Bull vs. Bear: ESG ETFs, the Post-Hype Sleeper?

This article was originally published on ETFTrends.com.

Bull vs. Bear is a weekly feature where the VettaFi writers’ room takes opposite sides to debate controversial stocks, strategies, or market ideas — with plenty of discussion of ETF ideas to play either angle. For this edition of Bull vs. Bear, Nick Peters-Golden and James Comtois debate whether ESG ETFs can bounce back after a rough 2023.

Nick Peters-Golden, staff writer, VettaFi: Hi James, I hope you’re having a nice week. For this edition of Bull vs. Bear, I hope you can allow me a bit of an extended metaphor from my countless hours spent on Fantasy Premier League: the post-hype sleeper.

Fantasy sports fans from football to soccer know the feeling: You snag a top draft pick and grab that exciting rookie or hot free agent who everyone is hyping up, only to see them fall flat on their faces. When it comes time to redraft for the next season, the consensus opinion of the player has changed, and an exciting prospect has instead become a disappointment to avoid.

That’s where smart players can profit by actually doing the work of seeing whether the new narrative is justified. That’s where you can find post-hype sleepers, great opportunities that others still see as disappointments, and my friend, I’m here today to argue that ESG ETFs are a strong contender to be a post-hype sleeper in the ETF landscape next year.

ESG Could Still Be a Contender

Let’s get the lay of the land in ESG, then, to see why this is a post-hype sleeper pick. First off, while investors have seemed disinterested in ESG strategies this year, there are several ESG ETFs that have done well. The iShares ESG Aware MSCI USA ETF (ESGU) has returned 21% YTD, per VettaFi data, for just a 15 basis point fee.

Yes, ESGU has seen a lot of outflows. That normally would indicate some amount of lost faith among investors. However, ESGU also sits in iShares’ model portfolios, with the firm’s maneuvering into quality this year likely responsible for the bulk of those flows.

Intriguingly, ESGU has done well longer term, too, returning 12.5% over the last five years and outperforming its ETF Database Category Average and FactSet Segment Average.

Active ESG ETFs did well, too. The WisdomTree International ESG Fund (RESD) actively invests with an ESG mandate, returning 15.6% YTD for a 30 bps fee.

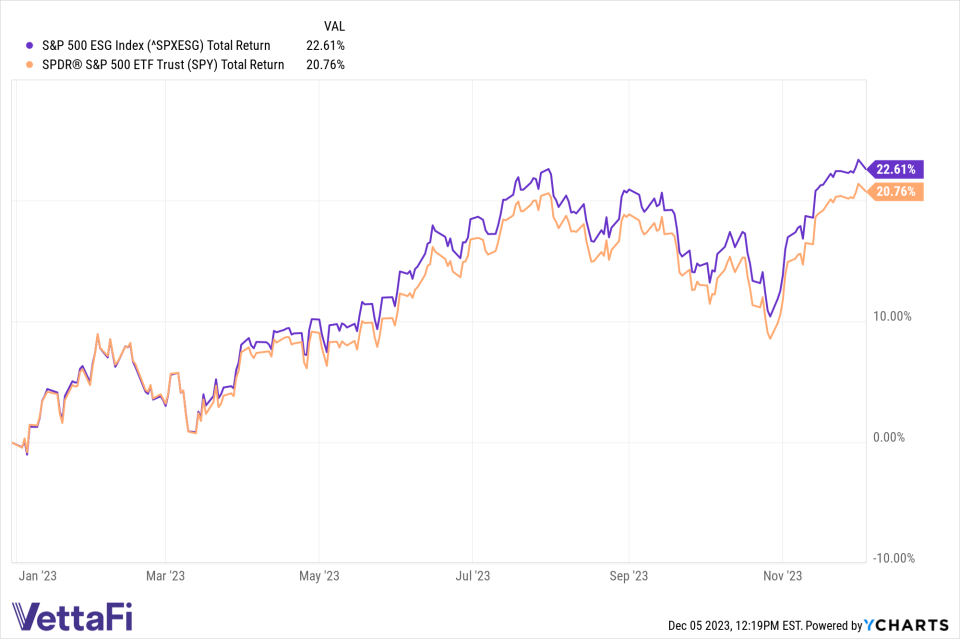

Putting a bow on this is the S&P 500 ESG Index (SPXESG) which has returned 22.6% YTD, per YCharts, as of December 5. That’s actually “better” than the SPDR S&P 500 ETF Trust (SPY).

