C.H. Robinson (CHRW) Q3 Earnings Top Estimates, Revenues Lag

C.H. Robinson Worldwide, Inc. (CHRW) third-quarter 2023 earnings per share of 84 cents beat the Zacks Consensus Estimate of 82 cents but declined 52.8% year over year. Total revenues of $4,341 million lagged the Zacks Consensus Estimate of $4,370 million and declined 27.8% year over year owing to lower pricing in the company’s ocean and truckload services.

Operating expenses declined 13.1% year over year to $521.3 million.

Adjusted gross profits fell 28.4% year over year to $634.8 million, owing to lower adjusted gross profit per transaction in truckload and ocean. Adjusted operating margin fell 1,450 basis points to 17.9%.

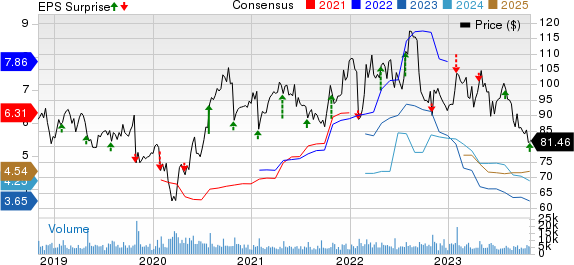

C.H. Robinson Worldwide, Inc. Price, Consensus and EPS Surprise

C.H. Robinson Worldwide, Inc. price-consensus-eps-surprise-chart | C.H. Robinson Worldwide, Inc. Quote

Segmental Results

North American Surface Transportation’s total revenues were $3,086.97million (down 22.9% year over year) in the third quarter, owing to lower truckload pricing. The adjusted gross profit of the segment declined 31.4% to $386.51 million.

Total revenues from Global Forwarding fell 52.4% to $719.04million, owing to lower pricing in CHRW’s ocean service. Adjusted gross profit of the segment fell 31.6% year over year to $169.89million.

Revenues from other sources (Robinson Fresh, Managed Services and Other Surface Transportation) increased 6.6% to $535.01 million.

Below, we present the division of adjusted profit among the service lines (on an enterprise basis).

Transportation: The unit (comprising Truckload, LTL, Ocean, Air, Customs and Other logistics services) delivered an adjusted gross profit of $607.44million in the quarter under review, down 29.5% from the prior-year figure.

Adjusted gross profits of Truckload, LTL and Customs declined 38.4%, 14.9% and 10.7% year over year to $245.43 million, $137.94 million and $24.90 million, respectively. However, other logistics services’ adjusted gross profit fell 0.9% to $64.84 million.

Adjusted gross profit of the Ocean transportation segment fell 35% year over year. The metric fell 36.9% to $30.20 million in the Air transportation sub-group.

Balance-Sheet Data

CHRW exited the third quarter with cash and cash equivalents of $174.73 million compared with $210.15 million at the end of June 2023. Long-term debt was $920.72 million compared with $920.49 million at the second-quarter end.

CHRW generated $205.2 million of cash from operations in the third quarter. Capital expenditures were $16.7 million in the reported quarter.

In the third quarter of 2023, CHRW repurchased shares worth $3 million and paid $72.7 million in cash dividends.

2023 Outlook

Capital expenditures for 2023 are anticipated toward the lower end of the previously announced guidance of $90 million-$100 million.

Currently, C.H. Robinson carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performances of Other Transportation Companies

J.B. Hunt Transport Services, Inc.’s JBHT third-quarter 2023 EPS of $1.80 missed the Zacks Consensus Estimate of $1.85 and declined 30% year over year.

JBHT’s total operating revenues of $3,163.8 million also lagged the Zacks Consensus Estimate of $3,224 million and fell 18% year over year. Total operating revenues, excluding fuel surcharges, decreased 15% year over year.

Delta Air Lines, Inc. (DAL) reported third-quarter 2023 EPS (excluding 31 cents from nonrecurring items) of $2.03, which comfortably beat the Zacks Consensus Estimate of $1.92 and improved 35% on a year-over-year basis.

DAL’s revenues of $15,488 million beat the Zacks Consensus Estimate of $15,290.4 million and increased 11% on a year-over-year basis, driven by higher air-travel demand.

Alaska Air Group, Inc. ALK reported third-quarter 2023 EPS of $1.83, which missed the Zacks Consensus Estimate of $1.88 and declined 28% year over year.

Operating revenues of $2,839 million missed the Zacks Consensus Estimate of $2,876.1 million. The top line jumped 0.4% year over year, with passenger revenues accounting for 92.2% of the top line and increasing 0.1% owing to continued recovery in air-travel demand.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

J.B. Hunt Transport Services, Inc. (JBHT) : Free Stock Analysis Report

C.H. Robinson Worldwide, Inc. (CHRW) : Free Stock Analysis Report

Alaska Air Group, Inc. (ALK) : Free Stock Analysis Report