Buyouts Contribute to Post Holdings (POST), Cost Woes Stay

Post Holdings, Inc. POST is benefiting from its focus on acquisitions, helping it expand customer base. The consumer packaged goods company is gaining from a recovery in the Foodservice channel. These upsides were seen in its second-quarter fiscal 2023 results, with the top and the bottom line increasing year over year and beating the Zacks Consensus Estimate. Yet, the company is not immune to rising cost environment.

Let’s delve deeper.

Acquisitions: Key Driver

Post Holdings strategically increased its presence through acquisitions. On Apr 28, 2023, POST unveiled that it completed the acquisition of select pet food brands. This acquisition will provide the company with a compelling entry point into the attractive and growing pet food category. On Apr 5, 2022, Post Holdings acquired Lacka Foods Limited. Lacka Foods is a U.K.-based marketer of high-protein, ready-to-drink (RTD) shakes under the UFIT brand. Post Holdings acquired Almark Foods (or Almark) on Feb 1, 2021. Almark, which is renowned for its hard-cooked and deviled egg products, provides conventional, organic and cage-free products. On Jan 25, 2021, Post Holdings acquired the Peter Pan peanut butter brand.

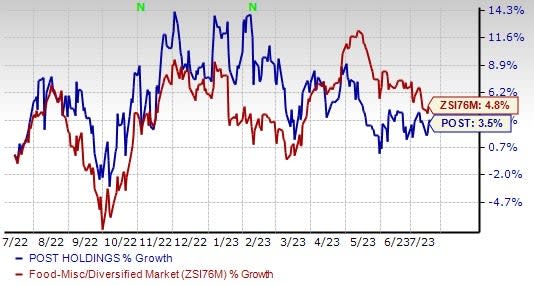

Image Source: Zacks Investment Research

Foodservice Business Drives Growth

Post Holdings is benefiting from strength in the Foodservice business. During the second quarter of fiscal 2023, Foodservice sales increased 40.1% to $633.2 million. Revenues reflect the effects of inflation-driven pricing actions and the impact of commodity cost pass-through pricing model. Volumes rose 12.1%. Egg volumes rose 13.3% and potato volumes climbed 10.8%. Segmental adjusted EBITDA was $78.1 million, up 290.5% on better average net pricing and volume growth. Prior to this, sales in the Foodservice segment increased 37%, 36.9% and 33.1% in the first, the fourth and the third quarter, respectively. Management highlighted that its Foodservice business has completely recovered from COVID and turned profitable.

Cost Hurdles on the Way

In its second-quarter fiscal 2023 earnings call, management highlighted supply chain disruptions eased slightly but continued to drive increased manufacturing costs while customer order fulfilment rates remained lower than optimal levels. The company also faced input and freight inflation in the quarter. In addition, Post Holdings has been seeing a rise in SG&A costs for a while. Its SG&A expenses increased 1.7% year over year to $235.4 million in the second quarter of fiscal 2023.

That being said, the aforementioned upsides are likely to keep aiding Post Holdings’ growth. The Zacks Rank #3 (Hold) stock has increased 3.5% in the past year compared with the industry’s 4.8% growth.

Solid Staple Bets

Here we have highlighted three top-ranked stocks, namely TreeHouse Foods, Inc. THS, Lamb Weston Holdings LW and Celsius Holdings CELH.

TreeHouse Foods, a manufacturer of packaged foods and beverages, currently sports a Zacks Rank #1 (Strong Buy). THS has a trailing four-quarter earnings surprise of 49.3%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for TreeHouse Foods’ current financial-year sales suggests decline of 12.4%, from the year-ago reported numbers.

Lamb Weston, a leading supplier of frozen potato, sweet potato, appetizer and vegetable products to restaurants and retailers worldwide, currently carries a Zacks Rank #2 (Buy). LW has a trailing four-quarter earnings surprise of 47.6%, on average.

The Zacks Consensus Estimate for Lamb Weston’s current financial-year sales and earnings suggests growth of 29.6% and 117.3%, respectively, from the year-ago reported numbers. The expected EPS growth rate for three to five years is 42.7%.

Celsius Holdings, which offers functional drinks and liquid supplements, currently carries a Zacks Rank #2. CELH delivered an earnings surprise of 81.8% in the last reported quarter.

The Zacks Consensus Estimate for Celsius Holdings’ current fiscal-year sales and earnings suggests growth of 69.6% and 154.4%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

TreeHouse Foods, Inc. (THS) : Free Stock Analysis Report

Post Holdings, Inc. (POST) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report