Has the Bull Rally for PayPal Begun?

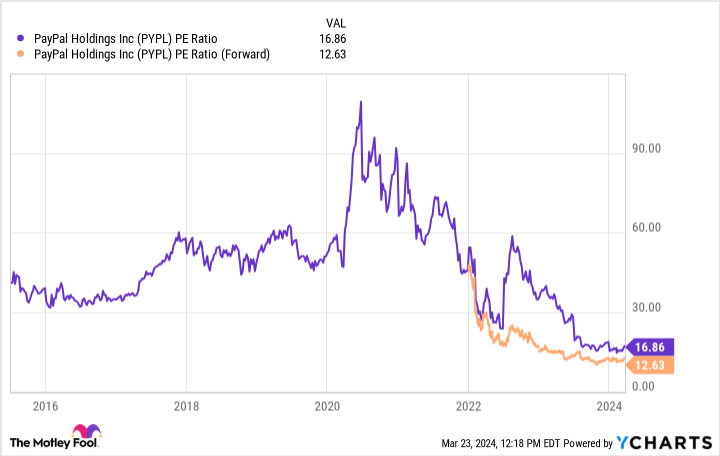

PayPal (NASDAQ: PYPL) has been one of the worst-performing stocks in the market during the past few years. Long-term shareholders (like myself) have felt a lot of pain since PayPal peaked at $308 per share in 2021. However, within the past six months, the stock has crossed into valuation territory often reserved for companies that are shrinking, not growing.

Many investors have wondered if PayPal might see a resurgence like Meta Platforms did in 2023, and with the stock up more than 10% from its March lows, it could be the start of a major bull run.

So, is it time to buy PayPal stock? Or is this just a false dawn?

PayPal has a long road to regain investors' confidence

PayPal has long been the face of the fintech industry. It helped smoothly transfer money from one person to another and process business transactions. However, competitors eventually rose and took some of PayPal's market share, including vital streams like eBay and various mobile payment apps.

Now, PayPal seems like a legacy app to many consumers. But it can also be an easy way to manage all payment types a consumer has and quickly process transactions for e-commerce stores because PayPal already has the user information. Quick transactions are key for any store, as they give the consumer less time to second-guess themselves. This makes partnering with PayPal a smart idea, which is why PayPal options have become more prevalent at online checkouts in recent years.

Speeding up the checkout process and giving the user more information is at the core of PayPal's six new innovations for its platform, which new Chief Executive Officer Alex Chriss unveiled in early 2024. But it remains to be seen if this can kick-start growth for PayPal.

It's the market's assumption that PayPal is a failing business that can never recover, which is why it trades for such a deep discount.

Indeed, 17 times trailing and 13 times forward earnings is dirt cheap, especially considering that the S&P 500 trades at 23 times trailing at 22 times forward earnings.

The broader market is shunning PayPal, but management isn't sitting around doing nothing.

PayPal has the potential to return to market-beating status

Thanks to PayPal's cheap valuation, the previous management team spent a lot of its cash flows on repurchasing shares. Chriss and his new team projected at least $5 billion in buybacks in 2024, so the trend will continue.

But how significant is a $5 billion share repurchase program? It's quite a big deal.

After subtracting the $1.56 billion in stock-based compensation expenses PayPal incurred in 2023, the net effect of the repurchase will be about $3.44 billion. With PayPal currently valued at $72 billion, this would reduce the shares outstanding by about 5% each year.

That means if PayPal has the exact same net income in 2024 as in 2023, its earnings per share will rise 5.3%. Remember, that's with no growth. However, PayPal also projects mid-single-digit percentage revenue growth in Q1.

Looking further out, Wall Street analysts project PayPal to continue this trend for 2024 and 2025, with an average of 42 analysts projecting 7% and 8% revenue growth this year and next.

If PayPal can grow in the high single digits while reducing its shares outstanding by 5%, it can produce earnings per share (EPS) growth rates in the low double digit percentages. That could lead to a market-beating stock.

This would undoubtedly unlock some new interest in owning the shares, which would cause its cheap valuation to increase. As a result, the PayPal rally may have already begun, with investors anticipating stronger-than-expected Q1 results.

We won't know how PayPal is doing until late April, but there are enough positive signs now and a high margin of safety that I'd be comfortable buying PayPal's stock right now.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and PayPal made the list -- but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of March 25, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Keithen Drury has positions in Meta Platforms and PayPal. The Motley Fool has positions in and recommends Meta Platforms and PayPal. The Motley Fool recommends eBay and recommends the following options: short July 2024 $52.50 calls on eBay and short March 2024 $67.50 calls on PayPal. The Motley Fool has a disclosure policy.

Has the Bull Rally for PayPal Begun? was originally published by The Motley Fool