Buybacks aren't the best way to enrich shareholders: Morning Brief

Tuesday, October 22, 2019

Two things to know about stock buybacks

The practice of stock buybacks is controversial and garners a lot of attention when people bring it up. Here are two provocative assertions often made about buybacks: 1) Stock buybacks are driving all of the stock market returns and 2) Companies should use cash by investing in their own businesses — and the economy — instead of enriching shareholders by buying back stock.

There isn’t enough space here to fully address these statements. But there is enough space to hit some facts.

For starters, we can all agree that earnings and the prospect for earnings growth are the key drivers of stock prices in the long run. According to what Warren Buffett calls the “ultimate formula,” the value of a stock is equal to the present value of all the money a company will earn.

And by extension, the price of a single share is driven by earnings per share (EPS). So, it’s easy to jump to the conclusion that a stock buyback will boost a share’s price because that company’s earnings is now being allocated to fewer shares.

But there are bigger things driving EPS. Consider revenue and profit margins.

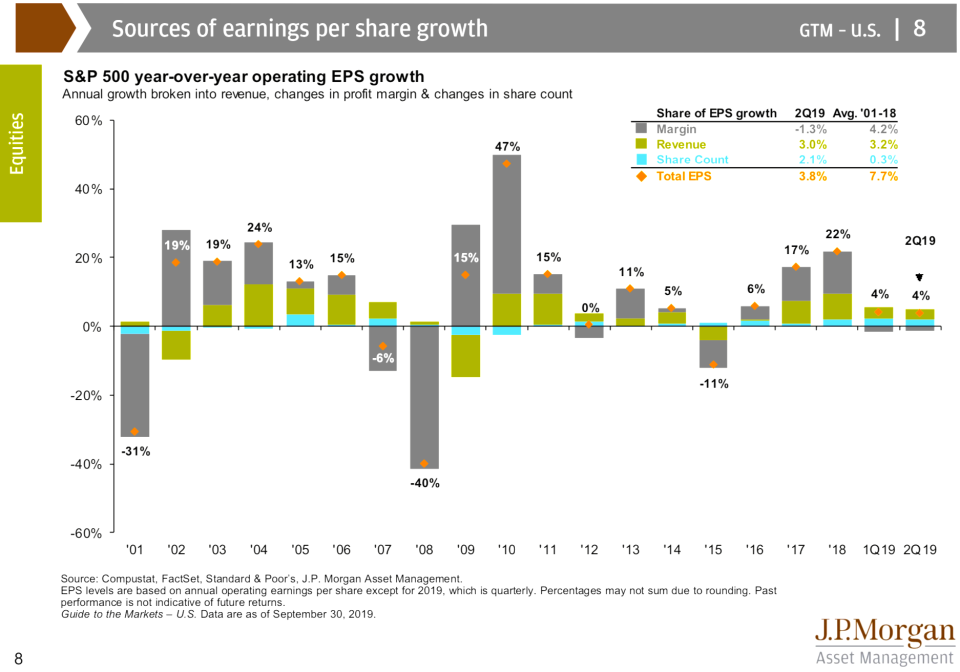

Below is a chart from JPMorgan Asset Management breaking down historical S&P 500 (^GSPC) EPS growth by revenue growth, profit margin expansion, and share count change. Sure, there are years when changes in share count account for a big part of one year’s change in EPS. But over time, EPS is overwhelmingly about revenue growth and the ability to amplify earnings with an expanding profit margin.

And you can’t can’t grow revenue and boost profit margins by buying back stock. You do it by increasing demand, expanding capacity and replacing inefficient equipment among other things. And you accomplish this with capital expenditures, research and development, and mergers and acquisitions.

So then, why are companies supposedly spending all their money on buybacks? Well, it’s because they’re not.

