Burlington Stores Inc (BURL) Surpasses Earnings Expectations with Strong Q4 and Full Year 2023 ...

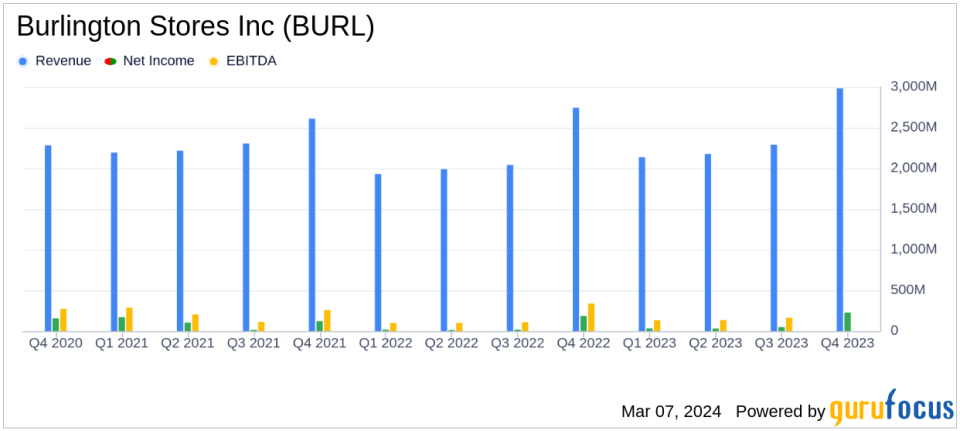

Total Sales: Increased by 14% on a 14-week GAAP basis in Q4, and by 12% on a 53-week GAAP basis for the full year.

Net Income: Reached $227 million in Q4, and $340 million for the full year.

Adjusted EPS: Grew by 25% to $3.69 in Q4, outperforming guidance.

Comparable Store Sales: Rose by 2% in Q4, surpassing expectations.

Gross Margin: Expanded by 190 basis points to 42.6% on a 13-week basis in Q4.

Inventory: Year-end merchandise inventories were $1,088 million, with a 5% decrease in comparable store inventories.

Outlook for FY24: Adjusted EPS projected to be between $7.00 and $7.60, marking an increase of 12% to 22% over FY23.

Burlington Stores Inc (NYSE:BURL) released its 8-K filing on March 7, 2024, detailing a robust performance for both the fourth quarter and the full fiscal year of 2023. The company, a leading off-price retailer, has continued to thrive in a challenging retail environment, delivering results that exceeded their own guidance and analysts' expectations.

Burlington Stores, with its 1,007 stores across the United States, has become a key player in the off-price retail sector. The company's strategy of offering a wide variety of branded merchandise at significant discounts has resonated well with cost-conscious consumers, driving a 2% increase in comparable store sales in Q4 and a 4% increase for the full year on a 52-week basis.

Financial Performance and Strategic Milestones

For the fourth quarter, Burlington Stores reported a 14% increase in total sales on a 14-week GAAP basis, reaching $3.121 billion. Adjusted for a 13-week basis, sales still saw a commendable 9% rise to $2.983 billion. The company's net income for the quarter was $227 million, translating to a diluted EPS of $3.53. When adjusted for certain expenses, the adjusted EPS climbed to $3.69, a notable 25% increase compared to the previous year.

CEO Michael OSullivan highlighted the company's achievements, stating,

Our performance in the fourth quarter exceeded our guidance... This completed a strong year for our business."

He also underscored the company's milestone of opening its 1000th store and the acquisition of Bed Bath & Beyond leases, which has bolstered the pipeline for new store openings.

Challenges and Outlook

Despite the positive results, Burlington Stores remains cautious due to the uncertain external environment. The company is planning flexibly for 2024, ready to adjust to any shifts in consumer behavior. For the fiscal year 2024, Burlington Stores anticipates an adjusted EPS of $7.00 to $7.60, reflecting a 12% to 22% increase over the previous year on a 52-week basis.

The company's balance sheet remains strong, with year-end liquidity of $1.634 billion and total debt standing at $1.409 billion. Inventory management has been effective, with a 5% decrease in comparable store inventories and a reduction in reserve inventory as a percentage of total inventory.

Burlington Stores' financial achievements, particularly in gross margin expansion and inventory management, are critical for an off-price retailer operating in the cyclical retail industry. These metrics indicate the company's ability to manage costs effectively and maintain profitability amidst fluctuating market conditions.

Value investors and potential GuruFocus.com members should note that Burlington Stores Inc (NYSE:BURL) is positioning itself for continued growth and profitability, making it a company to watch in the off-price retail sector.

For more detailed information on Burlington Stores Inc (NYSE:BURL)'s financial performance and future outlook, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Burlington Stores Inc for further details.

This article first appeared on GuruFocus.