Bull Signal Flashing for World's Biggest Uranium Stock

Shares of the world's largest publicly traded uranium company, Cameco Corp (NYSE:CCJ), are up 1.4% at $40.11 this afternoon. However, a recent downtrend just placed CCJ near a trendline with historically bullish implications.

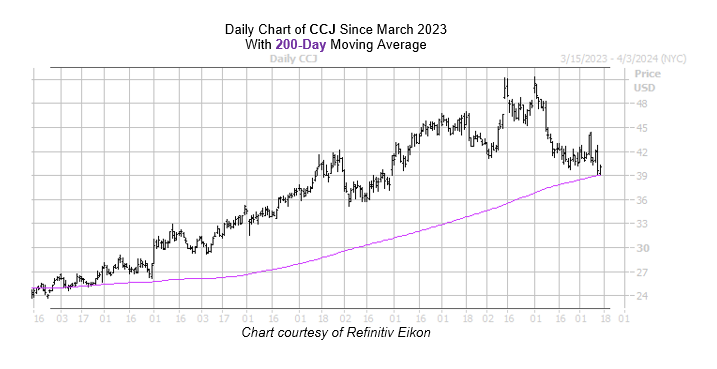

The stock has come within one standard deviation of its 200-day moving average for the sixth time in the past three years. According to Schaeffer's Senior Quantitative Analyst Rocky White, Cameco stock was positive one month later 67% of the time, averaging a 12.7% gain. A similar move would push the shares back up to the $45.20 level, recovering its March losses.

The 200-day trendline actually stepped up to save yesterday's 5.7% dip that mirrored falling spot prices -- the Global X Uranium ETF (URA) took a 2.9% dive during yesterday's session. Today's pop could be the beginning of a longer-term uptrend, and this is an intriguing entry point for a stock that's up 45.6% year-over-year, but down 1.2% year to date.

An unwinding of pessimism in the options pits could provide tailwinds as well. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), CCJ's 10-day put/call volume ratio of 1.45 ranks higher than 91% of readings from the past year.