Burlington Stores (BURL) Widens Spectrum: Here's How

Burlington Stores, Inc. BURL has been making efforts to evolve its business model to navigate the ever-evolving retail landscape. As part of its efforts, it focuses on Burlington 2.0 initiative, which aims to improve the execution of the off-price model. The strategy comprises three aspects – marketing, merchandising, and store prototype.

Under the marketing aspect, the company looks to communicate a stronger and more direct off-price value message, and hence deliver this communication in a more cost-effective manner. By doing so, the company seeks to leverage its marketing reach and expenditures effectively. This strategic shift in marketing is expected to play a pivotal role in the company's growth in the future.

As part of the store prototype strategy. Burlington stores plans to open smaller store prototypes aimed at achieving more productive retail locations at reduced operating and occupancy expenses. This strategic shift reflects a forward-thinking approach to retail operations and aligns with the evolving preferences of consumers.

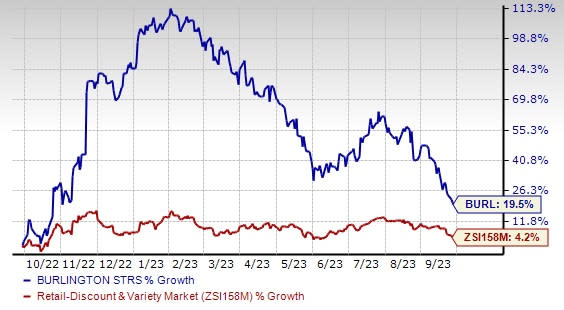

Image Source: Zacks Investment Research

One of the keystones of the Burlington 2.0 Off-Price initiative is dedication to providing outstanding customer value. To realize this, Burlington is investing in buying and planning capabilities, a long-term enabler for delivering higher merchandise value.

The company has also been investing in enhancing its merchandising capabilities to better execute the off-price model. This investment includes a mix of external hires and the development of internal talent, aligning with the company's commitment to delivering exceptional value to its customers.

Clearly, the Burlington 2.0 Off-Price initiative positions the company for sustained sales growth in the near term. Additionally, the gains from the ongoing initiative are well-reflected in its share price, with the stock outperforming the industry. Shares of this Zacks Rank #3 (Hold) company have rallied 19.5% in the past year compared with the industry’s growth of 4.2%.

Upbeat View

Looking ahead to fiscal 2023, Burlington Stores anticipates robust growth. Comparable sales are projected to increase 3-4%, a significant turnaround from the 13% decrease reported in fiscal 2022. Net sales are expected to grow 11-12%, including the impact of an extra 53rd week, compared with the 7% decline in the previous fiscal year.

The adjusted EBIT margin is forecasted to increase 80-100 basis points year over year, excluding the impact of expected incremental expenses related to the acquired Bed Bath & Beyond leases.

Adjusted earnings per share (EPS), excluding the impact of incremental expenses, are estimated to be in the range of $5.60-$5.90, a substantial increase from the $4.26 recorded in the previous fiscal year.

Management remains optimistic about expanding its store count, including the smaller store prototype. It also sees an opportunity to relocate and downsize older and less-productive outlets. The company aims to open 70 to 80 net new stores in 2023. To support this expansion, Burlington Stores anticipates capital expenditures of $560 million, net of landlord allowances, in fiscal 2023.

Stocks to Consider

We have highlighted three better-ranked stocks, namely Ollie's Bargain Outlet Holdings, Inc. OLLI, Ross Stores Inc. ROST and Walmart Inc. WMT.

Ollie's Bargain Outlet is a value retailer of brand-name merchandise at drastically reduced prices. The company currently has a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Ollie's Bargain Outlet’s current fiscal-year sales and EPS suggests growth of 19.6% and 67.3%, respectively, from the year-ago reported figures. OLLI has a trailing four-quarter earnings surprise of 1.3%, on average.

Ross Stores is an off-price retailer of apparel and home accessories. The company currently carries a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Ross Stores’ current fiscal-year sales and EPS suggests growth of 8.1% and 19.4%, respectively, from the year-ago reported figures. ROST has a trailing four-quarter earnings surprise of 11.4%, on average.

Walmart, which operates a chain of hypermarkets, discount department stores and grocery stores, currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Walmart’s current fiscal-year sales and earnings suggests growth of 9.3% and 2.2%, respectively, from the year-ago reported numbers. WMT has a trailing four-quarter earnings surprise of 11.6%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Walmart Inc. (WMT) : Free Stock Analysis Report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report

Burlington Stores, Inc. (BURL) : Free Stock Analysis Report

Ollie's Bargain Outlet Holdings, Inc. (OLLI) : Free Stock Analysis Report