Buy These 4 Low-Beta Technology Stocks to Combat Volatility

After a couple of pandemic-dampened years, the broader equity market started 2023 on a decent note, with the three major indexes in the positive trajectory so far this year.

Major stock market indices in the United States like the Dow Jones Industrial Average, Nasdaq Composite and S&P 500 have increased 3.8%, 31.7% and 15.9%, respectively, in the year-to-date (YTD) period. In fact, tech sector is one of the outperformers in this year’s broader stock market rally. The Zacks Computer and Technology sector has risen 37.3% YTD.

However, fears of recession still loom due to persistent macroeconomic and geopolitical issues. Consumers and enterprises have become more cautious about their information technology (IT) spending due to inflationary pressure and rising interest rates. The technology sector, for which supply-chain constraints were a major issue till mid-2022, is encountering higher inventory-level challenges due to softened IT spending.

Such challenges are likely to persist in the near term, affecting the price performances of most tech stocks. But the question is, should investors interested in tech stocks stay away from the space?

We believe that investing in low-beta tech stocks like America Movil AMX, Amdocs DOX, Vipshop Holdings VIPS and eGain EGAN can help investors in hedging against the current highly volatile market environment.

Beta measures a stock's systematic risk or volatility compared with the market. A stock with a beta of less than 1.0 will be less sensitive to the market’s movements than a stock with a beta of more than 1.0.

Picking the Right Low-Beta Stocks

We have run the Zacks Stocks Screener to identify stocks with a beta between 0.50 and 0.88. We have narrowed our search by considering stocks with a Zacks Rank #1 (Strong Buy) or #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Our Picks

America Movil is a leading provider of integrated telecommunications services in Latin America. It offers enhanced communications solutions with higher data speed transmissions in 25 countries in Latin America, the United States and Central and Eastern Europe. The company is gaining from an increasing broadband client base and wireless subscriber additions, especially in Brazil, Mexico and Columbia.

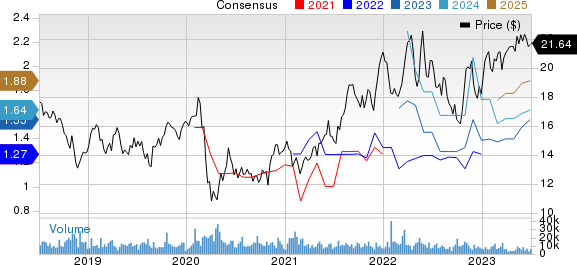

This Zacks Rank #1 company has a beta of 0.88. Shares of AMX have increased 16.4% in the trailing 6-month period.

America Movil, S.A.B. de C.V. Unsponsored ADR Price and Consensus

America Movil, S.A.B. de C.V. Unsponsored ADR price-consensus-chart | America Movil, S.A.B. de C.V. Unsponsored ADR Quote

America Movil aims to grow in other parts of the world by continuing to expand its subscriber base through the development of existing businesses and strategic acquisitions. It witnessed a surge in revenues from the Services segment due to the realized synergies from the buyout of Brazil’s Oi in April 2022. Its efforts to increase shareholders’ value and lower debt and comprehensive financing costs by selling off cellular towers to Sitios Latino-america bode well for the long term. In first-quarter 2023, the company gained 1.1 million wireless subscribers on an organic basis, including 1.9 million post-paid subscribers. Brazil, Austria and Colombia were the primary contributors to postpaid subscriber growth.

The consensus mark for AMX’s second-quarter 2023 earnings has been pegged at 37 cents per share, indicating a 24.5% year-over-year decline in the past seven days. For 2023, the Zacks Consensus Estimate for earnings increased from $1.50 to $1.56 per share in the past 30 days.

eGain is the leading provider of cloud customer engagement hub software. With a presence in North America, EMEA and APAC, the company offers web customer interaction applications, social customer interaction applications and contact center applications.

