Bunge Global (BG) & Chevron to Build New Facility in Destrehan

Bunge Global SA BG, along with Chevron Corporation CVX, announced the approval of a final investment decision for the joint venture, Bunge Chevron Ag Renewables LLC, to develop a new oilseed processing plant. Building the new facility is a further step forward in BG's long-term strategy to scale up its capabilities for the renewable fuels industry while lowering carbon intensity.

The processing facility intends to expand the joint venture’s scale and efficiencies, allowing the two companies to more effectively meet the growing market demand for renewable fuel feedstocks.

The new plant will be close to the company's existing processing facility on the Gulf Coast in Louisiana. It has a flexible design that allows it to process soybeans as well as softseeds, including novel winter oilseed crops like winter canola and CoverCress. The factory will also serve the growing feed and protein markets by producing meal products.

The plant is expected to be operational in 2026 and is likely to generate more than 150 construction jobs and 30 new positions.

Bunge Chevron Ag Renewables focuses on producing renewable fuel feedstocks by combining BG's expertise in oilseed processing and farmer contacts with Chevron's expertise in renewable fuel production and marketing.

BG reported fourth-quarter 2023 adjusted earnings of $3.70 per share, which surpassed the Zacks Consensus Estimate of $2.79. The bottom line improved 14% year over year. Net sales were $14.94 billion in the quarter under review, down 10.3% from the year-ago quarter. The top line beat the Zacks Consensus Estimate of $14.64 billion.

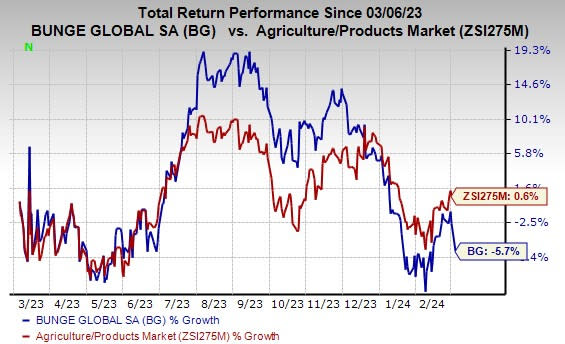

Price Performance

Shares of Bunge Global have lost 5.7% over the past year against the industry's growth of 0.6%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Bunge Global currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks from the basic materials space are Ecolab Inc. ECL and Carpenter Technology Corporation CRS. Currently, ECL sports a Zacks Rank #1 (Strong Buy) and CRS carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Ecolab’s 2024 earnings is pegged at $6.39 per share, indicating an increase of 22.7% from the prior year’s reported number. It has an average trailing four-quarter earnings surprise of 1.7%. ECL shares have gained 41.8% in a year.

The Zacks Consensus Estimate for Carpenter Technology’s 2024 earnings is pegged at $4.00 per share. The consensus estimate for 2024 earnings has moved 1% north in the past 60 days. It has an average trailing four-quarter earnings surprise of 14.3%. CRS shares have gained 33.5% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chevron Corporation (CVX) : Free Stock Analysis Report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Bunge Global SA (BG) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report