Buy 5 Manufacturing Stocks Despite Disappointing October PMI

The U.S. manufacturing sector has contracted for 11 consecutive months in September following a 28-month period of growth. The Institute of Supply Management (ISM) reported that the reading for U.S. manufacturing PMI (purchasing managers’ index) came in at 46.7.

Notably, any reading below 50 indicates a contraction in manufacturing activities. However, October’s reading was disappointing as it fell below the consensus mark of 49.3 and September’s reading of 49. Moreover, major subindexes have contracted.

The New Orders Index remained in contraction territory at 45.5%, 3.7% lower than 49.2% recorded in September. The Production Index reading of 50.4% reflects a 2.1% decrease compared to September's figure of 52.5%. The Prices Index registered 45.1%, up 1.3% compared to the reading of 43.8% in September.

However, there are some positive developments too. While supply-chain disruptions persist, especially related to the availability of electronic components, the situation has improved, as evident from the ISM report’s Supplier Deliveries Index, which reflected faster deliveries for the twelfth straight month in September.

The industry participants are focused on an acquisition-based growth strategy to expand their network and product offerings. This helps them foray into new markets and solidify their competitive position. Exposure to various end markets helps industrial manufacturing companies offset risks associated with a single market.

Our Top Picks

We have narrowed our search to five manufacturing stocks with strong potential for the rest of 2023. These stocks have seen positive earnings estimate revisions in the last 30 days. Each of our picks carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

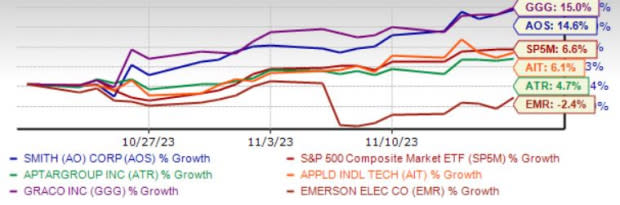

The chart below shows the price performance of our five picks in he past month.

Image Source: Zacks Investment Research

Emerson Electric Co. EMR has been benefiting from healthy demand across end markets. Strong demand across the process and hybrid markets are driving EMR’s underlying sales. The successive deals to acquire Afag and Flexim spark optimism. Emerson Electric’s $8.2 billion deal to acquire National Instruments holds promise. EMR’s bullish guidance for fiscal 2023 is encouraging.

Emerson Electric has an expected revenue and earnings growth rate of 14.3% and 16.2%, respectively, for the current year (ending September 2024). The Zacks Consensus Estimate for current-year earnings has improved 0.6% over the last seven days.

Graco Inc. GGG is benefiting from strength in its Industrial segment due to robust activity in the alternative energy, electronics and battery end markets. Continued sales growth in vehicle service and semiconductors is driving GGG’s Process segment. For 2023, GGG predicts organic sales growth (on a constant-currency basis) in low-single digits.

Graco has an expected revenue and earnings growth rate of 2.5% and 15.6%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 1.7% over the last 30 days.

A. O. Smith Corp. AOS is one of the leading manufacturers of commercial and residential water heating equipment, and water treatment products of the world. AOS specializes in offering innovative, as well as energy-efficient solutions and products, which are developed and sold on a global platform.

Improving supply chains and robust demand for commercial and residential boilers and water treatment products in North America have benefitted AOS. Higher sales from India support the Rest of the World unit’s performance amid weakness in China.

A.O. Smith has an expected revenue and earnings growth rate of 2.2% and 20.1%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 4.4% over the last 30 days.

AptarGroup Inc. ATR designs and manufactures a range of drug delivery, consumer product dispensing, and active material science solutions and services for the pharmaceutical, beauty, personal care, home care, and food and beverage markets. ATR operates through three segments: Aptar Pharma, Aptar Beauty, and Aptar Closures.

ATR’s Beauty segment will gain from the increased demand for beauty and personal care markets. The Pharma segment is witnessing steady demand growth for prescription and consumer healthcare. ATR’s strategic actions and strong balance sheet should also drive growth.

AptarGroup is well-poised to grow on innovative product launches. Backed by its efforts to bring new products into the market, ATR remains the preferred choice for renowned brands worldwide. Efforts to expand its business and invest in capacity expansion to capitalize on the growing demand should aid growth.

AptarGroup has an expected revenue and earnings growth rate of 4.6% and 23.5%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 2.4% over the last 30 days.

Applied Industrial Technologies Inc. AIT is poised to benefit from an improving product line and value-added services. Growth in larger national accounts and fluid power aftermarket sales, as well as benefits from sales force effectiveness initiatives, are aiding the Service Center Based Distribution unit.

Acquired assets are driving AIT’s top line. Focus on pricing and cross-selling actions and growth initiatives augur well. The September 2023 acquisition of Bearing Distributors and Cangro expanded AIT’s footprint and strategic growth initiatives across the U.S. Southeast and upper Northeast regions.

Applied Industrial Technologies has an expected revenue and earnings growth rate of 2.8% and 7.8%, respectively, for the current year (June 2024). The Zacks Consensus Estimate for current-year earnings has improved 3.3% over the last 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Emerson Electric Co. (EMR) : Free Stock Analysis Report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Graco Inc. (GGG) : Free Stock Analysis Report

AptarGroup, Inc. (ATR) : Free Stock Analysis Report