Currently, eGain flaunts a Zacks Rank #1. It has a beta of 0.58. Shares of EGAN have lost 19.2% in the past six months.

eGain Corporation Price and Consensus

eGain Corporation price-consensus-chart | eGain Corporation Quote

eGain solutions help improve customer experience, optimize service processes and boost sales across the web, social and phone channels. Hundreds of the world's major companies rely on eGain to transform their fragmented sales engagement and customer service operations into unified Customer Engagement Hubs. In the latest quarter, the company’s Knowledge Hub solution was adopted by some major global clients, which include a leading global airline, a U.S.-based health & benefit service provider and the Department of Taxation of one of the U.S. state governments.

The Zacks Consensus Estimate for EGAN’s first-quarter fiscal 2024 earnings is pegged at 6 cents, remaining steady in the past 30 days. The consensus mark for fiscal 2024 earnings has been steady in the past 30 days at 20 cents.

Amdocs is one of the leading providers of customer care, billing and order management systems for communications and Internet services. The company offers amdocsONE, a line of services designed for various stages of a service provider's lifecycle. It also provides advertising and media services for media publishers, TV networks, video streaming providers, advertising agencies and service providers.

The company is benefiting from its recurring revenue business model. Customer additions and solid demand for managed services are DOX’s primary growth drivers. The acquisition of Openet has rapidly expanded Amdocs’ footprint in fifth-generation cellular networks. Its solutions have been selected by the likes of AT&T and T-Mobile to bolster their 5G footprint.

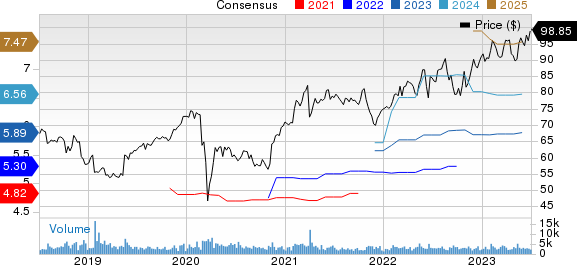

Amdocs Limited Price and Consensus

Amdocs Limited price-consensus-chart | Amdocs Limited Quote

Currently, the company has a Zacks Rank #2. Amdocs has a beta of 0.66. Shares of DOX have gained 8.7% YTD.

The long-term expected earnings growth rate for Amdocs is pegged at 11%. The Zacks Consensus Estimate for DOX’s fourth-quarter fiscal 2023 earnings is pegged at $1.47 per share, indicating an increase of 14% from the year-ago reported figure. For fiscal 2023, the consensus mark for earnings moved northward by 3 cents to $5.89 per share in the past 60 days, indicating a 11.1% year-over-year rise.

Vipshop is an online discount retailer for brands. It provides branded products to consumers in China through flash sales on its vipshop.com website. The company’s continued efforts toward strengthening product offerings and improving product procurement are aiding its financial performance, given the growing proliferation of online shopping amid the pandemic. Solid execution of its merchandising strategy is bolstering its active customer base.

Vipshop’s successful transition to discount retailing is a major upside. This is likely to continue driving momentum across repeat customers and help attract new ones. Its quarterly results are likely to keep benefiting from its deepening focus on high-margin-generating apparel-related businesses, especially the discount apparel business. Deep discount channels are expected to bolster its online gross merchandise volumes in the quarters ahead.

Vipshop Holdings Limited Price and Consensus

Vipshop Holdings Limited price-consensus-chart | Vipshop Holdings Limited Quote

Vipshop carries a Zacks Rank #2 company and has a beta of 0.50. Shares of VIPS have gained 21% YTD.

The consensus mark for VIPS’ third-quarter fiscal 2023 earnings has been revised upward by a penny to 40 cents per share in the past seven days, suggesting an 8.1% year-over-year rise. For fiscal 2023, the Zacks Consensus Estimate for earnings has increased by 29 cents to $1.94 per share in the past 60 days, calling for a year-over-year growth of 25.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

America Movil, S.A.B. de C.V. Unsponsored ADR (AMX) : Free Stock Analysis Report

Amdocs Limited (DOX) : Free Stock Analysis Report

eGain Corporation (EGAN) : Free Stock Analysis Report

Vipshop Holdings Limited (VIPS) : Free Stock Analysis Report