Byline Bancorp Inc (BY) Reports Solid Growth in 2023 Earnings

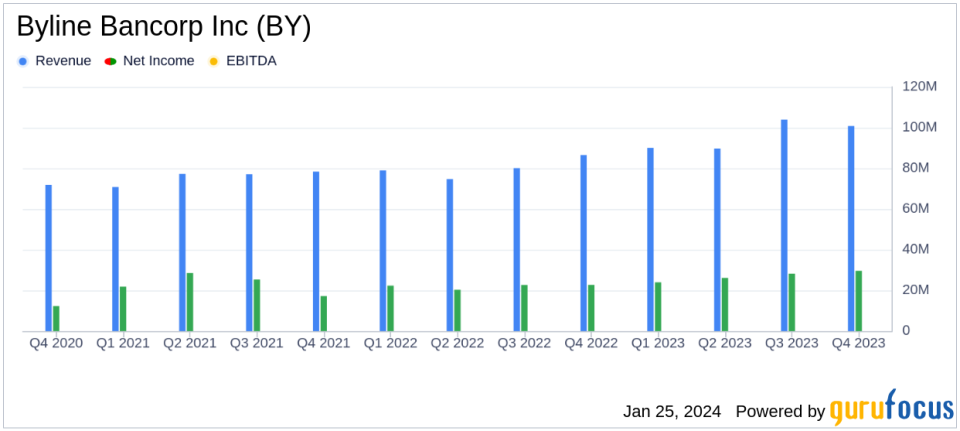

Net Income: $29.6 million for Q4 and $107.9 million for the full year.

Revenue: Total revenue reached $100.8 million in Q4, marking a year-over-year increase.

Earnings Per Share: Diluted EPS stood at $0.68 for Q4 and $2.67 for the full year.

Deposits and Loans: Total deposits grew to $7.2 billion, with loans and leases reaching $6.7 billion.

Asset Quality: Allowance for credit losses was $101.7 million, reflecting prudent risk management.

Efficiency Ratio: Improved to 51.63% in Q4, indicating enhanced operational efficiency.

Stock Repurchase: New program authorizes the repurchase of up to 1.25 million shares.

On January 25, 2024, Byline Bancorp Inc (NYSE:BY) released its 8-K filing, detailing a robust financial performance for the fourth quarter and full year of 2023. The company, a full-service commercial bank serving small-and-medium-sized businesses and consumers, reported a net income of $29.6 million for the fourth quarter and $107.9 million for the full year, translating to diluted earnings per share of $0.68 and $2.67, respectively.

Byline Bancorp's success can be attributed to several strategic initiatives, including the successful merger and integration of Inland Bancorp, Inc. This led to a significant increase in total deposits, which rose by $1.5 billion, and total loans and leases, which increased by $1.2 billion over the year. The company's balance sheet growth was instrumental in achieving the highest level of revenue in Byline's history.

Financial Highlights and Performance Analysis

The bank's financial achievements are a testament to its strong operational performance and strategic growth. Net interest income for the year saw a substantial increase of $65.3 million, or 24.6%, with a net interest margin (NIM) improvement of 31 basis points to 4.31%. This reflects the bank's ability to effectively manage interest-earning assets and interest-bearing liabilities in a dynamic rate environment.

Byline Bancorp also reported a record pre-tax pre-provision net income (PTPP) of $47.2 million for the fourth quarter, driven by positive operating leverage and a 28.0% increase in PTPP. The adjusted efficiency ratio, a measure of the bank's operational efficiency, stood at 48.64% for Q4, indicating disciplined expense management.

Asset quality remained a focus, with the allowance for credit losses (ACL) at $101.7 million, representing 1.52% of total loans and leases held for investment. The bank's proactive risk management is evident in its prudent provisioning for credit losses, which totaled $7.2 million for the fourth quarter.

Byline Bancorp's balance sheet strength is further underscored by its deposit growth of $223.3 million, or 12.7% annualized, and loan growth of $81.7 million, or 4.9% annualized. The bank's loan-to-deposit ratio of 93.39% reflects a healthy liquidity position, with a reduced reliance on brokered CDs and FHLB advances, which decreased by $384.1 million.

Executive Chairman and CEO Roberto R. Herencia expressed confidence in the bank's trajectory, stating, "We enter 2024 on solid footing and with great momentum to continue growing the value of our franchise." President Alberto J. Paracchini also highlighted the strong earnings, balanced growth, and robust profitability as key drivers of the bank's success.

In addition to its financial achievements, Byline Bancorp's Board of Directors authorized a new stock repurchase program and declared a cash dividend of $0.09 per share, signaling confidence in the bank's capital position and commitment to delivering shareholder value.

Byline Bancorp Inc (NYSE:BY) remains focused on serving its customers' financial needs while maintaining asset quality, capital, and liquidity positions. With a solid foundation and strategic initiatives bearing fruit, the bank is well-positioned for continued growth and success in the financial industry.

Explore the complete 8-K earnings release (here) from Byline Bancorp Inc for further details.

This article first appeared on GuruFocus.