for assessing the company's financial health relative to its peers.

Key Financial Metrics

BRP Group's balance sheet shows a solid liquidity position with over $116 million in cash and cash equivalents. The Adjusted Net Income figures provide a clearer picture of the company's profitability by excluding non-recurring items and other adjustments. These metrics are important as they help investors understand the company's operational performance and its ability to generate profit from its core business activities.

"We capped 2023 with another solid quarter of double-digit organic growth, leading us to generate full year organic revenue growth of nearly 20% and further illustrating the power and underlying health of our platform," said Trevor Baldwin, Chief Executive Officer of BRP Group.

BRP Group's performance in 2023 reflects a company that is growing its top line effectively. However, the net losses reported indicate that there are still challenges to be addressed. The company's focus on margin expansion and cash flow improvement will be key to its future success and ability to deliver value to shareholders.

For a more detailed analysis of BRP Group Inc's financial results, including income statements and balance sheets, investors and interested parties are encouraged to visit the company's investor relations website and review the full 8-K filing.

Explore the complete 8-K earnings release (here) from BRP Group Inc for further details.

This article first appeared on GuruFocus.