Bruker (BRKR) Advances in Proteomics Workflow With New Pacts

Bruker BRKR has announced new developments in the growing field of proteomics workflow. The company noted three advancements in collision cross section (CCS)-enabled 4D proteomics workflow at the virtual 20th Human Proteome Organization World Congress, HUPO Reconnect 2021. These developments are based on Bruker’s timsTOF multiomics platform within its mass spectrometry business.

The first update involved Bruker’s co-marketing agreement with Cellenion on the cellenONE single-cell isolation and nanoliter dispensing robotic platform. This partnership will provide timsTOF SCP users with an end-to-end solution on label-free 4D single-cell proteomics (SCP). According to Bruker, cellenONE, based on its unique feature of minimal perturbation to the integrity of the live cell, enables high-throughput, automated dispensing of individual cells from cell suspensions. It is also suitable for reagent dispensing, enabling miniaturized sample preparation protocols on those isolated cells.

Per the Cellenion spokesperson, this tie-up is going to be strategic, combining Cellenion’s expertise in precision dispensing and platform technology for up to 100% single-cell isolation accuracy and Bruker’s expertise in developing mass spectrometers such as the timsTOF SCP for single-cell proteomics.

The second advancement that Bruker announced was the progress in collaboration with Seer Proteograph. According to the company, the combination of Seer’s Proteograph Product Suite and timsTOF platforms allows researchers to make deeper findings into the plasma proteome, detecting protein variation at the amino acid level. Seer’s spokesperson stated that in a recently presented joint study, both the companies demonstrated that the Proteograph Product Suite enables quantification of more than 3,000 proteins from a single pooled human plasma sample within only 60 minutes of acquisition time on the timsTOF SCP.

The third development that Bruker mentioned at HUPO ReCONNECT 2021 was its expanded partnership with PreOmics on BeatBox technology for tissue proteomics. Bruker is currently co-marketing new PreOmics BeatBox for high-throughput, high-performance tissue, biopsy and cell culture homogenization prior to enzymatic digestion and timsTOF 4D proteomics.

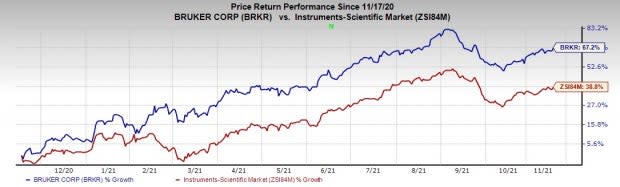

Image Source: Zacks Investment Research

According to Bruker, the complete BeatBox-timsTOF workflow from tissue sample to high-quality proteomic data is below four hours and can homogenize 96 tissue samples in parallel in 10 minutes. The new BeatBox technology provides the highest protein yields with up to 3x increases and shows good reproducibility across different tissues in comparison to other homogenization solutions.

Advancements a Strategic Fit

Bruker noted that because of the complex sample preparation protocols, the widespread adoption of proteomics had been limited. However, the situation is going to improve with the company’s collaboration with industry-leading partners on higher performance, automated workflows in three key areas, which are single-cell proteomics, plasma proteomics and tissue proteomics.

Going by a Market Research Future report, the global proteomics market size was $23.2 billion in 2017. It is expected to witness a CAGR of 14.1% till 2023.

Share Price Performance

Over the past year, Bruker has outperformed the industry it belongs to. The stock has gained 67.3% compared with the industry’s 38.8% rise.

Zacks Rank and Key Picks

Bruker currently carries a Zacks Rank #3 (Hold).

A few better-ranked stocks from the broader medical space are Thermo Fisher Scientific Inc. TMO, Laboratory Corporation of America Holdings, or LabCorp LH and Medpace Holdings, Inc. MEDP.

Thermo Fisher Scientific, carrying a Zacks Rank #2 (Buy), reported third-quarter 2021 adjusted earnings per share (EPS) of $5.76, which surpassed the Zacks Consensus Estimate by 23.3%. Revenues of $9.33 billion outpaced the Zacks Consensus Estimate by 12%.

Thermo Fisher has an estimated long-term growth rate of 14%. Thermo Fisher surpassed estimates in the trailing four quarters, the average surprise being 9.02%.

LabCorp reported third-quarter 2021 adjusted EPS of $6.82, which surpassed the Zacks Consensus Estimate by 42.9%. Revenues of $4.06 billion outpaced the Zacks Consensus Estimate by 13.4%. It currently carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

LabCorp has an estimated long-term growth rate of 10.6%. LabCorp surpassed estimates in the trailing four quarters, the average surprise being 25.7%.

Medpace reported third-quarter 2021 adjusted EPS of $1.29, surpassing the Zacks Consensus Estimate by 20.6%. Revenues of $295.57 million beat the Zacks Consensus Estimate by 1.2%. It currently carries a Zacks Rank #1.

Medpace has an estimated long-term growth rate of 16.4%. Medpace surpassed estimates in the trailing four quarters, the average surprise being 11.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Laboratory Corporation of America Holdings (LH) : Free Stock Analysis Report

Thermo Fisher Scientific Inc. (TMO) : Free Stock Analysis Report

Bruker Corporation (BRKR) : Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report

To read this article on Zacks.com click here.