Bruker Corporation (BRKR) Hits 52-Week High: What's Driving It?

Shares of Bruker Corporation BRKR reached a new 52-week high of $94.86 on Mar 21 before closing the session marginally lower at $94.27.

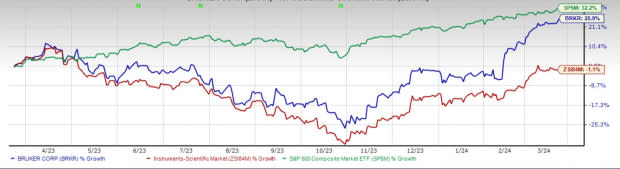

In the past year, this Zacks Rank #3 (Hold) stock has risen 25.9% against a 1.1% decline of the industry and the S&P 500 composite’s rise of 32.2%.

Over the past five years, Bruker registered earnings growth of 13%, comparing favorably with the industry’s 5.1% rise. The company has an expected long-term earnings growth rate of 14.4%. Bruker’s earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 11.42%.

Bruker is witnessing an upward trend in its stock price, prompted by the promising prospects of the Bruker Scientific Instruments (“BSI”) NANO division. Further, optimism led by the strategic initiatives within Bruker BioSpin and an impressive fourth-quarter 2023 performance are expected to contribute to the growth. However, the impact of currency fluctuations and uncertain macroeconomic conditions are major downsides.

Let’s delve deeper.

Key Growth Drivers

Strong Prospects of the BSI Nano Group: Over the past few quarters, NANO’s microelectronics and semiconmetrology tools boomed with strong bookings and a strong backlog. Throughout 2023, the NANO surface division and advanced X-ray delivered strong revenue growth. Bruker NANO Life Science fluorescence microscopy is gaining from product innovation and research demand and also includes a strong contribution from the 2022 acquisition of Inscopix neuroscience research tools.

In the fourth quarter of 2023, the company introduced Hysitron TI 990 TriboIndenter with superior levels of performance, automation and productivity in nanomechanical testing. Bruker earlier acquired the renowned functional cell biology company, PhenomeX (presently Bruker Cellular Analysis division), expanding Bruker’s footprint in translational research, clinical research and biopharma and also helping its Project Accelerate 2.0 initiative. BRKR is currently working on rightsizing the business and optimizing cost structures.

Image Source: Zacks Investment Research

BioSpin’s Robust Prospects: Bruker BioSpin’s products have specific applications in structural proteomics, drug discovery, research and food and materials science fields. In 2023, the segment grew across the biopharma, academic, government, industrial research and applied markets and in the new integrated data solutions or IDS division.

BRKR leveraged its innovations to support the advanced life and materials science research infrastructure in the United Kingdom, a pivotal move for the advancement of science, drug discovery and a green-tech economy. Bruker received orders for 1.2 gigahertz NMRs to be placed at the University of Warwick and the University of Birmingham. Both institutions already have the Bruker 1.0 GHz NMR spectrometer installed. In the United States, the company installed the first 1.2 gigahertz NMR at Ohio State University and the 1.1 gigahertz NMR at the University of Wisconsin at Madison during the fourth quarter of 2023.

Q4 Performance: Bruker delivered robust 15.9% organic revenue growth in the fourth quarter of 2023 and also surpassed both revenue and earnings estimates. The impressive growth can be attributed to the company’s fundamental commitment to innovations and delivering high-value solutions for customers and the ongoing portfolio transformation. 2023 also marked the third consecutive year of double-digit organic revenue growth and solid EPS growth while investing significantly in R&D, capacity and productivity and selected strategic bolt-on acquisitions.

Downsides

Exposed to Currency Movement: As Bruker generates a substantial portion of its revenues from several international markets, it is exposed to currency fluctuations that result in foreign currency transaction losses for the company. These could also cause the price of Bruker’s products to be less competitive than its principal competitors' offerings.

In the fourth quarter of 2023, the non-GAAP gross margin performance was unfavorably affected by foreign exchange fluctuations. This is expected to remain a headwind for Bruker in the first quarter of 2024 as well, leading to a softer operating margin forecast.

Macroeconomic Factors: Many of the countries in which Bruker operates experience uncertain economic conditions. Likewise, the company tends to be impacted by unfavorable changes in economic or political conditions, adverse interest rates or tax rates, volatile financial and commodity markets, contraction in the availability of credit in the marketplace and changes in capital spending patterns.

Moreover, continued volatility in global financial markets might impact Bruker’s customers from obtaining adequate financing, which may lead to a drop in sales volume and impact the company’s operational results and cash flow. The economic downturn could also cause an increase in pricing and cost pressures for Bruker’s products and services, potentially impacting its operating margins and profitability. In the fourth quarter of 2023, the company’s cost of revenues increased 23.9% year over year, causing the gross margin to fall by 129 basis points.

Key Picks

Some better-ranked stocks in the broader medical space are Cardinal Health CAH, Stryker SYK and DaVita DVA.

Cardinal Health, carrying a Zacks Rank #2 (Buy) at present, has a long-term estimated earnings growth rate of 14.2% compared with the industry’s 11.6%. CAH’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 15.6%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Cardinal Health’s shares have surged 63.1% compared with the industry’s 17.9% rise in the past year.

Stryker, carrying a Zacks Rank #2 at present, has an estimated long-term earnings growth rate of 10.3%. SYK’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 5.1%.

Shares of the company have increased 28.9% compared with the industry’s 7.1% rise over the past year.

DaVita, sporting a Zacks Rank #1 at present, has an estimated long-term earnings growth rate of 12.1% compared with the industry’s 11.9%. DVA’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 35.6%.

Shares of DVA have surged 81.1% compared with the industry’s 26.4% rise over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stryker Corporation (SYK) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Bruker Corporation (BRKR) : Free Stock Analysis Report