Bunker Hill Recommences Construction Activities, Remains on Schedule and Budget for Mine Restart in Q4 2024

Bunker Hill to Host Live Interactive 6ix Summit on Monday, July 31 @ 11.00am ET / 8:00am PT

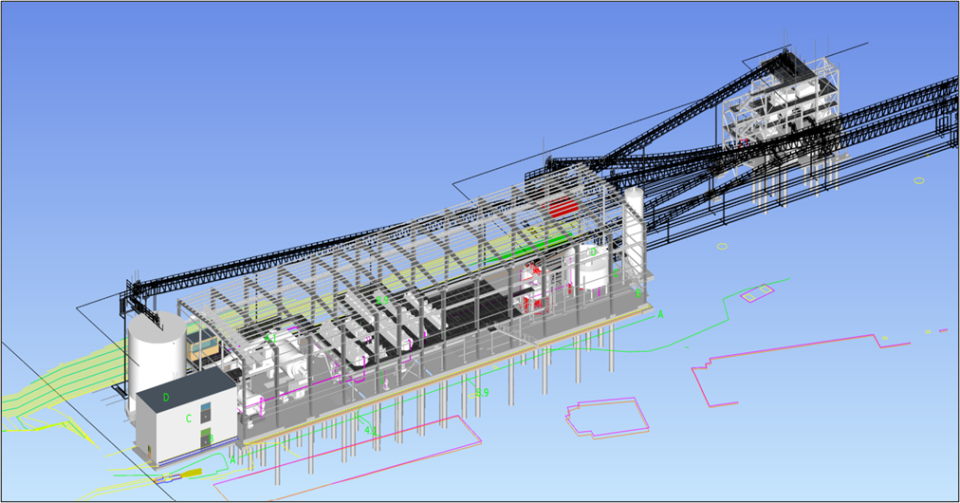

Mill Building and Crusher Tower, to be located in Bunker Hill Yard, looking West

HIGHLIGHTS

Portal rehabilitation contract awarded to GMS Mine Repair and Maintenance; work commencing to expand and upgrade the Russell Portal to ensure optimal haulage efficiencies and vehicle access once mining starts as a first step of a multi-phase underground infrastructure enhancement program

Completed purchase of ball mill capable of expanding production throughput capacity from Barrick’s Golden Sunlight Mine has been completed; transport to Bunker Hill site planned during Q3 2023

Process plant engineering expected to be 100% complete in Q3 2023, concurrent with initiation of long lead time procurement of conveyor systems, equipment refurbishment, mill building, other components

In partnership with Avista Utilities, construction commencing to upgrade the power infrastructure supporting mining and processing operations, linking the Wardner primary mining area to the main grid

Optimization work ongoing to examine the opportunity of increasing mine and mill throughput to 2,500 tpd, reducing operating costs and increasing recoveries

Executive Chairman Richard Williams and CEO Sam Ash to host interactive 6ix investor event Monday, July 31 at 11:00am ET / 8:00am PT. Investors are invited to register at: [LINK]

TORONTO, July 27, 2023 (GLOBE NEWSWIRE) -- Bunker Hill Mining Corp. (the “Company”) (CSE: BNKR, OTCQB: BHLL) is pleased to report that concurrent with finalizing the engineering of the processing plant, the Company has now restarted construction work on site, and is on schedule and budget to restart mining operations by the end of 2024.

Sam Ash, CEO, stated: “I am delighted to report that we have now restarted physical construction work on site, and that our post-financing project review affirms that we remain on track to start production in Q4 2024 in accordance with the existing budget. This aligns with our strategy of delivering a low capex restart to set a solid foundation to unlock significant value creation via subsequent optimization and exploration.”

RUSSELL PORTAL UPGRADE STARTED – THE NEXT STEP ON UNDERGROUND INFRASTRUCTURE DEVELOPMENT

The Russell Portal, constructed in the 1980s and located at the Wardner site, provides primary access to and egress from the initial mining areas at Level 4 of the underground. Following a competitive tender, this is being expanded by GMS Mine Repair and Maintenance Inc of Maryland, USA from 10’ x 10’ dimensions to 16’ x 16’ dimensions to enable the most efficient haulage and vehicle passage during operations and is expected to be completed by early September 2023.

This will be followed in phases, over 6 months, by (i) refurbishment of the existing underground ramp between the 6 and 8 Levels, (ii) geotechnical stabilization of the ramp as it cuts through the Cate Fault between Levels 5 and 6, (iii) installation of final ventilation support, (iv) establishment of key underground facilities such as the maintenance shop, (v) connecting the underground mine to the power grid, and (vi) definition drilling of initial mining areas.

PURCHASE OF ADDITIONAL LARGER MILL COMPLETED – OFFERS OPPORTUNITY TO INCREASE PRODUCTION RATE AND FURTHER IMPROVE MINE ECONOMICS

The Company has now completed the intended purchase of the additional mill capable of increasing production throughput capacity, as originally announced in the Company’s news release of September 20, 2022. The purchase and its subsequent move to the Bunker Hill site will enable the process plant engineering team to repurpose it as part of an upgraded comminution circuit.

Increased extra capacity provides the mine planners with an immediate upside opportunity to improve upon the economics of the existing 1,800 tpd restart plan and is being investigated as part of an ongoing business plan optimization process.

PROCESS PLANT ENGINEERING ADVANCES ON TRACK – ALLOWS CONVEYOR SYSTEM FABRICATION TO START

In accordance with the post-financing project schedule, Barr Engineering continues to advance final detailed engineering for the processing plant and expects this to be 100% complete in Q3 2023. The advanced status of this work has allowed the Company to issue a $3.5 million purchase order for the fabrication of the conveyor system to Rapat Corporation of Minnesota, and for procurement packages to be prepared for thickeners, inching drive, and 3rd zinc cleaner cell replacement.

