Brunswick (BC) Posts Dismal Q2 Preliminary Results, Cuts View

Brunswick Corporation BC has released its preliminary financial results for the fiscal second quarter (ended on Jul 1, 2023).

Per the company’s second-quarter preliminary results, revenues came in at approximately $1.7 billion. However, the results fell below the initial expectations due to the impacts of a recent IT security incident disclosed in June.

The company anticipates adjusted EPS in the range of $2.30-$2.35. Despite the setback caused by the security breach, the company expects to report strong free cash flow generation for the quarter.

The disruptions resulting from the IT security incident primarily affected the Propulsion and Engine P&A segments. Although the company's facilities and systems are now fully operational, the disruptions at the end of the quarter limited the opportunity for a full recovery in this period. Although the company is expected to recover some losses going forward, the lost production of high horsepower outboard engines may prove challenging to compensate. The company plans to be in full production for the rest of the year but with limited ability to make up for lost output.

Looking ahead to the rest of the year, BC will likely benefit from stronger-than-expected new boat retail in recent months and continued high Mercury retail market share. Also, the effective management of inventory levels across its businesses bodes well.

The company now estimates its full-year adjusted EPS to be approximately $9.50. Earlier, it had projected earnings in the range of $9.50-$11.00. The Zacks Consensus Estimate for 2023 earnings is pegged at $10.30 per share. The lingering effects of the IT security incident, coupled with ongoing global consumer pressure, have made the company cautious about its financial performance in the second half of the year.

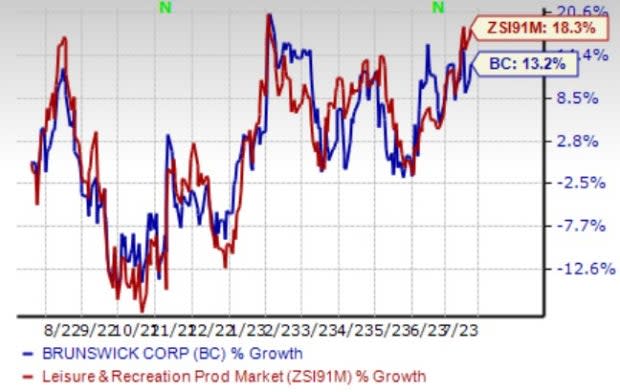

Price Performance

Image Source: Zacks Investment Research

Shares of BC have increased 13.2% in the past year compared with the industry’s 18.3% rise. The company is focused on navigating the market dynamics and uncertainties in the remainder of the fiscal year as it continues to address the challenges caused by the recent IT security incident.

Zacks Rank & Key Picks

Brunswick currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks from the Zacks Consumer Discretionary sector are:

Trip.com Group Limited TCOM flaunts a Zacks Rank #1 (Strong Buy). The company has a trailing four-quarter earnings surprise of 147.9%, on average. Shares of TCOM have increased 35.9% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Trip.com Group’s 2023 sales and earnings per share (EPS) suggests an increase of 101.6% and 531%, respectively, from the year-ago period’s levels.

OneSpaWorld Holdings Limited OSW carries a Zacks Rank #2 (Buy). OSW has a trailing four-quarter earnings surprise of 65.8%, on average. Shares of OSW have increased 67% in the past year.

The Zacks Consensus Estimate for OSW’s 2023 sales and EPS indicates a rise of 33.9% and 89.3%, respectively, from the year-ago period’s levels.

Royal Caribbean Cruises Ltd. RCL carries a Zacks Rank #2. The company has a trailing four-quarter earnings surprise of 26.4%, on average. Shares of RCL have surged 178% in the past year.

The Zacks Consensus Estimate for Royal Caribbean Cruises’ 2023 sales and EPS indicates a rise of 48.8% and 163.1%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Brunswick Corporation (BC) : Free Stock Analysis Report

OneSpaWorld Holdings Limited (OSW) : Free Stock Analysis Report

Trip.com Group Limited Sponsored ADR (TCOM) : Free Stock Analysis Report