Bruce Berkowitz Trims Stake in The St. Joe Co

On August 15, 2023, renowned investor Bruce Berkowitz (Trades, Portfolio) reduced his stake in The St. Joe Co (NYSE:JOE), a leading real estate development and asset management company. This article provides an in-depth analysis of the transaction, the guru's profile, and the traded company's financial health and performance metrics.

Details of the Transaction

Berkowitz's firm, Fairholme Capital Management, sold 638,200 shares of The St. Joe Co at a price of $61 per share. This transaction resulted in a -2.73% change in the guru's holdings and had a -2.96% impact on his portfolio. Despite the reduction, The St. Joe Co remains a significant holding for Berkowitz, accounting for 108.56% of his portfolio and 38.90% of the company's total shares.

Profile of the Guru: Bruce Berkowitz (Trades, Portfolio)

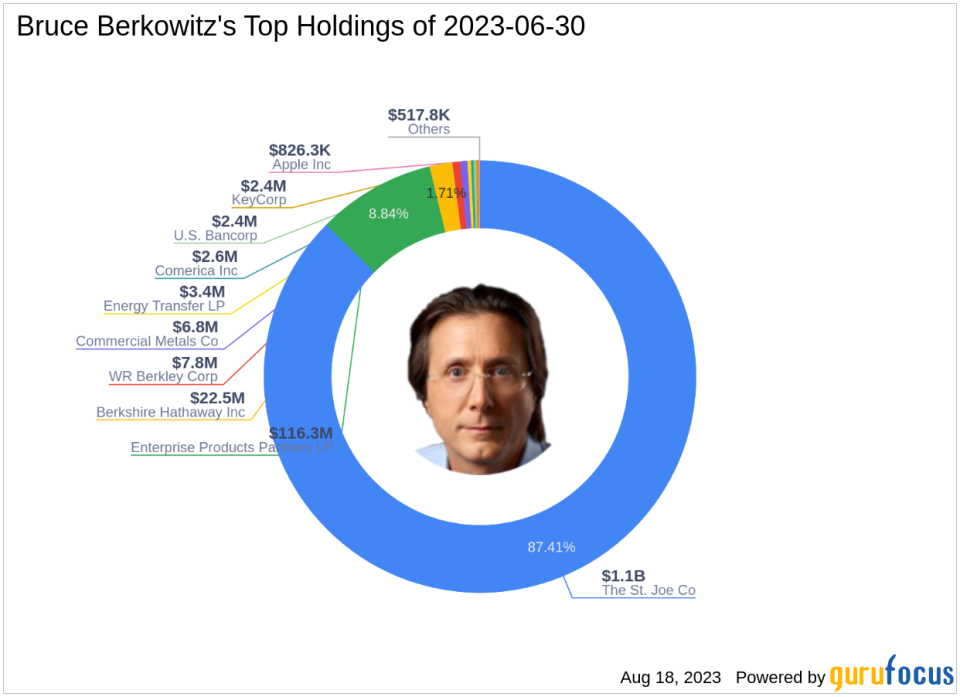

Bruce Berkowitz (Trades, Portfolio) is the founder and Managing Member of Fairholme Capital Management. Before establishing his firm, he served as a Managing Director of Smith Barney, Inc. from December 1993 to October 1997. Berkowitz's investment philosophy is inspired by Benjamin Graham's "The Intelligent Investor". He prefers to concentrate his investments in a small number of companies, favoring those with exceptional management, strong free cash generation, and undervalued stocks. His top holdings include Berkshire Hathaway Inc(NYSE:BRK.B), Commercial Metals Co(NYSE:CMC), Enterprise Products Partners LP(NYSE:EPD), The St. Joe Co(NYSE:JOE), and WR Berkley Corp(NYSE:WRB). His firm's equity stands at $1.32 billion, with Real Estate and Energy being the top sectors.

