Buy These 3 High-Yield Stocks for Passive Income

When selecting dividend-paying stocks, one of the first things that investors look at is the annual yield.

It’s common for companies to increase their payouts when business is fruitful, making them enticing investments for income-focused investors from a shorter-term perspective.

And for those interested in reaping a passive income stream, three high-yield stocks – DHT DHT, Ecopetrol EC, and Global Ship Lease GSL – all fit the criteria. Let’s take a closer look at each.

DHT

DHT operates a fleet of double-hull crude oil tankers on international routes. DHT's modern fleet consists of three Very Large Crude Carriers, two Suezmax tankers, and four Aframax tankers. The stock is currently a Zacks Rank #2 (Buy).

Shares currently yield a sizable 10.5% annually, nowhere near the Zacks Transportation sector average of 2.1%. The company has consistently increased its payout, sporting a solid 10.5% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

Keep an eye out for the company’s upcoming quarterly release on August 9th; the Zacks Consensus EPS estimate of $0.43 suggests a remarkable 975% jump in earnings from the year-ago quarter. Revenue growth is also strong, forecasted to see an improvement of more than 130%.

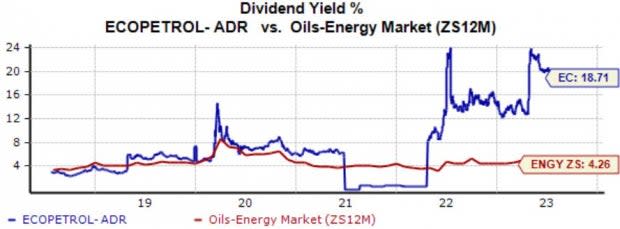

Ecopetrol

Ecopetrol is a Colombia-based petroleum company. Analysts have taken a bullish stance on the company’s earnings outlook across all timeframes, landing the stock into a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

EC shares currently yield 18.7% annually, more than quadruple the Zacks Oils and Energy sector average of an already impressive 4.3%. The company has grown its payout by a modest 1.3% over the last five years, with a sustainable payout ratio of 38% of earnings.

Image Source: Zacks Investment Research

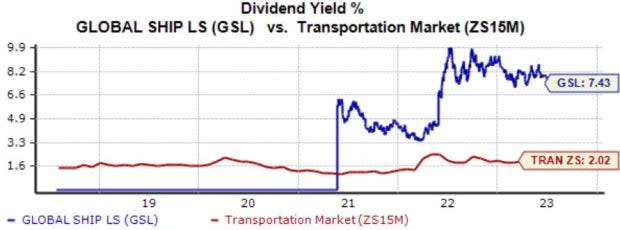

Global Ship Lease

Global Ship Lease is a rapidly growing containership charter owner incorporated in the Marshall Islands. The stock currently boasts an overall VGM Score of A.

GSL shares would entice any income-focused investor, with shares yielding a sizable 7.4% annually. The company’s payout ratio sits at a sustainable 18% of its earnings, with two dividend hikes hitting the tape over the last five years.

Image Source: Zacks Investment Research

In addition, the company has been a consistent earnings performer, delivering four consecutive double beats. Just in its latest print, GSL delivered an impressive 10% EPS beat and reported revenue 5% ahead of expectations.

Bottom Line

It’s critical to remember that while high-yielding stocks can allow investors to build up a cash pile quickly, the sustainability of the increased yield is vulnerable when business isn’t going so smoothly.

All three stocks above – DHT DHT, Ecopetrol EC, and Global Ship Lease GSL – are currently paying investors handsomely.

For those seeking reliability, targeting companies considered Dividend Aristocrats provides precisely that.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecopetrol S.A. (EC) : Free Stock Analysis Report

DHT Holdings, Inc. (DHT) : Free Stock Analysis Report

Global Ship Lease, Inc. (GSL) : Free Stock Analysis Report