Business First Bancshares Inc Reports Mixed Results for FY 2023 and Q4

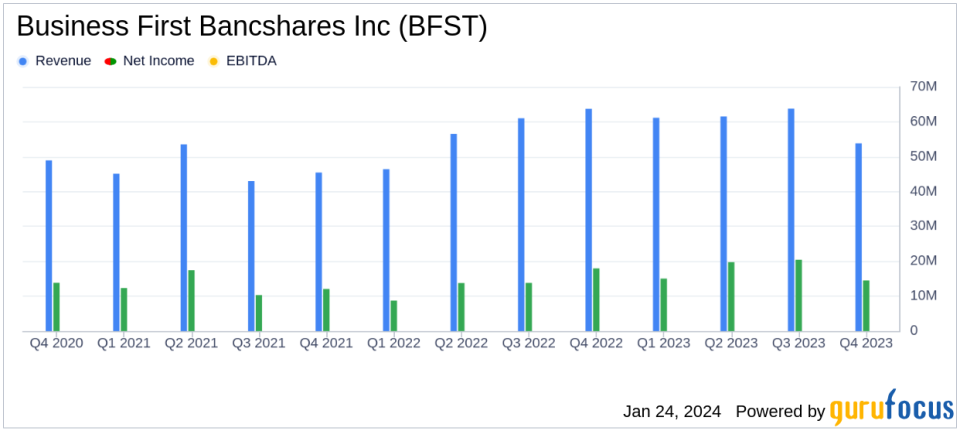

Annual Net Income: Increased to $65.6 million, or $2.59 per diluted share.

Quarterly Net Income: Decreased to $14.5 million, or $0.57 per diluted share in Q4.

Loan Portfolio Growth: Annual loan growth at 8.39%, with significant contributions from the Dallas Fort Worth and Greater New Orleans regions.

Deposits: Annual deposit growth at 8.89%, with a shift towards interest-bearing accounts.

Securities Portfolio: Increased by $29.9 million, with strategic repositioning to lock in higher yields.

Dividends: Quarterly preferred dividend of $18.75 per share and common dividend of $0.14 per share declared.

Shareholders Equity: Book value per common share rose to $22.58, reflecting earnings growth and positive fair value adjustments.

On January 23, 2024, Business First Bancshares Inc (NASDAQ:BFST) released its 8-K filing, detailing its financial results for the fiscal year 2023 and the fourth quarter. The company, a prominent bank holding entity in the United States, offers a suite of services including personal and commercial banking, treasury management, and wealth solutions, primarily generating revenue through interest income on loans and securities.

Fiscal Year 2023 Performance

BFST reported a robust annual net income available to common shareholders of $65.6 million, or $2.59 per diluted share, marking an increase from the previous year. The core net income, adjusted for non-GAAP measures, stood at $66.3 million, or $2.62 per diluted share. This performance underscores the company's ability to grow its earnings amidst a challenging economic landscape.

Fourth Quarter Challenges

Despite the annual gains, the fourth quarter saw a downturn, with net income available to common shareholders falling to $14.5 million, or $0.57 per diluted share. Core net income also saw a decrease compared to the linked quarter. President and CEO Jude Melville expressed pride in the company's performance, citing its role as a source of stability in a swiftly changing economic environment.

"There have been very few years in our companys life of which Ive been prouder than I am of the year 2023," said Jude Melville. "As our country generally, and banking specifically, faced the challenge of navigating swiftly moving economic currents, our team was a source of stability, performing consistently and well for our clients and our investors."

Financial Highlights and Dividends

BFST's loan portfolio experienced a healthy growth, particularly in the commercial and industrial sectors, contributing to an 8.39% annual increase. The Dallas Fort Worth region was a significant driver of this growth, accounting for over half of the net loan growth for the quarter. Deposit growth also remained strong, with a notable rise in money market accounts.

The securities portfolio saw an increase, driven by positive fair value adjustments and a strategic repositioning that resulted in a short-term loss but is expected to yield long-term benefits. Shareholders' equity improved, with book value per common share increasing to $22.58, thanks to continued earnings growth and positive adjustments in the securities portfolio.

Reflecting confidence in its financial stability, BFST declared a quarterly preferred dividend of $18.75 per share and a common dividend of $0.14 per share, to be paid in late February 2024.

Operational Analysis

Net interest income for Q4 decreased slightly from the linked quarter, with a marginal increase in loan and interest-earning asset yields. The cost of funds also rose, reflecting higher deposit costs and a decrease in noninterest-bearing deposits. The provision for credit losses was lower, indicating a stable credit quality.

Other income saw a decrease due to a loss on the sale of securities and lower equity investment income. Conversely, other expenses rose, primarily due to customer fraud losses and increased data processing costs. The return on assets and common equity showed a decline for the quarter, yet remained in a healthy range.

Business First Bancshares Inc (NASDAQ:BFST) continues to navigate the complex financial landscape with strategic initiatives and a focus on core growth. The company's ability to declare dividends and maintain a stable credit quality amidst economic uncertainties speaks to its resilience and prudent management.

For more detailed information, investors and stakeholders are encouraged to review the full earnings report and join the upcoming conference call and webcast hosted by executive management.

Explore the complete 8-K earnings release (here) from Business First Bancshares Inc for further details.

This article first appeared on GuruFocus.