Bull of the Day: Thermon Group Holdings, Inc. (THR)

Thermon Group THR, a Zacks Rank #1 (Strong Buy), has broken out to the upside in a bullish move that recently pushed the stock to 52-week highs. After widely outperformed during the latter half of the year, a slight retreat in price over the past few weeks presents investors with a solid buying opportunity. As we’ll see, THR has been witnessing positive earnings estimate revisions and is set to experience phenomenal growth even in this difficult environment.

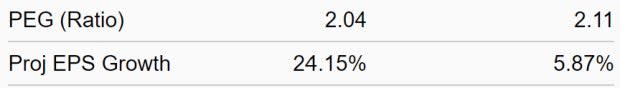

Thermon Group is part of the Zacks Instruments – Control industry group, which ranks in the top 11% out of approximately 250 Zacks Ranked Industries. Also note the favorable metrics for this industry group below:

Image Source: Zacks Investment Research

Because this group is ranked in the top half of all Zacks Ranked Industries, we expect it to outperform the market over the next 3 to 6 months. Historical research studies suggest that approximately half of a stock’s price appreciation is due to its industry grouping.

In fact, the top 50% of Zacks Ranked Industries outperforms the bottom 50% by a factor of more than 2 to 1. It’s no secret that investing in stocks that are part of leading industry groups can give us a leg up relative to the market. By focusing on leading stocks within the top 50% of Zacks Ranked Industries, we can dramatically improve our stock-picking success.

Company Description

Thermon Group provides engineering industrial process heating solutions globally. Its products include electric heating products such as air heaters, boilers and calorifiers, tank systems, and thermostats, along with gas heating products such as catalytic heaters and fired blowers. These products provide an external heat source to various instruments for the purposes of freeze protection, temperature maintenance, and environmental monitoring.

THR offers its solutions to a host of industries including chemical and petrochemical, oil and gas, power generation, rail and transit, semiconductor, as well as food and beverage. The company was founded in 1954 and is based in Austin, TX.

Earnings Trends and Future Estimates

THR has built up an impressive earnings history, surpassing earnings estimates in each of the past four quarters with an average surprise of 67.1%. Back in November, the industrial heating provider reported Q3 EPS of $0.38/share, an 80.95% surprise over the $0.21 consensus estimate. Revenues of $100.56 million during the quarter also exceeded estimates.

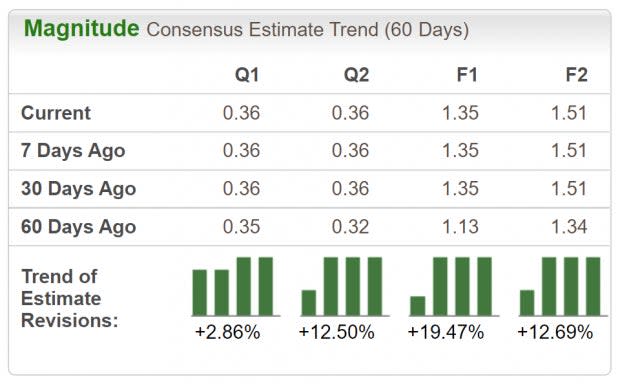

Analysts covering the company are bullish on the stock and have revised their earnings projections upward across the board. The current fiscal year’s EPS estimates have been increased by +19.47% in the past 60 days. The Zacks Consensus EPS Estimate now stands at $1.35/share, reflecting potential growth of 62.65% relative to last year. Sales are anticipated to climb 16.01% to $412.63 million.

Image Source: Zacks Investment Research

Let’s Get Technical

Since bottoming out in July, THR shares have advanced over 40% in the latter half of the year. Only stocks that are in extremely powerful uptrends are able to make this type of price move while the market hovers in a deep correction. This is the kind of stock we want to include in our portfolio – one that is trending well and receiving positive earnings estimate revisions.

Image Source: StockCharts

Notice how both the 50-day (blue line) and 200-day (red line) moving averages are sloping up. The stock had been making a series of higher highs through November, and the recent pullback represents a solid buying opportunity. With both strong fundamentals and technicals, THR is poised to continue its outperformance.

Empirical research shows a strong correlation between near-term stock movements and trends in earnings estimate revisions. And as we know, Thermon Group has recently witnessed positive revisions. As long as this trend remains intact (and THR continues to deliver earnings beats), the stock will likely continue its bullish run into the new year.

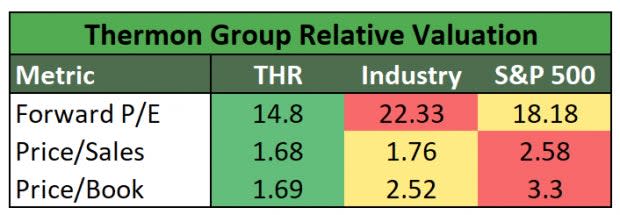

Despite the impressive price run, THR currently trades relatively undervalued, irrespective of the metric used:

Image Source: Zacks Investment Research

Bottom Line

Solid institutional buying should continue to provide a tailwind for the stock price. Backed by a leading industry group and robust history of earnings beats, it’s not difficult to see why this company is a compelling investment.

Robust fundamentals combined with a strong technical trend certainly justify adding shares to the mix. Recent positive earnings estimate revisions should also serve to create a ‘floor’ in terms of any sudden or unexpected downside moves. This market winner continues to prove its doubters wrong, and investors would be wise to consider THR as a portfolio candidate if they haven’t already done so.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Thermon Group Holdings, Inc. (THR) : Free Stock Analysis Report