Mill Building and Crusher Tower, to be located in Bunker Hill Yard, looking West

Although PFS-level testwork validated 100 years of processing performance, sufficient to provide a solid basis for business planning/financing, further metallurgical test work is being conducted over next 3-6 months to optimize these initial recoveries and concentrate quality calculations, concurrent with additional studies designed to highlight additional processing plant optimization opportunities.

PHASED POWER UPGRADE INVESTMENT OFFERS LOW-COST, GREEN POWER OVER LIFE OF MINE

Work has started now to complete the power distribution upgrades at Wardner to provide new primary metered delivery to the underground mine at a maximum of 1.85 MW, and remove the need for diesel power in the underground environment. This will be followed by the completion of a feeder between the Bunker Hill and Big Creek Substations to allow for shifting of load between those key facilities.

To ensure adequate support to the processing operations at the main Kellogg site, the next phase will see the upgrade of the distribution system through the installation of new primary metered delivery capable of an initial maximum of 5.0 MW by August 2024, an additional 1.2 MW by August 2025 and a further 2.0 MW by August 2027. These upgrades will then be further enhanced with investments in load management and the construction of a larger transformer at the Bunker Hill site to ensure a dedicated feeder position to serve the mine.

In this way, Avista Utilities and Bunker Hill are working together to deliver low-cost, hydro-electric/green grid power for as low as 4.7 cents per KWh, thereby setting the conditions for the replacement of all diesel-powered equipment with modern electrical machinery at some time in the future.

QUALIFIED PERSON

Mr. Scott E. Wilson, CPG, President of RDA and a consultant to the Company, is an independent “qualified person” as defined by Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects and is acting as the qualified person for the Company. He has reviewed and approved the technical information summarized in this news release.

ABOUT BUNKER HILL MINING CORP.

Under new Idaho-based leadership, Bunker Hill Mining Corp. intends to sustainably restart and develop the Bunker Hill Mine as the first step in consolidating and then optimizing a number of mining assets into a high-value portfolio of operations, centered initially in North America. Information about the Company is available on its website, www.bunkerhillmining.com, or within the SEDAR and EDGAR databases.

Cautionary Statements

Certain statements in this news release are forward-looking and involve a number of risks and uncertainties. Such forward-looking statements are within the meaning of that term in Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended, as well as within the meaning of the phrase ‘forward-looking information’ in the Canadian Securities Administrators’ National Instrument 51-102 – Continuous Disclosure Obligations (collectively, “forward-looking statements”). Forward-looking statements are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, “plan” or variations of such words and phrases. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these forward-looking statements are based on information currently available to the Company, the Company provides no assurances that actual results will meet management’s expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking statements.

Forward-looking statements in this news release include, but are not limited to, statements about: expectations and anticipated timing regarding the restart of the Bunker Hill Mine and expectations regarding the achievement of future short term, medium term and long term strategies; completion of the Russell portal upgrade; completion of engineering for the processing plant; and proposed benefits and timing of the upgrades to the power distribution.

Factors that could cause actual results to differ materially from such forward-looking statements include, but are not limited to, those risks and uncertainties identified in public filings made by Bunker Hill with the U.S. Securities and Exchange Commission (the “SEC”) and with applicable Canadian Securities regulatory authorities, and the following: the Company’s inability to raise additional capital for project activities, including through equity financings, concentrate offtake financings or otherwise; the ability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to the effects of COVID-19 on the price of commodities; capital market conditions; restrictions on labor and its effects on international travel and supply chains; failure to identify mineral resources; failure to convert estimated mineral resources to reserves; the preliminary nature of metallurgical test results; the Company’s ability to restart and develop the Bunker Hill Mine and the risks of not basing a production decision on a feasibility study of mineral reserves demonstrating economic and technical viability, resulting in increased uncertainty due to multiple technical and economic risks of failure which are associated with this production decision including, among others, areas that are analyzed in more detail in a feasibility study, such as applying economic analysis to resources and reserves, more detailed metallurgy and a number of specialized studies in areas such as mining and recovery methods, market analysis, and environmental and community impacts and, as a result, there may be an increased uncertainty of achieving any particular level of recovery of minerals or the cost of such recovery, including increased risks associated with developing a commercially mineable deposit, with no guarantee that production will begin as anticipated or at all or that anticipated production costs will be achieved; failure to commence production would have a material adverse impact on the Company's ability to generate revenue and cash flow to fund operations; failure to achieve the anticipated production costs would have a material adverse impact on the Company's cash flow and future profitability; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; political risks; changes in equity markets; uncertainties relating to the availability and costs of financing needed in the future; the inability of the Company to budget and manage its liquidity in light of the failure to obtain additional financing, including the ability of the Company to complete the payments pursuant to the terms of the agreement to acquire the Bunker Hill Mine complex; inflation; changes in exchange rates; fluctuations in commodity prices; delays in the development of projects; and capital, operating and reclamation costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry. Although the Company believes that the assumptions and factors used in preparing the forward-looking statements in this news release are reasonable, undue reliance should not be placed on such statements or information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all, including as to whether or when the Company will achieve its project finance initiatives, or as to the actual size or terms of those financing initiatives. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

Readers are cautioned that the foregoing risks and uncertainties are not exhaustive. Additional information on these and other risk factors that could affect the Company’s operations or financial results are included in the Company’s annual information form or annual report and may be accessed through the SEDAR website (www.sedar.com) or through EDGAR on the SEC website (www.sec.gov), respectively.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/9a87d957-c246-4e12-acfd-1620b6a17dcd

CONTACT: For additional information contact: David Wiens, CFA CFO & Corporate Secretary +1 208 370 3665 ir@bunkerhillmining.com