BYD Takes On EV Laggards Toyota, VW With Steep China Price Cuts

(Bloomberg) — Not content with unseating Tesla Inc. as the world’s top-selling electric-car maker, BYD Co. has set its sights on luring customers away from the likes of Toyota Motor Corp. and Volkswagen AG in one of the most aggressive rounds of discounting seen in China’s bruising price war.

Most Read from Bloomberg

Fed’s Powell Ready to Support Job Market, Even If It Means Lingering Inflation

Gucci’s China Shock Reverberates Across the Luxury Landscape

The automaker is currently discounting almost every electric and hybrid model it sells as part of a marketing campaign declaring “electricity is cheaper than oil.”

Data from Chinese car portal 16888.com analyzed by Bloomberg News shows BYD has cut prices on more than 100 existing model versions compared with December, and has relaunched a further 70 model trims with lower prices. About the only unaffected vehicles come from its new Yangwang brand, including its just-unveiled supercar that goes for 1.68 million yuan ($233,000).

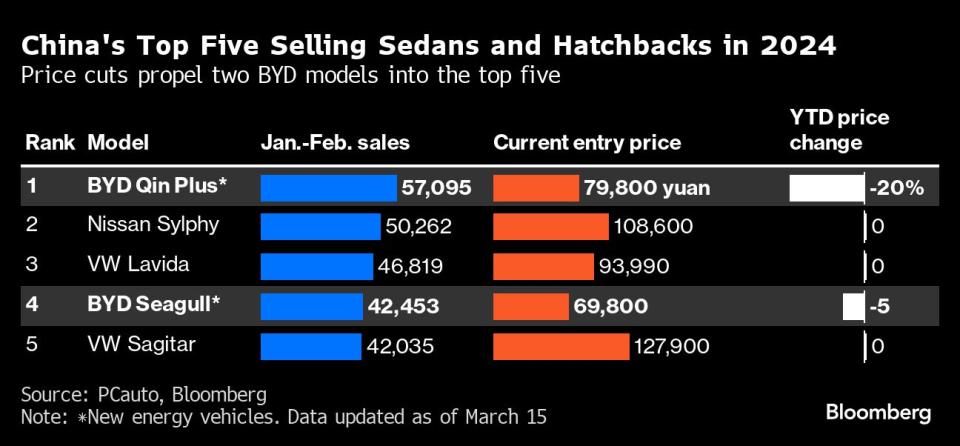

Notably, BYD’s most affordable EV has become even cheaper still. The Seagull hatchback has been discounted 5% to 69,800 yuan, or less than $10,000, which undercuts the average price of an EV in the US by more than $50,000. BYD has marked down its top-selling Qin Plus sedan even more steeply, by 20%, to a starting price of 79,800 yuan.

While Chinese EV manufacturers have generally pitched their models at first-time car buyers in wealthy cities like Shanghai and Shenzhen, BYD’s all-out price cuts are aimed at persuading drivers to ditch their gasoline cars and go electric, while also seeking to win customers in smaller cities and rural areas who previously couldn’t afford an EV.

The strategy is a threat to Toyota, Volkswagen and Nissan Motor Co., which have all been slow to transition to EVs and seen their China sales suffer as a result.

“This is round two of the price war,” said Bill Russo, founder and chief executive officer of Shanghai-based consultancy Automobility. “BYD is using its margin advantage to attack the market. If I’ve got more chips in my stack on the poker table, then I’m going to try and bully that person off the table.”

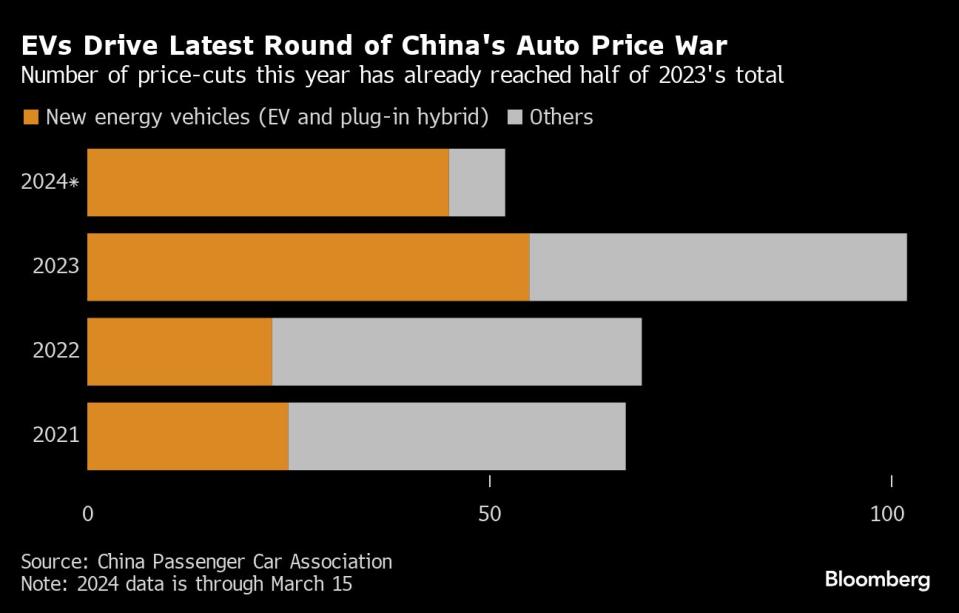

The extent of the latest price cuts has shocked even long-time observers used to the nature of China’s hyper-competitive auto market. China Passenger Car Association Secretary General Cui Dongshu wrote on his blog last week that discounting has become “ultra intense” and reached “an astonishing level.”

The hefty discounts are supercharging sales — the Qin Plus and Seagull both cracked the top-five-selling sedans or hatchbacks in the first two months of this year. A year ago, Nissan’s gasoline-fueled Sylphy was the top seller, followed by VW’s Lavida. The Sylphy and Toyota’s Corolla were among the cars named by Morgan Stanley analysts in a Feb. 19 report as being under the greatest threat from BYD’s discounts.

“New-energy vehicles are severely cutting prices,” the PCA’s Cui wrote in his blog, adding that some combustion-engine vehicle manufacturers had reached a floor with their discounts. New-energy vehicles, which include fully electric and plug-in hybrid models, accounted for 35.8% of new car sales in February, according to Bloomberg Intelligence.

BYD will release its 2023 results Tuesday. While the company has already flagged annual profit of between 29 billion yuan to 31 billion yuan, analysts and investors will be looking for signs the price war is hitting margins.

“With more companies trimming EV prices, those with higher margins could cushion more aggressive price cuts,” BloombergNEF wrote in a March 21 report. “But an extended price war will squeeze revenues as most firms are yet to turn a profit on producing EVs.”

The latest escalation of the price war could also hasten a shakeout of China’s EV sector, as weaker manufacturers are forced to merge or go out of business.

Read More: Zombie Chinese EV Makers Resurrected in ‘Productive Force’ Push

China has “too many brands, too many models on the market,” Yuqian Ding, HSBC Qianhai’s head of China auto research, told Bloomberg Television last week. “The industry is due for consolidation.”

Most Read from Bloomberg Businessweek

Weight-Loss-Drug Users Pay Up for Help Ditching the Pricey Meds

Magnificent Seven? It’s More Like the Blazing Two and Tepid Five

Wall Street and Silicon Valley Elites Are Warming Up to Trump

Business Schools Still Lag on Diversity, Despite Stated Goals

©2024 Bloomberg L.P.