Overview of The St. Joe Co

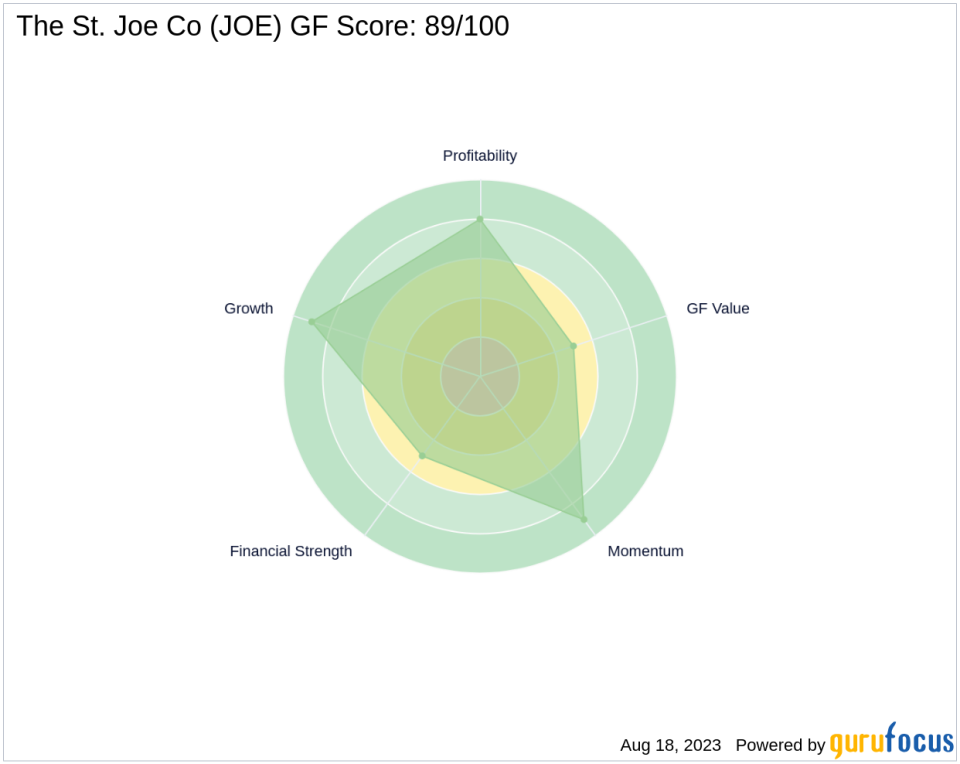

The St. Joe Co, based in the USA, is a real estate development, asset management, and operating company with a market capitalization of $3.49 billion. The company operates in four segments: Commercial, Hospitality, Other, and Residential. As of August 18, 2023, the company's stock price stands at $59.81, with a PE percentage of 40.69. According to GuruFocus, the stock is fairly valued with a GF Value of 65.79. The company's GF Score is 89/100, indicating good outperformance potential.

Analysis of The St. Joe Co's Financial Health

The St. Joe Co's financial strength is reflected in its balance sheet, profitability, and growth ranks. The company has a Financial Strength rank of 5/10, a Profitability Rank of 8/10, and a Growth Rank of 9/10. The company's cash to debt ratio is 0.14, and its interest coverage is 3.21. The St. Joe Co's ROE and ROA ranks are 291 and 298, respectively. The company's gross margin growth is 3.30%, and its operating margin growth is 35.40%.

Momentum and Predictability of The St. Joe Co's Stock

The St. Joe Co's stock has shown strong momentum, with a Momentum Rank of 9/10. The stock's RSI 14 Day Rank is 1409, indicating a neutral momentum. However, the company's predictability rank is not available.

Other Gurus' Investment in The St. Joe Co

Besides Berkowitz, other gurus like Mario Gabelli (Trades, Portfolio) also hold shares in The St. Joe Co, further validating the company's investment potential.

Conclusion

In conclusion, Bruce Berkowitz (Trades, Portfolio)'s recent transaction in The St. Joe Co is noteworthy for value investors. Despite the reduction, the company remains a significant holding in his portfolio. The St. Joe Co's strong financial health, growth potential, and momentum make it an attractive investment. However, investors should always conduct their due diligence before making investment decisions.

This article first appeared on GuruFocus.