Buy These 5 S&P 500 Laggards of 2023 With Strong Upside Left

Wall Street has seen an impressive bull run in 2023 after a highly disappointing 2022. Year to date, the three major stock indexes — the Dow, the S&P 500 and the Nasdaq Composite — are up 4.3%, 16.4% and 32%, respectively.

Despite facing volatility in the past four weeks, the long-term trend of U.S. stock markets remains bullish. However, several S&P 500 components lagged the index to a big extent. A handful of those laggers are U.S. corporate giants with a favorable Zacks Rank. We have selected five such stocks that have vast upside left.

Momentum Likely to Continue

The inflation rate has been dwindling steadily since June 2022. The consumer price index of August came in at a three-month high. However, that was primarily due to higher energy prices. Moreover, the fundamentals of the economy remain strong with a resilient labor market and solid consumer spending. These developments have brightened the chance of the Fed’s so-called “soft landing” and reduced the possibility of a near-term recession.

On Sep 11, the Wall Street Journal reported that in a major shift from its rigorous interest rate hike policy, the Fed would restrain from a rate hike at this month’s FOMC meeting. Moreover, the journal reported that Fed officials are considering all aspects about whether more rate hikes are at all needed this year.

At present, the Fed fund rate is in the range of 5.25-5.5%. The CME FedWatch tool is showing a 97% probability that the Fed will maintain a status quo in the September FOMC meeting, while a mere 3% chance is there that the rate will be hiked by 25 basis points.

Athough the inflation rate is currently well above the Fed’s 2% target level, majority of Fed officials are of the view that further tightening of monetary policies may be detrimental to the economy. Monetary policy variables always affect the economy during a lag period. Therefore, Fed officials believe that the central bank should wait for the full effect of the current level of interest rate to be visible.

Our Top Picks

We have narrowed our search to five U.S. corporate behemoth (market capital > $50 billion) with strong potential for the rest of 2023. These stocks have seen positive earnings estimate revisions in the last 60 days. Each of our picks carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

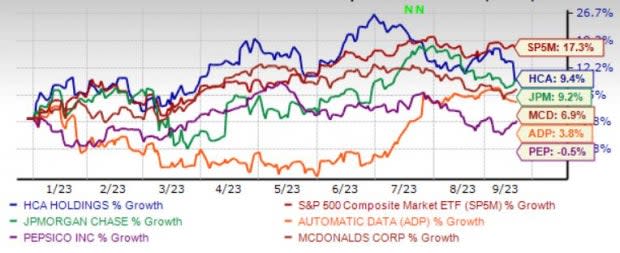

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

PepsiCo Inc. PEP reported robust second-quarter 2023 earnings results. The results reflect strength and resilience in its diversified portfolio, modernized supply chain, improved digital capabilities, flexible go-to-market distribution systems and robust consumer demand trends. Resilience and strength in the global beverage and food businesses also aided results.

PEP expects organic revenue growth of 10% for 2023 compared with the 8% rise estimated earlier. PEP expects core earnings per share of $7.47 for 2023 compared with the $7.27 forecast earlier.

PepsiCo has an expected revenue and earnings growth rate of 6.7% and 10.2%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.9% over the last 60 days. PEP currently has a dividend yield of 2.84%.

JPMorgan Chase & Co. ‘s JPM second-quarter 2023 results show the impacts of the First Republic Bank buyout, higher rates and a worsening economic outlook. High rates, global expansion efforts and decent loan demand should support the net interest income (NII) of JPM. Our estimates for NII (managed) indicate a CAGR of 5.8% by 2025. With green shoots visible in the investment banking (IB) business, IB fees are likely to see a turnaround soon.

JPMorgan Chase has an expected revenue and earnings growth rate of 22% and 30.9%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.1% over the last 30 days. JPM has a current dividend yield of 2.73%.

McDonald's Corp. MCD continues to impress investors with robust comps growth. MCD’s increased focus on menu innovation and loyalty program expansion is commendable. MCD is also making every effort to drive growth in international markets. Robust digitalization is likely to boost McDonald's long-term growth and capture market share. MCD plans to open more than 1,900 restaurants globally in 2023.

McDonald’s has an expected revenue and earnings growth rate of 9.8% and 13.8%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 3.9% over the last 60 days. MCD has a current dividend yield of 2.17%.

Automatic Data Processing Inc. ADP continues to enjoy a dominant position in the human capital management market through strategic buyouts like Celergo, WorkMarket, Global Cash Card and The Marcus Buckingham Company. ADP has a strong business model, high recurring revenues, good margins, robust client retention and low capital expenditure. Further, ADP continues to innovate, improve operations, and invest in its ongoing transformation efforts.

Automatic Data Processing has an expected revenue and earnings growth rate of 6.3% and 11.1%, respectively, for the current year (ending June 2024). The Zacks Consensus Estimate for current-year earnings has improved 11.1% over the last 60 days. ADP has a current dividend yield of 2.02%.

HCA Healthcare Inc.’s HCA revenues remain on an upward trajectory on the back of a surge in admissions, outpatient surgeries and other procedures. Multiple buyouts aided HCA in increasing patient volumes, enabled network expansion, added hospitals to its portfolio and boosted business scale. HCA has been gaining from its telemedicine business line on the back of digitization of fueling demand. HCA resorts to prudent capital deployment via buybacks and dividends.

HCA Healthcare has an expected revenue and earnings growth rate of 6% and 9.2%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.1% over the last 30 days. HCA has a current dividend yield of 0.92%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

McDonald's Corporation (MCD) : Free Stock Analysis Report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

HCA Healthcare, Inc. (HCA) : Free Stock Analysis Report