[caption id="attachment_549001" align="aligncenter" width="628"]

Per YCharts, the ESG S&P 500 index has outperformed SPY YTD.[/caption]

But how does ESG look moving forward? High interest rates have weighed heavily on ESG stocks and ETFs. Firms that ESG strategies like — renewable energy, tech firms — have felt the pain.

However, if we do see the rate “cuts” that are increasingly dominating the headlines — perhaps as early as next year — ESG ETFs would benefit. Those like the iShares Climate Conscious & Transition MSCI USA ETF (USCL) focus on the energy transition itself. Investors might take a rate cut as an opportunity to dive back into renewable energy stocks that could benefit significantly from it.

Lack of Definition

James Comtois, staff writer, VettaFi: Greetings, Nick! Great to be back on the battlefield of ideas with you once again, this time mulling over the validity of ESG funds. While I won’t ever naysay the importance or value of environmental or socially responsible investing, I’m not sure ESG funds are the way to go.

For one thing, there’s still a lack of specific reporting standards. The lack of a unified reporting standard has led to multiple sustainability reporting frameworks. This makes it difficult, if not impossible, to define what even qualifies as an ESG fund.

According to a study from the International Federation of Accountants and the Association of International Certified Professional Accountants, “significant hurdles remain when it comes to providing consistent, comparable, and high-quality sustainability information for investors and lenders.”

This absence of standardized reporting poses a significant challenge for investors. And the disparate sustainability metrics hamstring investors’ ability to compare and contrast performance. Where does an investor even begin?

Plus, this lack of definition opens the door for greenwashing (much more on this later).

So, while I am all for environmentally conscious investing, the lack of universal guidelines makes it unclear as to what even constitutes an ESG fund.

See more: "Progress Emerging Regarding ESG Reporting"

Defining the ESG in ESG ETFs

Peters-Golden: One aspect of ESG that I think gets lost is that this isn’t even ESG’s final form. We’re not just talking about the firms in which your standard ESG fund would invest. As one great piece published in June put it, ESG investing isn’t dead, it’s just growing up, so to speak.

So, yes, there are issues with clear, universal guidelines. However, they're being worked out and — once they are — can really unlock a positive future for the space The ongoing process of government and nongovernmental organizations attempting to pin down what “ESG” really means, and what its purpose as a set of standards should be, impacts ESG investing. However, it also adds bureaucracy, complication, and other barriers that limit the efficiency of ESG investing.

ESG in Transition

I pinged VettaFi’s Financial Futurist Dave Nadig to share his thoughts on the state of play surrounding ESG indexes.

“I think ESG is in transition. There's little question there's institutional demand. Retail demand inside the U.S. has largely flagged,” he said. “But ESG is a global phenomenon that is going to do continue to be driven by institutions, and institutions generally prefer indexing over picking hot hands for the obvious predictability and control reasoning.”

“Increasingly, however, I suspect we'll see mandates that tease out things much more specifically,” Nadig added. “Climate-centered investing doesn't necessarily have a darn thing to do with anti-corruption-based investing (the G). Focusing on positive labor market dynamics or specific social justice issues are radically different, yet still get lumped under the ‘S’.”

“So what’s changing is the idea that 'ESG' can be a monolithic factor like 'momentum.' It never was, and any marketing claiming such was just silly. What's really happening is the smartening up of the investor base," he concluded.

The Exchange ETF conference in Miami this February will see a further discussion on defining ESG, including folks from Morningstar, so curious readers may want to check out Exchange. For right now, however, I think Dave adds some needed perspective. An overwhelming amount of the ESG discourse focuses on the “E” alone. That should tell us that it’s a bit of an antiquated acronym. But rather than let that bog ESG down, I think it tells us that, with some needed retooling, the E, S, and G can thrive.