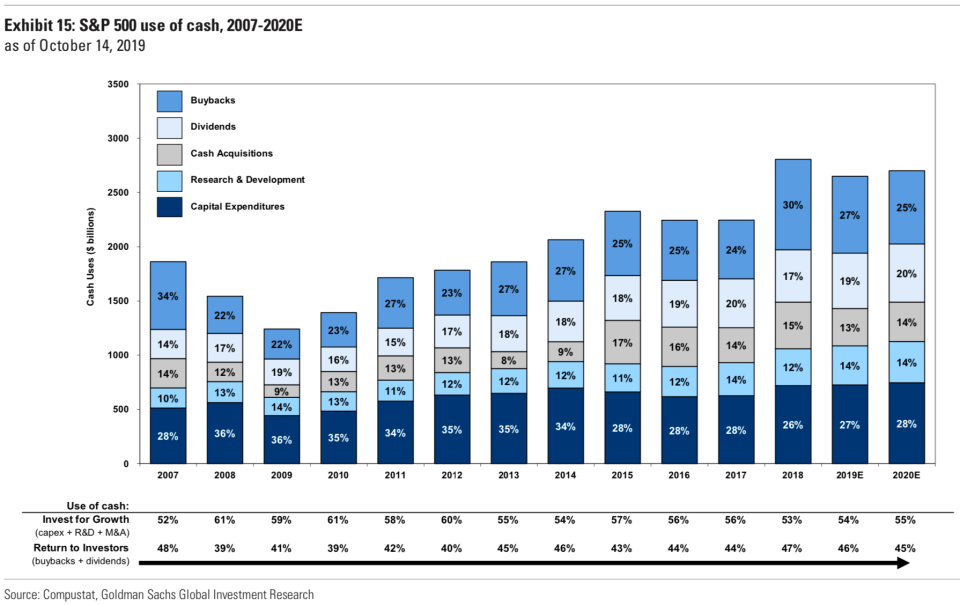

Believe it or not, companies have historically spent most of their cash on these shareholder enriching growth initiatives. According to Goldman Sachs, S&P 500 constituents have consistently allocated more than half of their cash usage for investing in growth. The biggest single category for cash use: capital expenditures.

If the priority is to get that stock price up, then the move is to invest in growth if that opportunity exists. Obviously, no one wants to see a company open a store that’s gonna generate no business, so demand better be there or you can expect that chicken to come home and roost in the form of a writedown.

When those growth options have been exhausted and if the stock appears to be trading below intrinsic value and if there’s excess cash sitting on the balance sheet generating paltry returns (don’t forget interest rates are at their lowest levels in decades), then buying back stock isn’t a bad idea. Send that money to shareholders and let them figure out what to do with it.

By Sam Ro, managing editor. Follow him at @SamRo

What to watch today

Economy

10 a.m. ET: Richmond Fed Manufacturing Index, October (-9 prior)

10 a.m. ET: Existing Home Sales, September (5.45 million expected, 5.49 million in August)

Earnings

Pre-market

6:55 a.m. ET: Procter & Gamble (PG) is expected to report adjusted earnings of $1.24 per share on $17.43 billion in revenue

6:55 a.m. ET: United Technologies (UTX) is expected to report adjusted earnings of $2.03 per share on $19.35 billion in revenue

7 a.m. ET: UPS (UPS) is expected to report adjusted earnings of $2.06 per share on $18.37 billion in revenue

7:30 a.m. ET: Lockheed Martin (LMT) is expected to report adjusted earnings of $5.02 per share on $14.87 billion in revenue

8 a.m. ET: McDonald’s (MCD) is expected to report adjusted earnings of $2.21 per share on $5.49 billion in revenue

Other notable reports: Centene (CNC), Biogen (BIIB), Kimberly-Clark (KMB), Hasbro (HAS), Harley-Davidson (HOG), PulteGroup (PHM), Sherwin-Williams (SHW)

Post-market

4:10 p.m. ET: Chipotle (CMG) is expected to report adjusted earnings of $3.21 per share on $1.38 billion in revenue

4:10 p.m. ET: Snap (SNAP) is expected to report an adjusted earnings loss of 5 cents per share on $437.94 million in revenue

Other notable reports: Whirlpool (WHR), Discover Financial (DFS), Texas Instruments (TXN)

Top News

Softbank reportedly prepared to take control of WeWork [Yahoo Finance]

Trump says China signals trade talks on target for November deal [Bloomberg]

Infosys dives most in 6 years as whistleblowers target CEO [Bloomberg]

TD Ameritrade 4Q profit up 21% before cutting commissions [AP]

YAHOO FINANCE HIGHLIGHTS

UPS has a new flight path — drone home delivery

A key benefit of Obamacare is stalling — here's why

'Bond' designed Aston Martin tops Neiman Marcus Fantasy Gift list

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.