Bruker (BRKR) Advances Novel 4D-Proteomics Capabilities

Bruker Corporation BRKR recently introduced advances in instrumental methods, consumables and software for 4D-Proteomics, MALDI HiPLEX-IHC spatial tissue proteomics, 4D-Lipidomics and 4D-Metabolomics.

This latest development broadens the BSI (Bruker Scientific Instruments) Life Science segment’s product line.

Latest Advancements in Instruments

Bruker announces TIMSquant, a scalable, CCS-enabled, label-free quantification technique included in Bruker ProteoScape. Using global retention time and collision cross-section (CCS) prediction models, TIMSquant accurately quantifies the peptides and proteins found in 100s or 1000s of samples.

Selected improvements to Bruker's time control acquisition software, which incorporates the 300 Hz PASEF and VistaScan technologies, are available as downloads from the Bruker website. Up to 18,000 CCS-enabled MS/MS spectra can now be acquired per minute with relatively brief LC gradients using the 300Hz dda-PASEF acquisition.

To accurately quantify approximately 3,500 protein groups using PreOmics ENRICH-iST microbeads (SP3 technology) from small sample amounts and various species without antibodies or aptamers, Bruker, together with PreOmics and Biognosys are now offering improved high-throughput, affordable, medium-depth plasma proteomics kits and CRO services.

Image Source: Zacks Investment Research

For optimal timsTOF performance, the business also unveiled Novel TwinScape, a digital twin. The business improved the spatial tissue proteomics MALDI HiPLEX-IHC workflow.proteomics workflow for MALDI HiPLEX-IHC.

Benefits of Latest Advancement

Bruker’s Discovery platform is built on the open software ecosystem supplied by Bruker. The company has an advantage in distinguishing substances from nature more accurately thanks to their CCS-enabled procedures. Bruker’s commitment to innovation and customer support makes it a great partner and helps achieve its mission of translating nature into medicine.

Industry Prospects

Per a report by Grand View Research, the global proteomics market size was valued at $ 22.30 billion in 2021 and is expected to expand at a CAGR of 13.5% from 2022 to 2030. Key factors driving the industry growth include the growing demand for personalized medicines & advanced diagnostics in targeted disease treatment and the high prevalence of target diseases.

Recent Developments

In June 2023, Bruker’s majority-owned business, PreOmics, recently announced the availability of its new ENRICH-iSTTM kits that enable biologically unbiased enrichment of less abundant plasma and serum proteins onto non-functionalized paramagnetic particles. This technology increases the typical depths of plasma proteomics analysis by 50% to more than 100% compared with neat plasma or serum proteomics without depletion or enrichment.

In June 2023, Bruker announced transformative sensitivity on the 4D-Proteomics timsTOF platform by launching the timsTOF Ultra mass spectrometer at the 71st ASMS meeting. The company also introduced VistaScan software for enhanced dia-PASEF 4D-Proteomics.

Price Performance

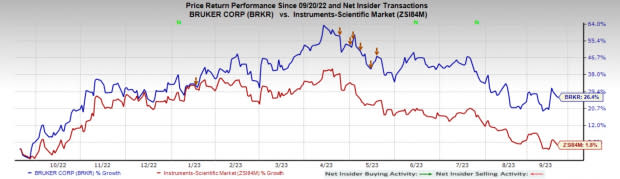

In the past year, BRKR shares have gained 26.4% compared with the industry’s rise of 1.8%.

Zacks Rank and Key Picks

Bruker currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Haemonetics HAE, HealthEquity, Inc. HQY and SiBone SIBN. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Haemonetics’ stock has risen 19.9% in the past year. Earnings estimates for Haemonetics have increased from $3.56 to $3.74 in 2023 and $3.96 to $4.07 in 2024 in the past 30 days. It currently carries Zacks Rank #1.

HAE’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 19.39%. In the last reported quarter, it posted an earnings surprise of 38.16%

HealthEquity, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 23.5%. HQY’s earnings surpassed estimates in all the trailing four quarters, with an average of 13%.

HealthEquity has lost 3.9% compared with the industry’s 10.2% decline over the past year.

Estimates for SiBone’s2023 loss have narrowed from $1.42 to $1.27 per share in the past 30 days. Shares of the company have increased 31% in the past year compared with the industry’s rise of 1.9%. It currently carries Zacks Rank #2.

SIBN’s earnings beat estimates in all the trailing four quarters, the average surprise being 20.37%. In the last reported quarter, SiBone delivered an earnings surprise of 26.83%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

Bruker Corporation (BRKR) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

SiBone (SIBN) : Free Stock Analysis Report