See more: "Capitalize on the Surge in Solar Energy With TAN"

Just Bog-Standard Large-Cap Funds

Comtois: While I do think ESG can thrive, if given the right care and attention, I don't think we're there yet. The landscape still seems a bit lawless.

Now then. Let’s get to the greenwashing. Simply put, a lot of popular ESG funds simply aren’t ESG funds.

Let’s look at the top holdings of the SPDR S&P 500 ESG ETF (EFIV). Five of the six top holdings are simply FAANG stocks. One could argue it’s just a bog-standard large-cap fund. What’s so ESG about that?

(Another major holding is Tesla, and hoooo boy, we’ve done an entire Bull vs. Bear on that company, which has had a… let’s call it tumultuous… relationship with the S&P 500 ESG Index).

Plus, look at how many so-called ESG funds have ExxonMobil (XOM) as one of their top holdings. I can’t say I’m impressed.

So, rather than invest in generic large-cap funds calling themselves ESG, why not target more focused energy-transition funds? The Invesco Solar ETF (TAN), for example, delivers targeted exposure to the solar energy industry. It has a much more targeted mandate than just a vague ESG focus. Plus, its holdings aren’t just Apple or Microsoft, both of which have dubious claims to sustainability (more on that later).

The Kids Are (and Will Be) All Right

Peters-Golden: Dave noted that retail interest has dipped for ESG. That comes with a down year. Still, the promise of ESG does not lie in year-to-year ups and downs. ESG is a long-term investment idea tied to an even longer time frame in which younger, more ESG-minded generations start to seriously invest. That idea has focused on millennials, of course, but subsequent generations -- Gen Z and Gen Alpha investors -- also care about the environment and conscious investing.

Nearly two-thirds of Gen Z investors are interested in making portfolio allocations to match their beliefs outside of investing. That’s actually more than the percentage of millennials, with 59% of that cohort looking to invest to support certain causes. However, 80% of both Gen Z and millennials would be willing to even take “reduced returns” to invest in firms that also invest with certain views, including ESG.

That represents a long-term opportunity in ESG. Now think about how huge swaths of the American public don’t really even know about ESG. Younger generations, particularly, aren’t really thinking about investing, either. The right awareness campaign could see ESG ETFs become a hot trend similar in type, but of course not degree, to thematic ETFs in areas like crypto or marijuana.

Other investors may have some doubt about the idea that generational change will ride in and win the day for ESG. Investing isn’t the only area that has long promised sweeping change, because a new age group with a completely different set of preferences takes a prominent role. However, combined with the above factors, i.e., rate cuts and a clearer set of rules for ESG, ESG ETFs could really bounce back next year.

ESG Scoring: Is It All Just a Sham?

Comtois: Yes, a lot of younger investors want to invest in ESG. That’s great! But what’s not so great? They’re being misled.

NYU Professor Hans Taparia described ESG investing as “a sham” that “falsely lead[s] many investors to believe their portfolios are doing good for the world.”

A big issue comes from the ratings agencies. Investment managers rely on the likes of S&P and MSCI to construct their ESG indexes. But according to Taparia, these agencies aren’t scoring companies based on how environmentally conscious or socially responsible they are. Rather, they’re measuring how much potential harm ESG factors like carbon emissions have on their financial performance. Those aren’t the same thing.

This scoring system makes it far too easy for companies to be considered ESG-friendly. In fact, most stocks in the S&P 500 (90%) can be found in an ESG fund built with MSCI ratings. And when you see companies like McDonald’s, Coca-Cola, and Pepsi receive high ESG scores, what are we even doing here?

Now, don’t misunderstand me: I believe this is a very important issue. We should all be working toward decarbonization before it’s too late. And if investors can contribute to achieving that goal with their portfolios, I am all for it. But from where I sit, many of these ESG funds are just a placebo and aren’t helping accomplish this objective.

And on that cheery note, until next time, Nick!

Peters-Golden: Until then!

For more news, information, and analysis, visit the Innovative ETFs Channel.

POPULAR ARTICLES AND RESOURCES FROM ETFTRENDS.COM