Bruker's (BRKR) New Deal Widens Biopharma PAT Product Portfolio

Bruker Corporation BRKR recently acquired Tornado Spectral Systems Inc. (Tornado) — a Canadian company specializing in process Raman instruments, primarily used in pharma and biotech quality control applications. However, the financial details of the transaction were kept under wraps.

The recent development will significantly bolster the Bruker Optics division, which is part of the Bruker Scientific Instruments (“BSI”) CALID segment. Bruker Optics mainly designs, manufactures and distributes research, analytical and process analysis instruments and solutions based on infrared and Raman molecular spectroscopy and imaging technologies.

More on the Acquisition

Founded in 2013, Tornado designs, manufactures and sells chemical analysis systems based on Raman spectroscopy. The company’s non-destructive, real-time measurement solutions provide numerous benefits for established analytical practice and facilitate the broader application of Raman methods for pharmaceutical, petrochemical, biotech and other applications.

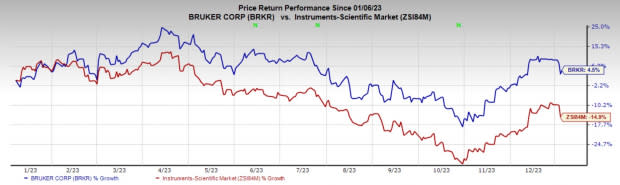

Image Source: Zacks Investment Research

Tornado's patented High-Throughput Virtual Slit technology measures the highest-quality spectra even in difficult Raman analyses. Tornado’s portfolio of Raman analyzers includes the HyperFlux PRO Plus, Process Guardian and SuperFlux — all with superior performance compared to traditional process Raman spectrometers for more accurate chemical identification and quantification in mixtures and at low concentrations.

Tornado analyzers also allow faster measurements of dynamic reactions. With low laser power, they permit safe operation even in hazardous environments.

Tornado’s product line also includes rugged, high-performance Raman probes for immersion, flow cell, non-contact and large-spot measurements, each optimized for different process environments. Tornado analyzers can be multiplexed with a fiber-switch accessory, with one analyzer monitoring up to eight probes at eight different sampling points.

Bruker is delighted to welcome the Tornado team, which has a decade of experience in innovative and industry-proven Raman solutions. The acquisition will enhance Bruker’s biopharma PAT (Process Analytical Technology) product portfolio with Tornado’s well-established offerings.

Industry Prospects

Per a report by Data Bridge Market Research, the global Raman Spectroscopy market was valued at $338.7 million in 2022 and is expected to witness a CAGR of 7.9% by 2030.

Notable Developments in the BSI CALID Segment

In October 2023, Bruker became a majority investor in the Swiss high-tech company, MIRO Analytical AG, which further complements the Bruker Optics gas-analysis spectroscopy portfolio with fast, compact, highest-precision Quantum Cascade Laser multi-trace gas analyzers. MIRO is poised to grow rapidly in high-precision trace gas analysis markets, boasting a total addressable market of greater than $100 million annually.

Earlier in the year, BRKR announced transformative sensitivity on the 4D-Proteomics timsTOF platform with the launch of the new timsTOF Ultra. The mass spectrometer provides market-leading sensitivity and throughput with expanded peptide coverage and more accurate quantitation in unbiased 4D single-cell cell lines and tissue proteomics. At the HUPO 2023 Congress held in Korea, Bruker announced further advances in timsTOF methods, consumables and software for next-generation, unbiased, high-fidelity, four-dimensional, 4D proteomics and 4D multiomics.

Price Performance

In the past year, shares of BRKR have increased 4.5% against the industry’s decline of 14.9%.

Zacks Rank and Key Picks

Bruker currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Haemonetics HAE, DaVita DVA and HealthEquity HQY. Haemonetics and HealthEquity each presently carry a Zacks Rank #2 (Buy), and DaVita sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Haemonetics’ stock has increased 8.7% in the past year. Earnings estimates for Haemonetics have remained constant at $3.89 in 2023 and at $4.15 in 2024 in the past 30 days.

HAE’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 16.1%. In the last reported quarter, it posted an earnings surprise of 5.3%.

Estimates for DaVita’s 2023 earnings per share have remained constant at $8.07 in the past 30 days. Shares of the company have increased 36.5% in the past year compared with the industry’s rise of 10%.

DVA’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 36.6%. In the last reported quarter, it delivered an average earnings surprise of 48.4%.

Estimates for HealthEquity’s 2023 earnings per share have increased from $2.03 to $2.15 in the past 30 days. Shares of the company have increased 12.1% in the past year against the industry’s 2.1% fall.

HQY’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 16.5%. In the last reported quarter, it delivered an average earnings surprise of 22.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

Bruker Corporation (BRKR) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report