Bruce Berkowitz Bolsters Berkshire Hathaway Stake by 139.81%

Insight into the Fairholme Fund (Trades, Portfolio)'s Q4 2023 Investment Moves

Bruce Berkowitz (Trades, Portfolio), the esteemed founder and Managing Member of the Fairholme Fund (Trades, Portfolio), has made notable changes to his investment portfolio in the fourth quarter of 2023. Known for his concentrated investment approach and admiration for Benjamin Graham's "The Intelligent Investor," Berkowitz seeks out companies with exceptional management, robust free cash flow, and attractive valuations. His latest N-PORT filing reveals strategic adjustments, including a significant increase in his Berkshire Hathaway Inc. position and the complete exit from Home BancShares Inc.

Key Position Increases

Bruce Berkowitz (Trades, Portfolio) has augmented his holdings in two stocks during the last quarter. Notably:

Berkshire Hathaway Inc (NYSE:BRK.B) saw an addition of 71,685 shares, bringing the total to 122,958 shares. This move marks a substantial 139.81% increase in share count and a 1.64% impact on the current portfolio, valued at $43,854,200.

Enterprise Products Partners LP (NYSE:EPD) also experienced an increase with an additional 144,200 shares, resulting in a total of 5,208,400 shares. This adjustment signifies a 2.85% increase in share count, with a total value of $137,241,340.

Summary of Sold Out Positions

In a decisive move, Berkowitz has completely divested from one holding in the fourth quarter of 2023:

Home BancShares Inc (NYSE:HOMB) was entirely sold off, with 103,400 shares liquidated, impacting the portfolio by -0.15%.

Key Position Reductions

Additionally, Berkowitz trimmed positions in three stocks, with significant reductions in:

Bank OZK (NASDAQ:OZK) by 96,300 shares, leading to a -65.29% decrease in shares and a -0.25% impact on the portfolio. The stock's average trading price was $41.21 during the quarter, with a 3-month return of 5.15% and a year-to-date decline of -13.78%.

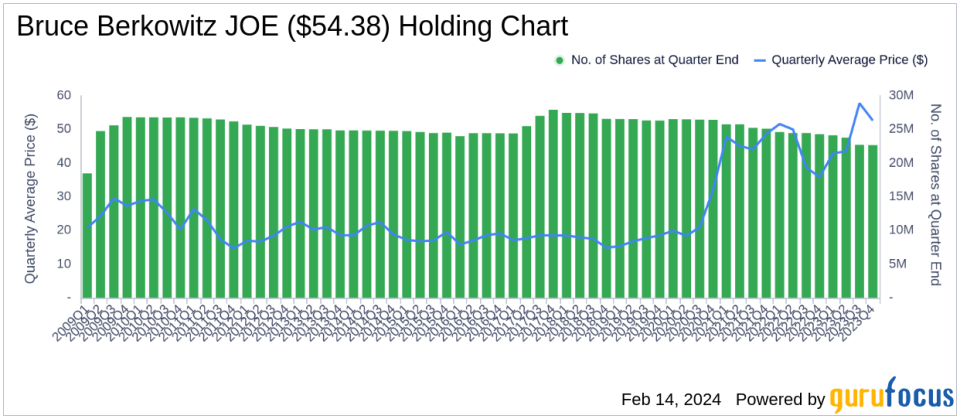

The St. Joe Co (NYSE:JOE) by 32,600 shares, resulting in a -0.14% reduction in shares and a -0.13% impact on the portfolio. The stock's average trading price was $52.62 during the quarter, with a 3-month return of 4.37% and a year-to-date decrease of -9.94%.

Portfolio Overview

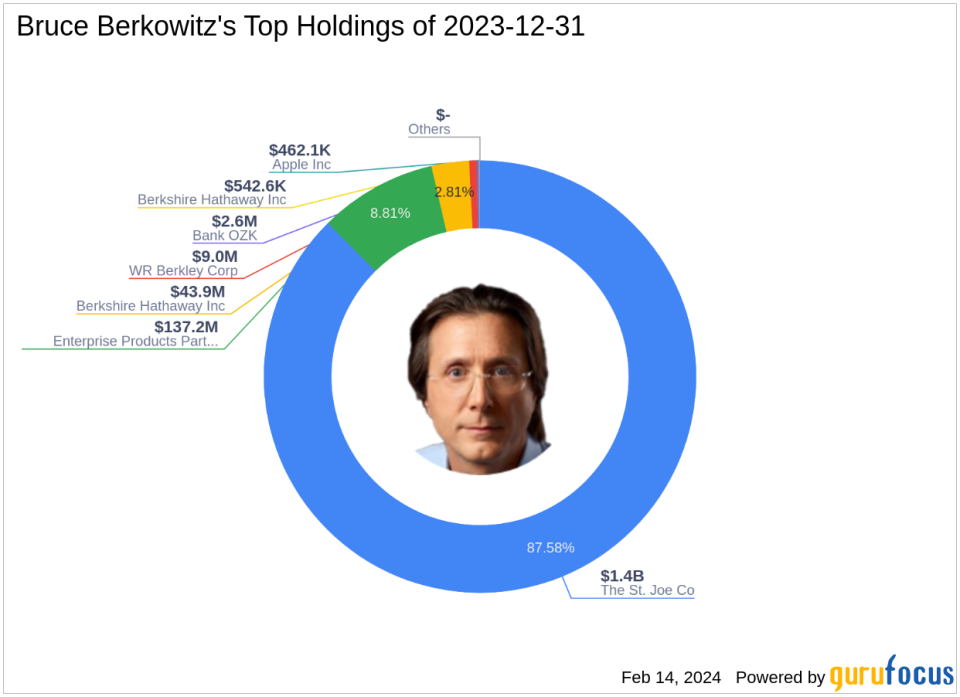

As of the fourth quarter of 2023, Bruce Berkowitz (Trades, Portfolio)'s portfolio comprises 7 stocks, with the top holdings being 87.58% in The St. Joe Co (NYSE:JOE), 8.81% in Enterprise Products Partners LP (NYSE:EPD), 2.81% in Berkshire Hathaway Inc (NYSE:BRK.B), 0.57% in WR Berkley Corp (NYSE:WRB), and 0.16% in Bank OZK (NASDAQ:OZK). The investments are primarily concentrated in four industries: Real Estate, Energy, Financial Services, and Technology.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.