Bruce Berkowitz Trims Stake in The St. Joe Co

On July 28, 2023, Bruce Berkowitz (Trades, Portfolio), the founder and Managing Member of the Fairholme Fund (Trades, Portfolio), reduced his stake in The St. Joe Co (NYSE:JOE), a prominent real estate development and asset management company. This article will delve into the details of the transaction, provide an overview of Berkowitz's investment philosophy, and analyze the performance of The St. Joe Co's stock.

Details of the Transaction

The transaction saw Berkowitz sell 791,500 shares of The St. Joe Co at a price of $64.51 per share. This move resulted in a -3.28% change in his holdings and had a -4.22% impact on his portfolio. Despite the reduction, Berkowitz still holds a significant position in the company, with 23,349,948 shares as of July 28, representing 40% of his holdings and a portfolio weight of 130.08%.

Profile of Bruce Berkowitz (Trades, Portfolio)

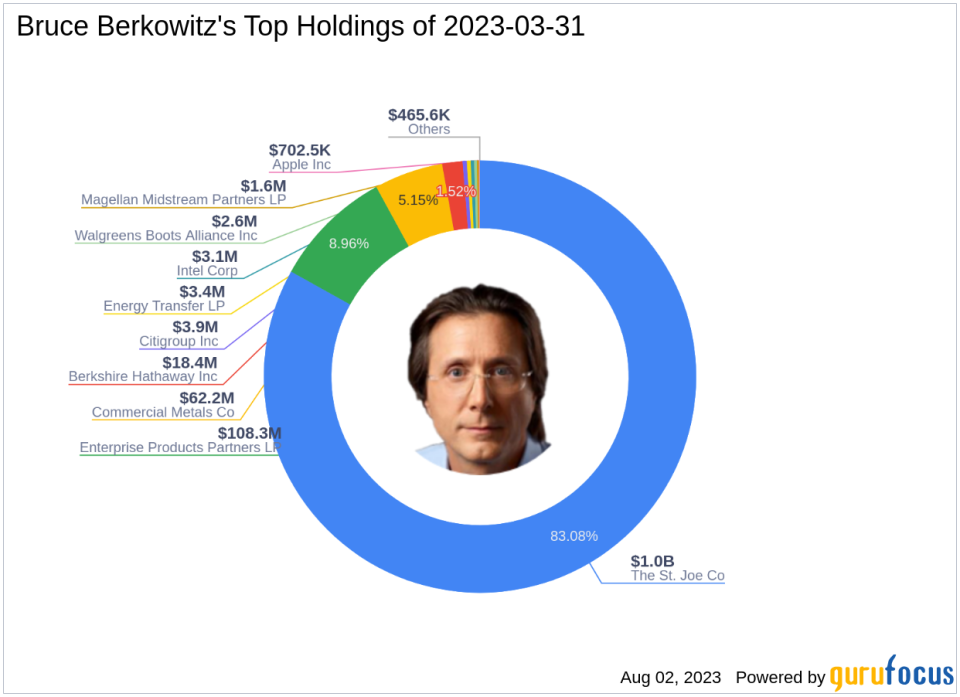

Bruce Berkowitz (Trades, Portfolio) is a renowned value investor and the founder of the Fairholme Fund (Trades, Portfolio). Before establishing Fairholme Capital Management, he served as a Managing Director of Smith Barney, Inc. from December 1993 to October 1997. Berkowitz's investment philosophy is heavily influenced by Benjamin Graham's "The Intelligent Investor". He prefers to concentrate his investments in a small number of companies, favoring those with exceptional management, strong free cash generation, and undervalued stocks. His top holdings include Berkshire Hathaway Inc (NYSE:BRK.B), Citigroup Inc (NYSE:C), Commercial Metals Co (NYSE:CMC), Enterprise Products Partners LP (NYSE:EPD), and The St. Joe Co (NYSE:JOE). His portfolio is primarily focused on the Real Estate and Energy sectors, with a total equity of $1.21 billion.

