A Bull Market Is Here: 2 Magnificent Stocks Down 80% to Buy Right Now

You've no doubt seen mutual fund warnings that past performance isn't necessarily indicative of future results. This caution applies to stocks as well. However, it doesn't just mean that investments that have performed well in the past may not keep winning; it also implies that those that haven't performed well won't necessarily continue to languish.

With a new bull market under way, some stocks that have been big losers in the recent past could be ready to rebound. Two Motley Fool contributors think they've identified magnificent stocks down 80% or more that are great picks to buy right now. Here's why they chose Intellia Therapeutics (NASDAQ: NTLA) and Moderna (NASDAQ: MRNA).

Intellia Therapeutics

Adria Cimino (Intellia Therapeutics): Intellia stock has dropped more than 80% below its high over the past three years, even as this CRISPR gene-editing specialist moves closer to the finish line with its lead candidates. And this could offer bargain-hunting investors looking for the next big biotech story a terrific buying opportunity.

But before talking more about the stock price, let's consider Intellia's path to product commercialization. The company has four candidates in the pipeline and also is working on several research programs. Intellia's two lead candidates -- NTLA-2001 for transthyretin amyloidosis (ATTR) and NTLA-2002 for hereditary angioedema (HAE) -- could make significant progress over the next few years. The company plans to complete patient enrollment in pivotal studies of these candidates and file for regulatory review of NTLA-2002 by 2026.

ATTR is caused by accumulation of a misfolded protein, which impacts various organs. And HAE is characterized by sudden and excessive swelling. Today, treatment options for both are limited, so a gene-editing therapy offering a functional cure could be a game changer.

And there's reason to be optimistic about regulators' views of this exciting technology. Another company using the CRISPR gene-editing technique, CRISPR Therapeutics, recently won approval for its first product, a treatment for blood disorders. This represented the first-ever approval for a CRISPR-based therapy, suggesting regulators are ready to give the thumbs-up as long as clinical trial data are solid.

Intellia also plans to launch clinical trials of newer candidates over the coming two years and further innovate in the areas of gene editing and delivery.

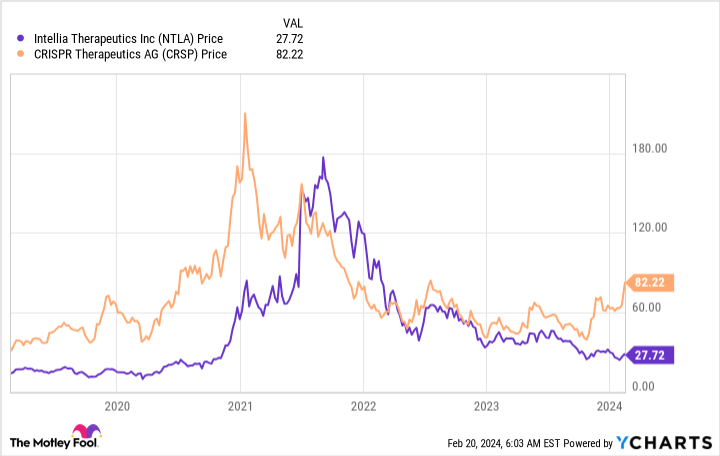

Now, let's get back to the stock price. Intellia shares trade for considerably less than those of CRISPR Therapeutics, but that wasn't always the case.

It's easy to imagine Intellia stock catching up with its more advanced peer if the gene-editing company brings a product to market later this decade. And that means now looks like a great time to get in on the stock at what could be a dirt cheap level.

Moderna

Keith Speights (Moderna): Moderna skyrocketed in 2020 and early 2021 thanks to the company's rapid development and commercialization of a messenger RNA-based COVID-19 vaccine. However, the biotech stock has plunged roughly 80% from its peak set in mid-2021.

Declining demand for COVID-19 vaccines has caused Moderna's revenue and share price to sink. The company's bottom line has also taken a huge hit. After generating profits of $12.2 billion in 2021, Moderna posted a net loss of $4.7 billion last year.

But better days could soon be on the way. The U.S. Food and Drug Administration (FDA) has set a PDUFA date of May 12, 2024, for an approval decision for Moderna's respiratory syncytial virus (RSV) vaccine mRNA-1345. This vaccine could be a commercial success with its solid efficacy and ready-to-use pre-filled syringes. Moderna also hopes to win regulatory approvals this year for mRNA-1345 in Australia and Germany.

The company has already reported positive late-stage results for its mRNA-1010 seasonal flu vaccine. It's in discussions with regulators and plans to file for approvals later in 2024.

Despite the lower demand for COVID-19 vaccines, there's still a significant market to go after. Moderna expects to announce results from a late-stage study of its next-generation refrigerator-stable COVID-19 vaccine (mRNA-1283) in the first half of this year. It also has a combination flu-COVID vaccine in phase 3 development, with data anticipated in 2024.

More promising programs are in the pipeline, too. Moderna is collaborating with Merck on a combination of its mRNA-4157 cancer vaccine with Merck's Keytruda. The company should report late-stage efficacy data from its experimental cytomegalovirus vaccine this year.

Moderna expects to return to sales growth in 2025. The company also thinks that it will reach breakeven in 2026. With new products likely to be on the market soon along with a robust pipeline, I predict that Moderna will bounce back in the not-too-distant future.

Revisiting the warning

Both Intellia and Moderna could turn things around in a major way after their steep declines. However, it's worth revisiting the warning mentioned earlier. While there's no guarantee the past will be indicative of future results, the possibility still exists that the future won't be significantly better than the past.

These biotech stocks remain risky and volatile. But aggressive investors willing to wait just might enjoy tremendous returns if Intellia and Moderna can fulfill their potential.

Should you invest $1,000 in Moderna right now?

Before you buy stock in Moderna, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Moderna wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 26, 2024

Adria Cimino has no position in any of the stocks mentioned. Keith Speights has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends CRISPR Therapeutics, Intellia Therapeutics, and Merck. The Motley Fool recommends Moderna. The Motley Fool has a disclosure policy.

A Bull Market Is Here: 2 Magnificent Stocks Down 80% to Buy Right Now was originally published by The Motley Fool