Buy 5 Low-Beta High-Yielding Stocks in a Volatile September

September is historically known as the worst-performing month on Wall Street. The first half of the month has maintained the trend. U.S. stock markets faced the first major setback in August after an impressive bull run in the first seven months of 2023. The volatile trading pattern of August continued in the first half of September.

Volatility May Continue in the Near Future

Month to date, the three major stock indexes – the Dow, the S&P 500 and the Nasdaq Composite – are down 0.3%, 1.3% and 2.3%, respectively. Market participants are uncertain about Fed’s future move on monetary policies. Last week, the S&P 500 and the Nasdaq Composite posted two consecutive weeks of decline.

At present, the CME FedWatch is showing a 98% probability that the central bank will keep the interest rate unchanged at the existing rate of 5.25-5.5% in its FOMC meeting scheduled next week. Notably, this is the highest Fed fund rate since March 20021.

However, there exists a 28% probability that the benchmark interest rate will be hiked by another 25 basis points or more in the November FOMC meeting. In this regard, the post- FOMC meeting statement of Fed Chairman Jerome Powell will have immense importance.

Higher interest rate is affecting the U.S. banking sector. U.S. banks are currently under rating watch. Last month, Moody’s Investors Service cut the rating of 10 small and mid-sized U.S. banks by a single notch. Additionally, the rating agency put six big banks under review for a potential downgrade.

Fitch Ratings warned that it might downgrade the ratings of more than a dozen U.S. heavyweight banks in the near future. Moreover, S&P Global cut credit ratings on some regional lenders with high commercial real estate exposure.

At this stage, investment in low-beta stocks with a high dividend yield and a favorable Zacks Rank may be the best option. If the markets regain momentum, the favorable Zacks Rank of these stocks will capture the upside potential. However, if the downtrend continues, low-beta stocks will minimize portfolio losses and dividend payments will act as a regular income stream.

Our Top Picks

We have narrowed our search to five large-cap (market capital > $10 billion) low-beta (beta >0 <1) stocks with a solid dividend yield. These companies have strong growth potential for 2023 and have seen positive earnings estimate revisions in the past 60 days. Each of our picks carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

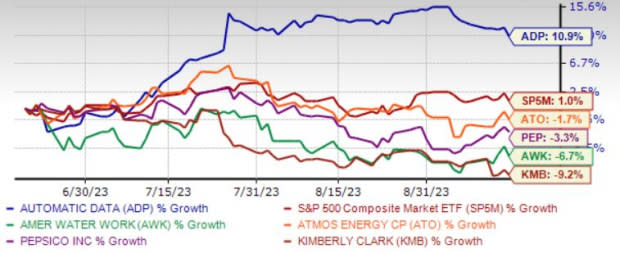

The chart below shows the price performance of our five picks in the past three months.

Image Source: Zacks Investment Research

American Water Works Co. Inc. AWK is gaining from the implementation of new water systems and contributions from military contracts. Investments to upgrade its infrastructure will allow AWK to provide quality services to its expanding customer base. AWK continues to expand operations through organic and inorganic initiatives. Cost management is boosting margins. Our model projects an increase in revenues for the 2023-2025 period.

American Water Works Co. has an expected revenue and earnings growth rate of 8.2% and 6.4%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.2% over the past 30 days. AWK has a beta of 0.57 and a current dividend yield of 2.01%.

Atmos Energy Corp. ATO continues to benefit from rising demand, courtesy of an expanding customer base. ATO’s long-term investment plan will further help to increase the safety and reliability of its natural gas pipelines. ATO gains from industrial customer additions and constructive rate outcomes.

Atmos Energy has an expected revenue and earnings growth rate of 13.2% and 6.7%, respectively, for the current year (ending September 2024). The Zacks Consensus Estimate for current-year earnings has improved 0.5% over the past 60 days. ATO has a beta of 0.62 and a current dividend yield of 2.54%.

PepsiCo Inc. PEP reported robust second-quarter 2023 earnings. The results reflected strength and resilience in its diversified portfolio, modernized supply chain, improved digital capabilities, flexible go-to-market distribution systems and robust consumer demand trends. Resilience and strength in the global beverage and food businesses also aided results.

PEP expects organic revenue growth of 10% for 2023 compared with the 8% rise estimated earlier. PEP expects core earnings per share of $7.47 for 2023 compared with $7.27 forecast earlier.

PepsiCo has an expected revenue and earnings growth rate of 6.7% and 10.2%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.9% over the past 60 days. PEP has a beta of 0.54 and a current dividend yield of 2.79%.

Automatic Data Processing Inc. ADP continues to enjoy a dominant position in the human capital management market through strategic buyouts like Celergo, WorkMarket, Global Cash Card and The Marcus Buckingham Company. ADP has a strong business model, high recurring revenues, good margins, robust client retention and low capital expenditure. Further, ADP continues to innovate, improve operations, and invest in its ongoing transformation efforts.

Automatic Data Processing has an expected revenue and earnings growth rate of 6.3% and 11.1%, respectively, for the current year (ending June 2024). The Zacks Consensus Estimate for current-year earnings has improved 11.1% over the past 60 days. ADP has a beta of 0.81 and a current dividend yield of 2.01%.

Kimberly-Clark Corp. KMB has been benefiting from its three growth pillars. These include focusing on improving KMB’s core business in the developed markets, speeding up the growth of the Personal Care segment in developing and emerging markets and enhancing digital and e-commerce capacities. Apart from this, KMB’s pricing and saving initiatives have been aiding amid cost inflation.

Kimberly-Clark has an expected revenue and earnings growth rate of 1.5% and 14%, respectively, for the current year. The Zacks Consensus Estimate for next-year earnings has improved 3.4% over the past 60 days. KMB has a beta of 0.39 and a current dividend yield of 3.75%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

Kimberly-Clark Corporation (KMB) : Free Stock Analysis Report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

Atmos Energy Corporation (ATO) : Free Stock Analysis Report

American Water Works Company, Inc. (AWK) : Free Stock Analysis Report