Butterfly Network Inc (BFLY) Faces Headwinds Amid Transition: A Dive into Q4 2023 Earnings

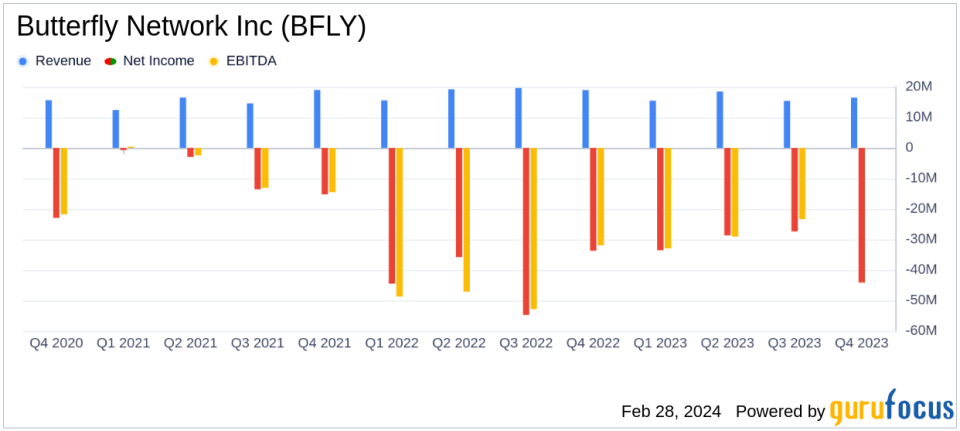

Revenue: Total revenue declined to $16.5 million in Q4 2023 from $19.0 million in Q4 2022.

Gross Margin: Adjusted gross margin improved to 56.6% from 54.5% year-over-year, despite a gross loss due to inventory write-down.

Operating Expenses: Operating expenses decreased by 42% year-over-year to $34.2 million, reflecting cost rationalization efforts.

Net Loss: Net loss widened to $44.1 million in Q4 2023 from $33.7 million in Q4 2022.

Adjusted EBITDA: Adjusted EBITDA loss improved to $15.7 million from $27.7 million year-over-year.

Liquidity: Cash, cash equivalents, and restricted cash totaled $138.7 million as of December 31, 2023.

On February 28, 2024, Butterfly Network Inc (NYSE:BFLY) released its 8-K filing, detailing the financial results for the fourth quarter and full year ended December 31, 2023. The company, known for its innovative handheld ultrasound technology, faced a challenging year with a strategic focus on cost savings and product development.

Company Overview

Butterfly Network Inc is at the forefront of digital health, revolutionizing care with its handheld, whole-body ultrasound device, Butterfly iQ+. The company's proprietary Ultrasound-on-Chip technology allows for affordable and accessible imaging, which is complemented by cloud-connected software and hardware easily operated through a mobile application. Butterfly's products, including the newly FDA-cleared Butterfly iQ3, are designed to integrate seamlessly into clinical workflows, offering a practical and powerful imaging solution.

Financial Performance and Challenges

Butterfly Network's total revenue saw a decrease to $16.5 million in Q4 2023, down from $19.0 million in the same quarter of the previous year. This decline was attributed to a drop in U.S. probe sales and the absence of large international distributor orders that were present in 2022. Despite these challenges, the company managed to improve its adjusted gross margin to 56.6%, up from 54.5% in the prior year, thanks to a higher average selling price and a shift towards subscription revenues.

However, the company reported a gross loss of $12.5 million, primarily due to a significant $21.9 million write-down of excess and obsolete inventory. This write-down, while impacting the total gross margin, was excluded from the adjusted gross profit and margin calculations. Operating expenses were significantly reduced by 42% to $34.2 million, reflecting the company's efforts to rightsize its business through workforce reductions and spend rationalization.

Despite these cost-saving measures, Butterfly Network's net loss widened to $44.1 million in Q4 2023 from $33.7 million in the prior year period. The adjusted EBITDA loss showed improvement, shrinking to $15.7 million from $27.7 million year-over-year, indicating some success in the company's operational efficiency initiatives.

Financial Achievements and Importance

The reduction in operating expenses and the improvement in adjusted EBITDA are significant achievements for Butterfly Network, especially within the competitive Medical Devices & Instruments industry. These efforts demonstrate the company's commitment to achieving a more sustainable cost structure and improving operational efficiency, which are crucial for long-term growth and profitability.

Analysis and Outlook

Butterfly Network's transition year has set the stage for potential growth in 2024, with the launch of the Butterfly iQ3 and expansion into new markets such as Asia. The company's focus on educational initiatives and partnerships within the Butterfly Garden and Powered by Butterfly ecosystems are expected to drive adoption and support future revenue growth.

While the company's liquidity remains strong with $138.7 million in cash, cash equivalents, and restricted cash, the widened net loss and revenue decline highlight the ongoing challenges Butterfly Network faces. Investors will be looking forward to the upcoming Investor Day for further insights into the company's growth initiatives, including ventures into home and wearables markets.

Value investors and potential GuruFocus.com members should monitor Butterfly Network's progress closely, as the company's strategic shifts and product innovations could lead to improved financial performance and market positioning in the evolving digital health landscape.

Explore the complete 8-K earnings release (here) from Butterfly Network Inc for further details.

This article first appeared on GuruFocus.