Burlington (NYSE:BURL) Misses Q3 Revenue Estimates, But Stock Soars 12.6%

Off-price retail company Burlington Stores (NYSE:BURL) reported results in line with analysts' expectations in Q3 FY2023, with revenue up 12.3% year on year to $2.29 billion. Turning to EPS, Burlington made a non-GAAP profit of $0.98 per share, improving from its profit of $0.26 per share in the same quarter last year.

Is now the time to buy Burlington? Find out by accessing our full research report, it's free.

Burlington (BURL) Q3 FY2023 Highlights:

Revenue: $2.29 billion vs analyst estimates of $2.30 billion (small miss)

EPS (non-GAAP): $0.98 vs analyst expectations of $0.98 (small miss)

Full year EPS (non-GAAP) Guidance raised to $5.60 at the midpoint

Free Cash Flow of $120.7 million, up from $32.24 million in the same quarter last year

Gross Margin (GAAP): 43.3%, up from 41.2% in the same quarter last year (beat)

Same-Store Sales were up 6% year on year (beat vs. expectations of up 5.3% year on year)

Store Locations: 977 at quarter end, increasing by 84 over the last 12 months

Michael O’Sullivan, CEO, stated, “We were pleased with our performance during the third quarter. We had a strong trend in August and September, and this drove 6% comparable store sales growth for the full quarter despite the negative impact of unseasonably warm weather in October. This trend together with strong merchandise margins delivered earnings at the high end of expectations.”

Founded in 1972 as a discount coat and outerwear retailer, Burlington Stores (NYSE:BURL) is now an off-price retailer that has broadened into general apparel, footwear, and home goods.

Off-Price Apparel and Home Goods Retailer

Off-price retailers, which sell name-brand goods at major discounts because of their unique purchasing and procurement strategies, understand that everyone loves a good deal. Specifically, these companies buy excess inventory and overstocks from manufacturers and other retailers so they can turn around and offer these products at super competitive prices. Despite the unique draw lure of discounts, these off-price retailers must also contend with the secular headwinds of online penetration and stalling retail foot traffic in places like suburban shopping centers.

Sales Growth

Burlington is larger than most consumer retail companies and benefits from economies of scale, giving it an edge over its competitors.

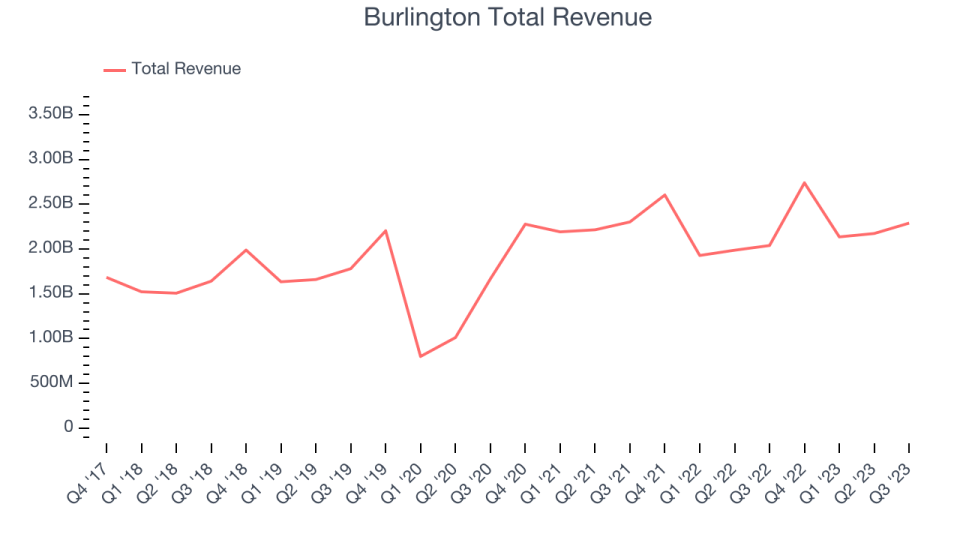

As you can see below, the company's annualized revenue growth rate of 7.2% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was decent as it opened new stores and expanded its reach.

This quarter, Burlington's year-on-year revenue growth clocked in at 12.3%, falling short of Wall Street's estimates. Looking ahead, analysts expect sales to grow 9.4% over the next 12 months.

Our recent pick has been a big winner, and the stock is up more than 2,000% since the IPO a decade ago. If you didn’t buy then, you have another chance today. The business is much less risky now than it was in the years after going public. The company is a clear market leader in a huge, growing $200 billion market. Its $7 billion of revenue only scratches the surface. Its products are mission critical. Virtually no customers ever left the company. You can find it on our platform for free.

