Buy This Cheap Dividend Stock for Value, Growth and Upside?

First BanCorp. FBP is a low-priced stock trading for under $15 per share that’s managed to climb in 2022 even as the market tumbles. The financial services provider also pays an industry-beating dividend, and First BanCorp’s raised its outlook after it reported strong Q2 results amid a rising interest rate environment.

FBP’s Basics

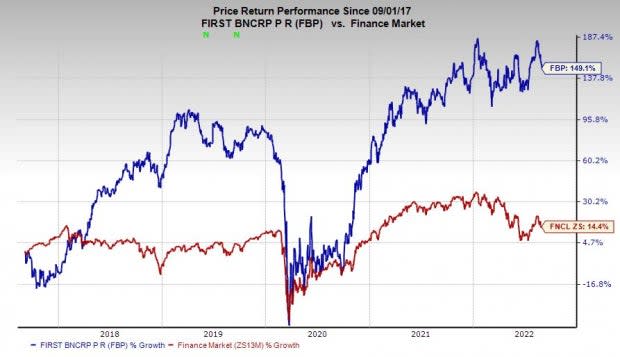

First BanCorp is an established financial services company with roots dating back well over 50 years. The firm went public in the early 1990s. FBP shares have outperformed the market and the Zacks Finance sector over the last 10 years, up an impressive 250%.

FBP stock has also popped roughly 4% in 2022 even as the Finance sector dropped 14% and the benchmark fell 17%, with it up 12% in the past 12 months. And it closed regular trading Wednesday at the “cheap” price of $14.30 per share.

First BanCorp operates in Puerto Rico, the U.S./British Virgin Islands, and Florida. The company’s diverse portfolio includes banks, insurance firms, loan companies, and more. FBP’s Banks–Southeast industry is in the top 14% of over 250 Zacks industries at the moment, as the group benefits from higher interest rates.

Image Source: Zacks Investment Research

Other Enticing Fundamentals

First BanCorp posted solid Q2 results in late July. More importantly, FBP raised its outlook as it benefits from rising interest rates, which could be getting even better for regional banks as the Fed ramps up its inflation fight.

First BanCorp’s FY22 and FY23 consensus earnings estimates have popped by around 6% since its release to help FBP capture a Zacks Rank #1 (Strong Buy) right now.

In terms of growth, Zacks estimates call for its revenue to pop 7% this year and another 9% in FY23. Meanwhile, its adjusted earnings are projected to surge 14% and 9.4%, respectively.

Alongside its low stock price, FBP shares trade at a 25% discount to its own 10-year median at 8.5X forward 12-month earnings. And it trades nearly 60% below its decade-long highs and right near its year-long lows.

First BanCorp’s also offers 10% value compared to its highly-ranked industry and 39% vs. the broader Finance sector, even though the stock has consistently outperformed both.

Image Source: Zacks Investment Research

Bottom Line

Alongside its value and low share price, First BanCorp’s current average price target offers 17% upside to Wednesday’s closing levels. Plus, four out of the five brokerage recommendations Zacks has are “Strong Buys,” with the other at a “Buy.”

On top of that, First BanCorp provides investors income with its dividend yielding 3.3% to beat its industry’s 2.2%, the S&P 500’s 1.5%, and the 10-year U.S. Treasury’s 3.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

First BanCorp. (FBP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research