Bull of the Day: Tecnoglass Inc. (TGLS)

Tecnoglass TGLS, a Zacks Rank #1 (Strong Buy), has benefitted from strength this year in the building materials industry. The stock has broken out to the upside and is hitting all-time highs. Only stocks that are in extremely powerful uptrends are able to make new highs amid an uncertain economic environment. Shares continue to display relative strength as buying pressure accumulates in this market leader.

A secondary offering of ordinary shares temporarily pushed the stock lower in May, but TGLS has come roaring back and has now exceeded the highs of the year. Tecnoglass is part of the Zacks Building Products – Retail industry group, which is currently ranked in the top 7% of all Zacks Ranked Industries. It’s no secret that investing in stocks that are part of leading industry groups can give us a leg up relative to the market.

Quantitative research studies have shown that roughly half of a stock's price movement can be attributed to its industry group. In fact, the top 50% of Zacks Ranked Industries outperforms the bottom 50% by a factor of more than 2 to 1. By focusing on leading stocks within the top 50% of Zacks Ranked Industries, we can dramatically improve our stock-picking success.

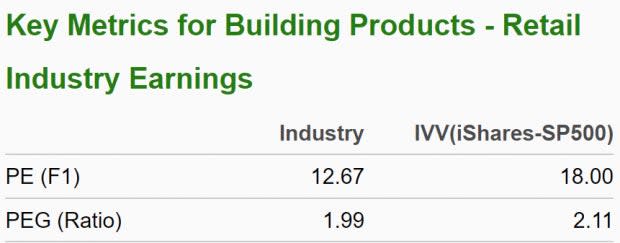

Also note the favorable valuation characteristics for this industry group:

Image Source: Zacks Investment Research

Company Description

Tecnoglass produces, markets, and installs architectural systems for commercial and residential construction industries. The company offers low emissivity, laminated, tempered, and digital print glass products. It also provides aluminum products including bars, plates, rods, and tubes that are used in the manufacture of architectural glass settings such as windows, doors, and spatial separators.

In addition, TGLS offers curtain wall facades, commercial display and hurricane-proof windows, awnings, and other components of architectural systems. Tecnoglass markets and sells its products under the Tecnoglass, ESWindows, and Alutions brand names through internal and independent sales representatives, as well as directly to distributors.

Earnings Trends and Future Estimates

TGLS has built up an impressive earnings history, surpassing earnings estimates in each of the last four quarters. Back in May, the company reported first-quarter earnings of $1.08/share, a 17.39% surprise over the $0.92/share consensus estimate. TGLS has delivered a 22.7% average earnings surprise over the past four quarters.

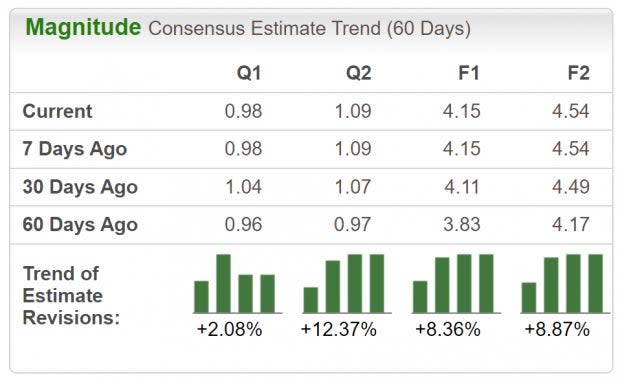

Analysts covering the building materials company are in agreement and have raised their earnings estimates across the board. The full-year EPS estimate has been raised by +8.36% in the past 60 days. The 2023 Zacks Consensus EPS Estimate now stands at $4.15/share, reflecting potential growth of 25% relative to last year. Sales are anticipated to climb 18.2% to $846.97 million.

Image Source: Zacks Investment Research

Let’s Get Technical

TGLS shares bottomed out in June of last year, well before the major indices. The stock has surged over 177% in the past year. Only stocks that are in extremely resilient uptrends are able to make this type of price move. The stock is up nearly 60% this year alone, widely outperforming the major averages. This is the kind of stock we want to include in our portfolio – one that is trending well and receiving positive earnings estimate revisions.

Image Source: StockCharts

Notice how the 50-day (blue line) and 200-day (red line) moving averages are sloping up. The stock has been making a series of higher highs and recently eclipsed its all-time high. With both strong fundamentals and technicals, TGLS is poised to continue its outperformance.

Empirical research shows a strong correlation between near-term stock movements and trends in earnings estimate revisions. As we know, Tecnoglass has recently witnessed positive revisions. As long as this trend remains intact (and TGLS continues to deliver earnings beats), the stock will likely continue its bullish run this year.

Bottom Line

Backed by a leading industry group and robust history of earnings beats, it’s not difficult to see why this company is a compelling investment. A stock making new all-time highs should be viewed as a sign of strength.

A durable technical trend along with relative undervaluation (11.7 forward P/E) certainly justify adding shares to the mix. Recent positive earnings estimate revisions should also serve to create a ‘floor’ regarding any sudden or unexpected downside moves. If you haven’t already done so, make sure to put TGLS on your shortlist.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tecnoglass Inc. (TGLS) : Free Stock Analysis Report