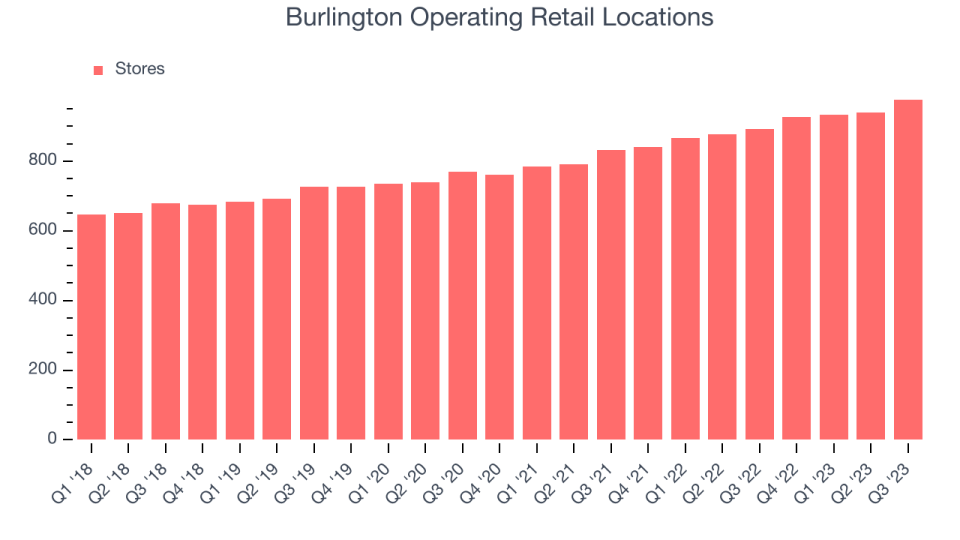

Number of Stores

When a retailer like Burlington is opening new stores, it usually means it's investing for growth because demand is greater than supply. Since last year, Burlington's store count increased by 84 locations, or 9.4%, to 977 total retail locations in the most recently reported quarter.

Taking a step back, the company has rapidly opened new stores over the last eight quarters, averaging 9.2% annual growth in its physical footprint. This store growth is much higher than other retailers. With an expanding store base and demand, revenue growth can come from multiple vectors: sales from new stores, sales from e-commerce, or increased foot traffic and higher sales per customer at existing stores.

Same-Store Sales

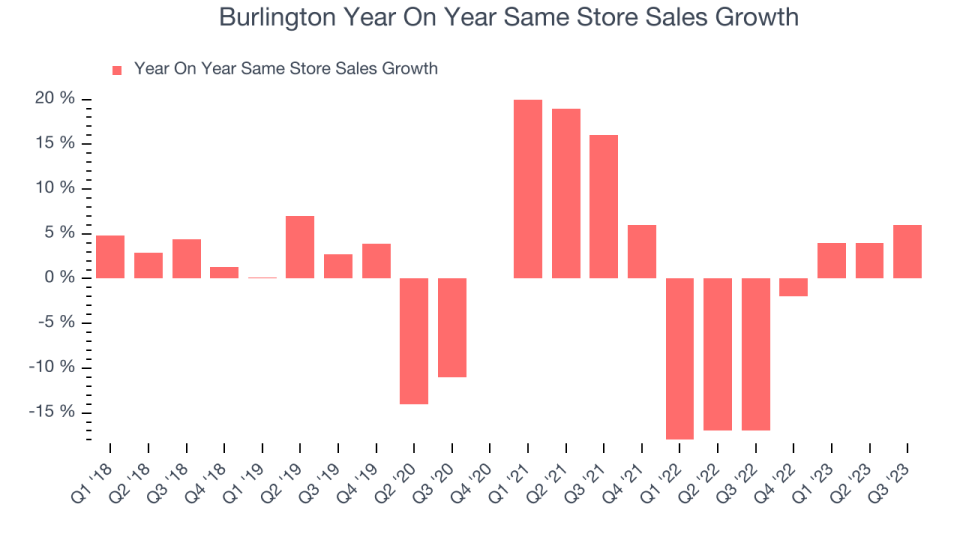

A company's same-store sales growth shows the year-on-year change in sales for its brick-and-mortar stores that have been open for at least a year, give or take, and e-commerce platform. This is a key performance indicator for retailers because it measures organic growth and demand.

Burlington's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 4.3% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

In the latest quarter, Burlington's same-store sales rose 6% year on year. This growth was a well-appreciated turnaround from the 17% year-on-year decline it posted 12 months ago, showing the business is regaining momentum.

Key Takeaways from Burlington's Q3 Results

Sporting a market capitalization of $8.76 billion, Burlington is among smaller companies, but its more than $615.9 million in cash on hand and positive free cash flow over the last 12 months puts it in an attractive position to invest in growth.

Although revenue missed slightly, the all-important same-store sales metric in retail beat expectations. It was also good to see Burlington beat analysts' gross margin expectations this quarter. Lastly on the positives, full year EPS guidance was raised and management gave positive commentary on the current environment, saying that “November is off to a solid start, helped by cooler weather at the beginning of the month. We feel very good about how we are set up for Holiday." The stock is up 12.6% after reporting and currently trades at $154 per share.

Burlington may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned in this report.