Bruker Corp (BRKR) Posts Strong Revenue Growth Amidst Mixed Profitability Signals

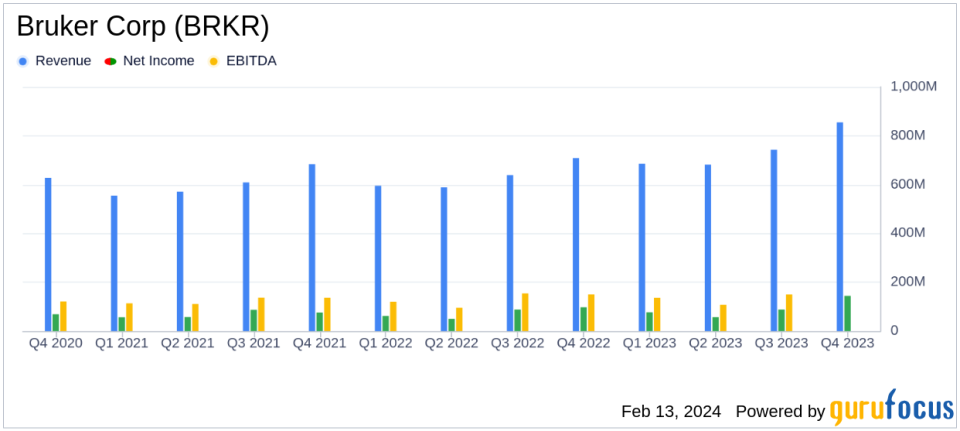

Revenue Growth: Q4 2023 revenues surged by 20.6% year-over-year to $854.5 million, with full-year revenues climbing 17.1% to $2.96 billion.

Earnings Per Share (EPS): Q4 GAAP EPS stood at $1.41, bolstered by a gain from the PhenomeX acquisition, while non-GAAP EPS dipped by 5.4% year-over-year to $0.70.

Profitability: Full-year non-GAAP EPS increased by 10.3% to $2.58, with organic revenue growth contributing significantly.

Operating Margin: Q4 non-GAAP operating margin decreased by approximately 290 basis points year-over-year to 18.1%.

2024 Outlook: Bruker anticipates 8% to 10% constant-exchange rate (CER) revenue growth for 2024, with organic growth projected at 5% to 7%.

Bruker Corp (NASDAQ:BRKR) released its 8-K filing on February 13, 2024, detailing its financial results for the fourth quarter and the full year ended December 31, 2023. The company, a leading manufacturer of scientific instruments and diagnostic tests for the life sciences, pharmaceutical, and biotechnology industries, reported a significant increase in revenues, driven by robust organic growth across its operating segments.

Bruker's President and CEO, Frank Laukien, remarked on the company's transformation into a fast-growth entity, with three consecutive years of double-digit organic revenue growth. He noted, "Brukers transformation into a fast-growth company is on track after three consecutive years of double-digit organic revenue growth. Remarkably, in 2023 our industry-leading 14.5% organic revenue growth included double-digit growth from each of our four groups."

"For the full year 2023, we also delivered 10.3% non-GAAP EPS growth, while investing significantly in R&D, capacity and productivity. This shows the resiliency of our innovation model and exemplifies our focus on disciplined entrepreneurialism," Laukien added.

The company's financial achievements, particularly in revenue growth, are significant in the context of the Medical Devices & Instruments industry, where innovation and the ability to adapt to market demands are critical for success. Bruker's performance reflects its strong market position and the successful integration of acquisitions such as PhenomeX.

However, the company faced challenges in profitability, as evidenced by the decrease in non-GAAP operating margin and a slight dip in non-GAAP EPS for Q4 2023. The non-GAAP operating margin for the full year also saw a decrease of approximately 160 basis points compared to the previous year. These figures suggest that while Bruker is growing its top line, it is also encountering pressures on its profitability metrics, which investors should monitor closely.

Looking ahead, Bruker expects continued growth in 2024, with a positive outlook for revenue and non-GAAP EPS. The company's guidance reflects confidence in its ability to maintain momentum and capitalize on market opportunities.

For a detailed analysis of Bruker Corp's financials and future prospects, investors are encouraged to review the full earnings report and consider the company's strategic position within the industry.

Contact information for investor relations at Bruker Corporation is provided for those seeking further details or wishing to engage with the company's financial team.

Explore the complete 8-K earnings release (here) from Bruker Corp for further details.

This article first appeared on GuruFocus.