Buenaventura (BVN) Gets Environmental Approval for Yumpag

Compañía de Minas Buenaventura S.A.A. BVN announced that it received an Environmental Impact Assessment approval by the Peruvian Environmental Certification authority for its Yumpag project.

The Yumpag project receiving this approval is an important step in the process of taking the project to its production phase. Buenaventura will further apply for the necessary authorizations to start the exploitation of the deposit and submit a request to the Peruvian Ministry of Energy and Mines.

The company will announce the project’s reserve and resource findings at its Investor Day in early December. The company maintains the target of production initiation at Yumpag in the fourth quarter of 2023, subject to final permitting and the approval required to operate.

Previously, Buenaventura announced that on Aug 28, 2023, it submitted the Updated Mine Plan to the Peruvian Ministry of Energy and Mines for its fully-owned Uchucchacua mine. This marks a step toward restarting operations at the mine that has been suspended since October 2021.

With the resumption of operations at the Uchucchacua processing facility, Buenaventura will also be able to conduct metallurgical testing on up to 124,600 tons of ore from the Yumpag project's pilot stope.

Buenaventura expects the Uchucchacua mine and the Yumpag project to yield between 2.3 million and 2.8 million ounces of silver in 2023.

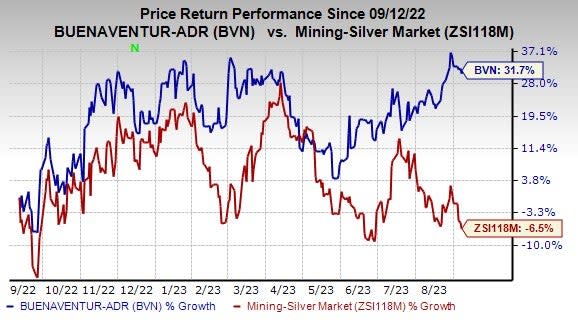

Price Performance

Shares of Buenaventura have gained 31.7% in the past year against the industry’s 6.5% decline.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Buenaventura currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the basic materials space are Hawkins, Inc. HWKN, Carpenter Technology Corporation CRS and L.B. Foster Company FSTR. HWKN and CRS sport a Zacks Rank #1 (Strong Buy) at present, and FSTR carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Hawkins has an average trailing four-quarter earnings surprise of 25.5%. The Zacks Consensus Estimate for HWKN’s fiscal 2024 earnings is pegged at $3.40 per share. The consensus estimate for 2024 earnings has moved 38% north in the past 60 days. Its shares gained 62.7% in the last year.

Carpenter Technology has an average trailing four-quarter earnings surprise of 10%. The Zacks Consensus Estimate for CRS’s fiscal 2024 earnings is pegged at $3.48 per share. The consensus estimate for 2023 earnings has moved 8% north in the past 60 days. Its shares gained 72.9% in the last year.

L.B. Foster has an average trailing four-quarter earnings surprise of 134.5%. The Zacks Consensus Estimate for FSTR’s 2023 earnings is pegged at 53 cents per share. Earnings estimates have been unchanged in the past 60 days. FSTR’s shares gained 50.4% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

L.B. Foster Company (FSTR) : Free Stock Analysis Report

Buenaventura Mining Company Inc. (BVN) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report