C.H. Robinson Worldwide Inc (CHRW) Faces Headwinds as Q4 Earnings Decline

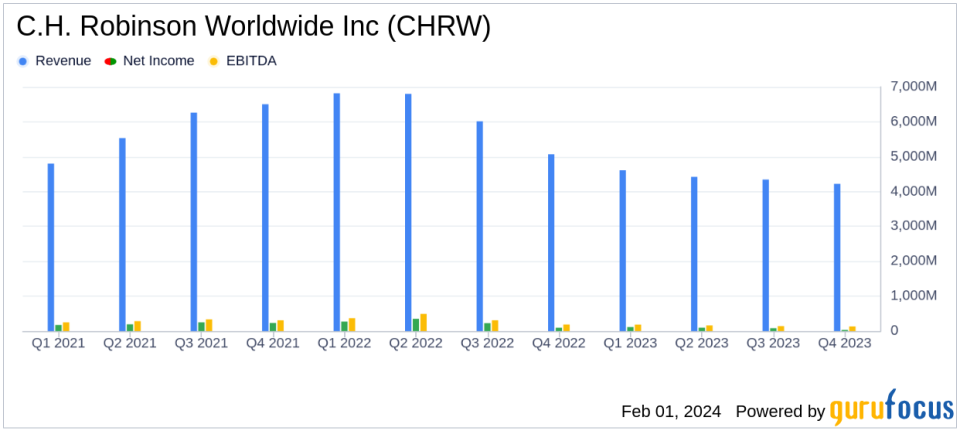

Revenue: Total revenues decreased by 16.7% to $4.2 billion in Q4 2023.

Gross Profit: Gross profits declined by 20.0% to $609.3 million in Q4 2023.

Net Income: Net income saw a significant drop of 67.8% to $31.0 million in Q4 2023.

Earnings Per Share (EPS): Diluted EPS decreased by 67.5% to $0.26 in Q4 2023.

Operating Cash Flow: Cash generated by operations decreased by $726.1 million to $47.3 million in Q4 2023.

Adjusted Operating Margin: Adjusted operating margin decreased by 400 basis points to 17.4% in Q4 2023.

Effective Tax Rate: The effective tax rate increased to 55.3% in Q4 2023.

C.H. Robinson Worldwide Inc (NASDAQ:CHRW) released its 8-K filing on January 31, 2024, revealing a challenging quarter marked by decreased financial performance across several key metrics. The company, a leading non-asset-based third-party logistics provider, faced a tough demand and pricing environment, particularly in its truckload and ocean services.

Company Overview

C.H. Robinson specializes in domestic freight brokerage, which constitutes about 60% of its net revenue, alongside a significant air and ocean forwarding division that accounts for 30%. The company's diverse portfolio also includes a European truck-brokerage division, transportation management services, and a legacy produce-sourcing operation.

Performance and Challenges

The fourth quarter of 2023 was particularly challenging for C.H. Robinson, with gross profits decreasing by 20.0% to $609.3 million and income from operations dropping by 34.5% to $107.4 million. The company's adjusted operating margin also saw a decrease of 400 basis points to 17.4%. President and CEO Dave Bozeman cited weak freight demand and excess carrier capacity as key factors leading to a competitive market environment.

"Our fourth quarter results did not meet our expectations as we continue to battle through a poor demand and pricing environment," said Bozeman.

Financial Achievements and Industry Significance

Despite the downturn, C.H. Robinson achieved a 17% improvement in North American Surface Transportation (NAST) shipments per person per day in Q4, surpassing its 15% target. This reflects the company's efforts in enhancing productivity and reducing waste and manual processes. In the transportation industry, where efficiency is paramount, such improvements are critical for maintaining competitiveness and profitability.

Financial Metrics and Importance

Key financial details from the income statement and balance sheet show a decrease in total revenues by 16.7% to $4.2 billion, primarily due to lower pricing in truckload and ocean services. The balance sheet reflects the company's efforts to manage its capital structure prudently, with capital expenditures expected to be between $85 million to $95 million for 2024.

Important metrics such as diluted EPS, which decreased by 67.5% to $0.26, and adjusted EPS, which decreased by 52.8% to $0.50, are vital indicators of the company's profitability. The significant decline in these figures underscores the impact of the challenging market conditions on C.H. Robinson's bottom line.

Analysis of Company's Performance

C.H. Robinson's performance in Q4 2023 reflects the broader challenges faced by the logistics and transportation industry, including an oversupply of capacity and subdued demand. The company's focus on improving productivity and managing costs is a strategic response to these headwinds, aiming to position itself for recovery when market conditions improve.

Bozeman remains optimistic about the company's future, emphasizing the ongoing efforts to enhance C.H. Robinson's value proposition and market share. The company's strategic initiatives are geared towards reducing structural costs and improving efficiency, operating margins, and profitability.

"Im confident that together we will win for our customers, carriers, employees, and shareholders, and Im incredibly excited about our future," Bozeman concluded.

For a detailed understanding of C.H. Robinson's financials and strategic outlook, investors and stakeholders are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from C.H. Robinson Worldwide Inc for further details.

This article first appeared on GuruFocus.