Bull of the Day: Plexus Corp. (PLXS)

Plexus Corporation PLXS, a Zacks Rank #1 (Strong Buy), has recently broken out to the upside in a bullish move that is pushing the stock to new 52-week highs. Simply put, there aren’t many stocks making fresh yearly highs right now. The price movement is a sign of strength, with the general market looking to narrow its yearly losses as we head deeper into the historically positive fourth quarter.

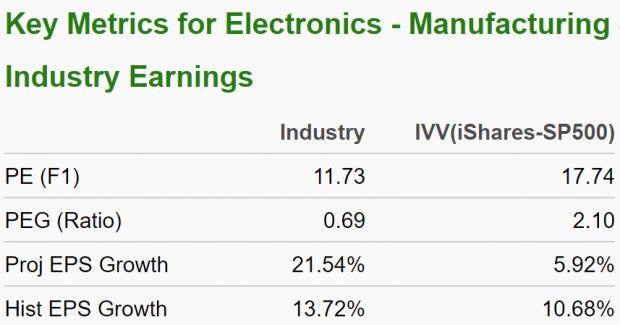

PLXS sports the second-highest Zacks Momentum Style Score of ‘B’, indicating a strong likelihood that the stock continues to propel higher on the combination of price performance and earnings momentum. The company is part of the Zacks Electronics – Manufacturing Services industry group, which ranks in the top 1% out of more than 250 industries. Because this group is ranked in the top half of all Zacks Ranked Industries, we expect it to outperform the market over the next 3 to 6 months. Also note the favorable metrics for this industry group below:

Image Source: Zacks Investment Research

Historical research studies suggest that approximately half of a stock’s price appreciation is due to its industry grouping. In fact, the top 50% of Zacks Ranked Industries outperforms the bottom 50% by a factor of more than 2 to 1. It’s no secret that investing in stocks that are part of leading industry groups can give us a leg up relative to the market. By focusing on leading stocks within the top industries, we can dramatically improve our stock-picking success.

Company Description

Plexus provides electronic manufacturing services globally. The company offers design and development, supply chain, new product introduction, and manufacturing solutions. PLXS delivers its services to companies in a host of different sectors including healthcare and life sciences, industrial, aerospace and defense, and communications.

In its fiscal fourth quarter, PLXS won 32 manufacturing contracts that are worth a combined $214 million in annualized revenues. The company’s expansion into several secular growth markets and massive backlog bode well for the foreseeable future. In addition to its continuation of new program ramps, Plexus has been streamlining its manufacturing facilities to optimize its operations.

Earnings Trends and Future Estimates

PLXS has built up an impressive earnings history, surpassing earnings estimates in three of the past four quarters with a 17.52% average beat over this timeframe. Last month, the electronic manufacturer reported fiscal Q4 EPS of $1.78/share, a 39.06% surprise over the $1.28 consensus estimate. Revenues of $1.12 billion also exceeded projections by 11.13%.

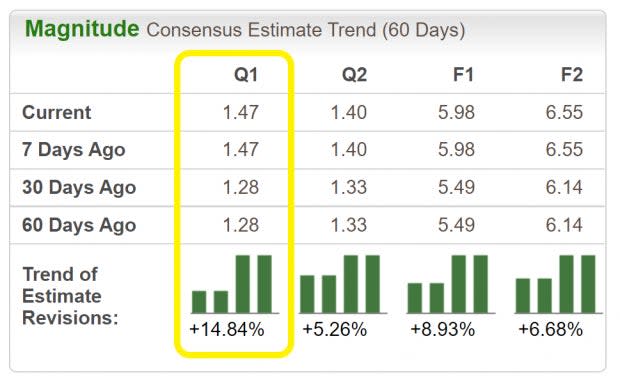

Analysts are bullish on the stock and have been raising earnings estimates across the board. The fiscal Q1 consensus EPS estimate has been revised upward in the past 60 days by 14.84% to $1.47/share. If the company is able to achieve this, it would translate to growth of 67.05% relative to the same quarter last year.

Image Source: Zacks Investment Research

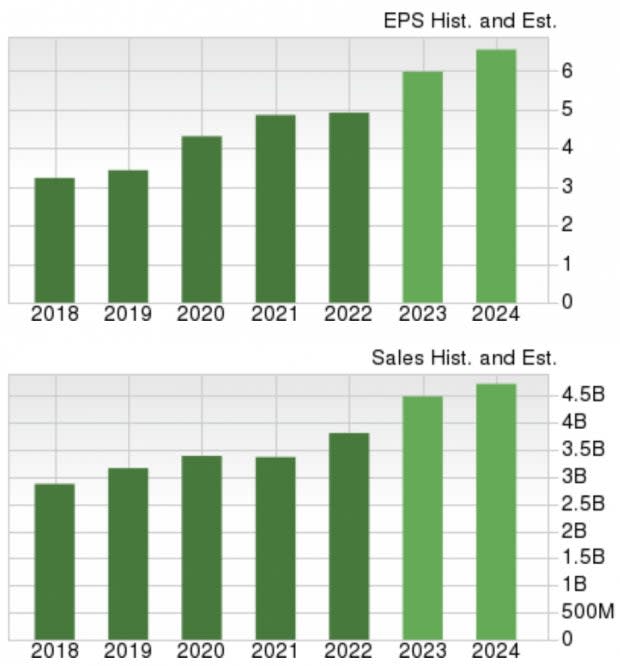

Looking ahead, estimates for the current fiscal year appear favorable. The 2023 Zacks Consensus EPS Estimate now stands at $5.98/share, translating to potential growth of 21.54% relative to last year. Sales are seen rising 17.75% to $4.49 billion. It’s clear that the growth trends for PLXS remain promising.

Image Source: Zacks Investment Research

Let’s Get Technical

In a bullish sign, PLXS shares bottomed back in February – well before the major indices. Since that time, the stock has advanced more than 40% and is showing no signs of slowing down. After completing a powerful cup-with-handle breakout pattern in October, shares have soared to new 52-week highs. This is the kind of stock we want to include in our portfolio – one that is trending well and receiving positive earnings estimate revisions.

Image Source: StockCharts

Notice how the 200-day moving average (blue line) has begun to turn and is now sloping up. The stock has been making a series of higher highs into November. With both strong fundamentals and technicals, PLXS is poised to continue its outperformance.

Empirical research shows a strong correlation between near-term stock movements and trends in earnings estimate revisions. As we know, Plexus has recently witnessed positive revisions. As long as this trend remains intact (and PLXS continues to deliver earnings beats), the stock will likely continue its bullish run.

Bottom Line

Buoyed by a leading industry group, it’s not difficult to see why PLXS is a compelling investment. A healthy number of contract wins along improved operational efficiencies paint a pretty picture for this top-rated stock.

Robust sales and earnings growth combined with a strong technical trend certainly warrant a closer look. Recent positive earnings estimate revisions should also serve to create a ‘floor’ in terms of any sudden or unexpected downside moves. If you haven’t already done so, be sure to put PLXS on your shortlist.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Plexus Corp. (PLXS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research