Overview of The St. Joe Co

The St. Joe Co, based in the USA, is a leading real estate development, asset management, and operating company. It operates through four segments: Commercial, Hospitality, Other, and Residential. The company's market capitalization stands at $3.67 billion, with a current stock price of $62.9. Since its IPO on March 10, 1992, the company's stock has seen a significant increase of 526.49%, with a year-to-date increase of 60.46%.

Analysis of The St. Joe Co's Stock

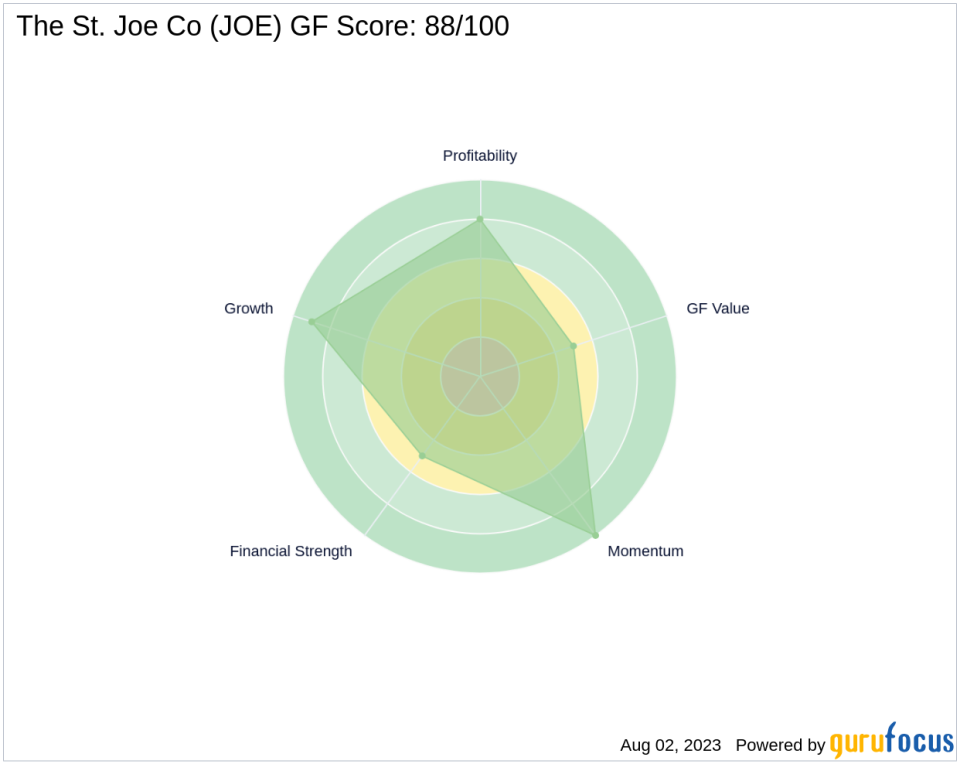

The St. Joe Co's stock has a price-earnings ratio of 42.79, indicating a profitable operation. According to GuruFocus's GF Valuation, the stock is fairly valued, with a GF Value of $65.26 and a Price to GF Value ratio of 0.96. The stock's GF Score is 88/100, suggesting good outperformance potential. The company's Balance Sheet, Profitability, and Growth ranks are 5/10, 8/10, and 9/10 respectively, while its GF Value and Momentum ranks are 5/10 and 10/10 respectively. Although the company has a poor Piotroski F-Score of 3, St. Joe's Altman Z-Score of 3.52 indicates moderately-strong financial stability.

Comparison with Other Gurus

Berkowitz is not the only guru with a stake in The St. Joe Co. Mario Gabelli (Trades, Portfolio) also holds shares in the company. However, Berkowitz's position is significantly larger, with Fairholme Capital Management being the largest guru shareholder in the company.

Conclusion

In conclusion, Bruce Berkowitz (Trades, Portfolio)'s recent transaction in The St. Joe Co represents a strategic move in line with his investment philosophy. Despite the reduction, he maintains a substantial position in the company, reflecting his confidence in its potential. The St. Joe Co's strong performance and promising GF Score further validate this confidence. As always, investors are advised to conduct their own thorough research before making investment decisions.

This article first appeared on GuruFocus.