Byrna Technologies Inc (BYRN) Reports Mixed Fiscal 2023 Results Amid Strategic Shifts

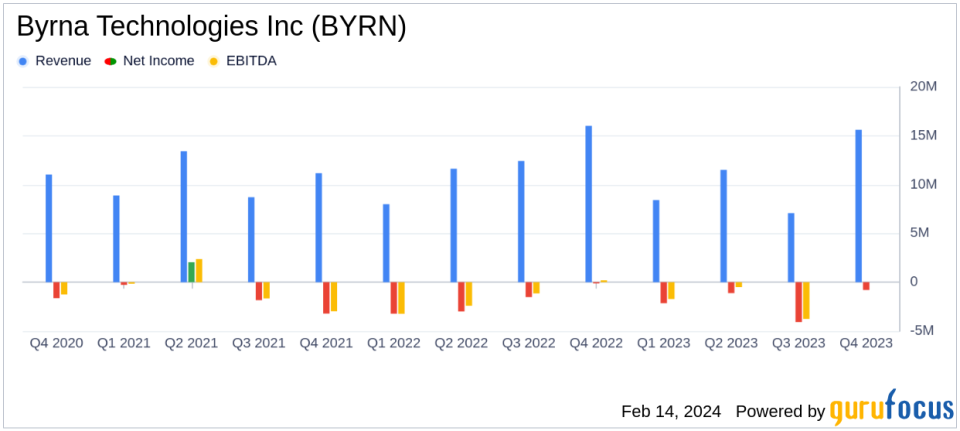

Net Revenue: FY 2023 net revenue decreased to $42.6 million from $48.0 million in FY 2022.

Gross Profit: Gross profit for FY 2023 was $23.6 million, maintaining a stable gross margin year-over-year.

Operating Expenses: Operating expenses decreased to $31.4 million in FY 2023 from $34.0 million in FY 2022.

Net Loss: Net loss for FY 2023 slightly increased to $(8.2) million from $(7.9) million in FY 2022.

Adjusted EBITDA: Adjusted EBITDA for FY 2023 was $(2.0) million, compared to $(1.0) million for FY 2022.

Liquidity: Cash and cash equivalents stood at $20.5 million as of November 30, 2023, with no debt.

On February 14, 2024, Byrna Technologies Inc (NASDAQ:BYRN) released its 8-K filing, detailing the financial results for its fiscal fourth quarter and full year 2023. Byrna Technologies Inc is a leader in the development, manufacture, and sale of innovative less-lethal personal security solutions, with a market presence spanning the United States, South Africa, Europe, South America, Asia, and Canada.

The company reported a slight decrease in net revenue for Q4 2023 at $15.6 million compared to $16.0 million in Q4 2022. This was attributed to an exceptionally strong international sales performance in the previous year, including a significant stocking order from Argentina. However, domestic revenue showed robust growth, up 32% year-over-year and 122% sequentially from Q3 2023.

Gross profit for Q4 2023 improved to $9.0 million, or 58% of net revenue, up from $8.7 million, or 54% of net revenue, in Q4 2022. The increase in gross margin was primarily due to a higher percentage of sales from the direct-to-consumer channel, which typically yields higher margins.

Operating expenses for Q4 2023 increased to $9.7 million from $8.8 million in Q4 2022, driven by heightened marketing expenditures as part of Byrna's new celebrity endorsement strategy. This strategy has been pivotal in overcoming advertising challenges on major social media platforms, leading to a significant uptick in web traffic and sales.

The net loss for Q4 2023 was $(0.8) million, compared to approximately breakeven in Q4 2022. The slight increase in net loss was primarily due to the increase in marketing spend and additional bonus accruals. Adjusted EBITDA for Q4 2023 was $0.4 million, a decrease from $1.4 million in Q4 2022.

For the full fiscal year 2023, Byrna reported a net revenue of $42.6 million, down from $48.0 million in FY 2022. This decline was largely due to a decrease in international sales, partially offset by increases in domestic dealer and distributor sales, Amazon sales, and Fox Labs sales. The net loss for FY 2023 was $(8.2) million, a slight increase from $(7.9) million in FY 2022.

Byrna's CEO, Bryan Ganz, commented on the year's challenges and successes, highlighting the transformative impact of the celebrity endorsement program and the relaunch of the Byrna LE launcher. The company's strategic shift to celebrity endorsements has led to a record $15.4 million in domestic sales in Q4 2023 and a significant increase in first-time customers.

2023 was a transformational year for Byrna. We faced significant challenges but emerged stronger, with a successful celebrity endorsement strategy that has driven substantial growth in domestic sales and web traffic, said Bryan Ganz, CEO of Byrna.

Byrna's balance sheet remains strong, with $20.5 million in cash and cash equivalents and no debt as of November 30, 2023. The company's financial stability and strategic marketing initiatives position it for potential growth in 2024.

Investors and stakeholders are invited to join the company's management for a conference call to discuss these results and answer questions.

Byrna's performance in FY 2023 reflects the resilience and adaptability of the company in the face of advertising challenges and market shifts. The company's focus on direct-to-consumer sales and strategic marketing initiatives, including celebrity endorsements, have helped to mitigate the impact of decreased international sales and position Byrna for future growth.

For more detailed financial information and the full earnings report, please refer to the provided 8-K filing.

Explore the complete 8-K earnings release (here) from Byrna Technologies Inc for further details.

This article first appeared on GuruFocus.