Burlington (NYSE:BURL) Beats Q4 Sales Targets, Stock Soars

Off-price retail company Burlington Stores (NYSE:BURL) beat analysts' expectations in Q4 FY2023, with revenue up 13.9% year on year to $3.13 billion. It made a non-GAAP profit of $3.66 per share, improving from its profit of $2.96 per share in the same quarter last year.

Is now the time to buy Burlington? Find out by accessing our full research report, it's free.

Burlington (BURL) Q4 FY2023 Highlights:

Revenue: $3.13 billion vs analyst estimates of $3.05 billion (2.4% beat)

EPS (non-GAAP): $3.66 vs analyst estimates of $3.30 (10.9% beat)

EPS (non-GAAP) Guidance for 2024 is $7.30 at the midpoint, above analyst estimates of $7.07

Free Cash Flow of $410.3 million, down 14.2% from the same quarter last year

Gross Margin (GAAP): 42.8%, up from 40.8% in the same quarter last year

Same-Store Sales were up 2% year on year

Store Locations: 1,007 at quarter end, increasing by 80 over the last 12 months

Market Capitalization: $13.16 billion

Michael O’Sullivan, CEO, stated, “Our performance in the fourth quarter exceeded our guidance. On a 13-week basis, total sales increased 10%, comparable store sales grew 2%, adjusted operating margin expanded by 110 basis points, and adjusted EPS increased 25%.”

Founded in 1972 as a discount coat and outerwear retailer, Burlington Stores (NYSE:BURL) is now an off-price retailer that has broadened into general apparel, footwear, and home goods.

Off-Price Apparel and Home Goods Retailer

Off-price retailers, which sell name-brand goods at major discounts because of their unique purchasing and procurement strategies, understand that everyone loves a good deal. Specifically, these companies buy excess inventory and overstocks from manufacturers and other retailers so they can turn around and offer these products at super competitive prices. Despite the unique draw lure of discounts, these off-price retailers must also contend with the secular headwinds of online penetration and stalling retail foot traffic in places like suburban shopping centers.

Sales Growth

Burlington is larger than most consumer retail companies and benefits from economies of scale, giving it an edge over its competitors.

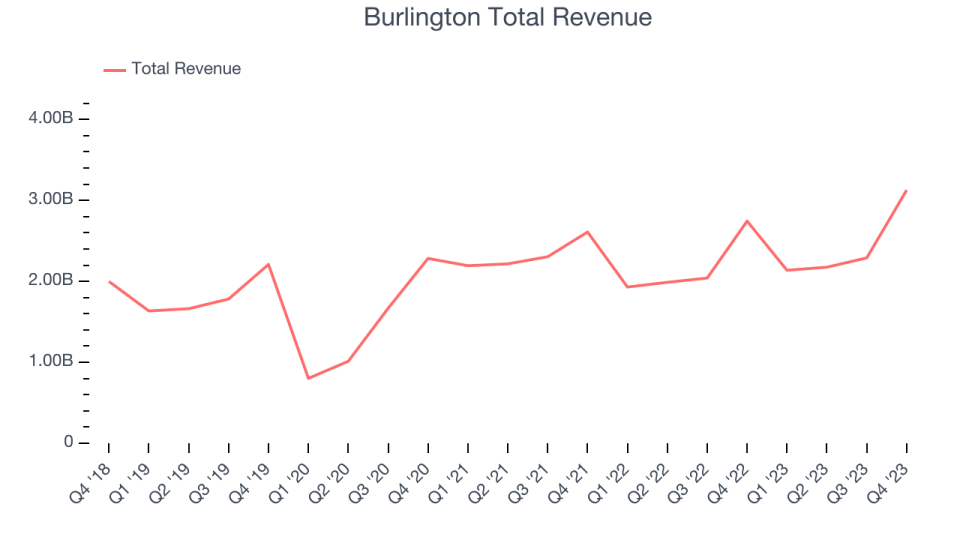

As you can see below, the company's annualized revenue growth rate of 7.5% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was weak as it opened new stores and expanded its reach.

This quarter, Burlington reported robust year-on-year revenue growth of 13.9%, and its $3.13 billion in revenue exceeded Wall Street's estimates by 2.4%. Looking ahead, Wall Street expects sales to grow 7.2% over the next 12 months, a deceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Same-Store Sales

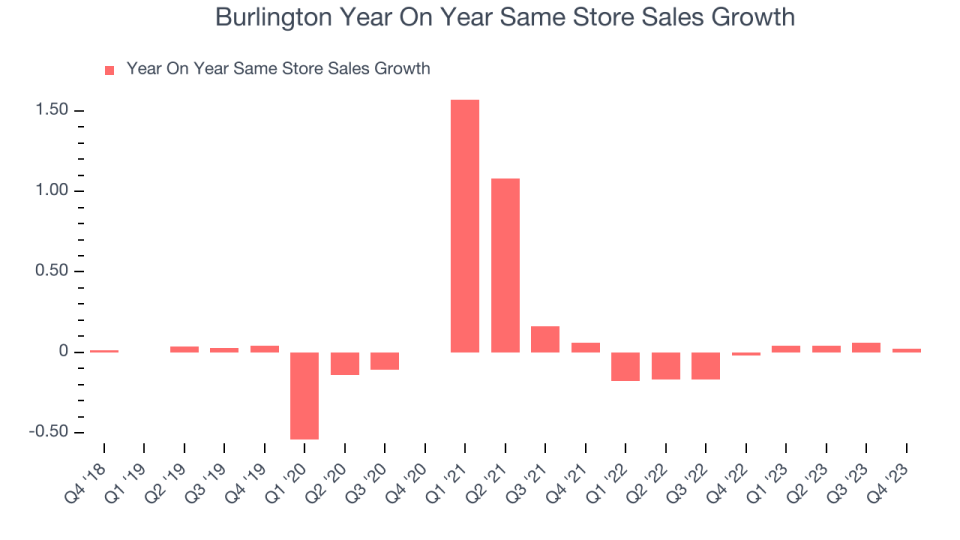

Same-store sales growth is a key performance indicator used to measure organic growth and demand for retailers.

Burlington's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 4.8% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

In the latest quarter, Burlington's same-store sales rose 2% year on year. This growth was a well-appreciated turnaround from the 2% year-on-year decline it posted 12 months ago, showing the business is regaining momentum.

Key Takeaways from Burlington's Q4 Results

It was great to see Burlington's strong earnings forecast for the full year, which exceeded analysts' expectations. We were also excited its revenue outperformed Wall Street's estimates. On the other hand, its earnings forecast for next quarter missed analysts' expectations. Overall, this quarter's results seemed fairly positive and shareholders should feel optimistic. The stock is up 6.8% after reporting and currently trades at $219.93 per share.

Burlington may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.