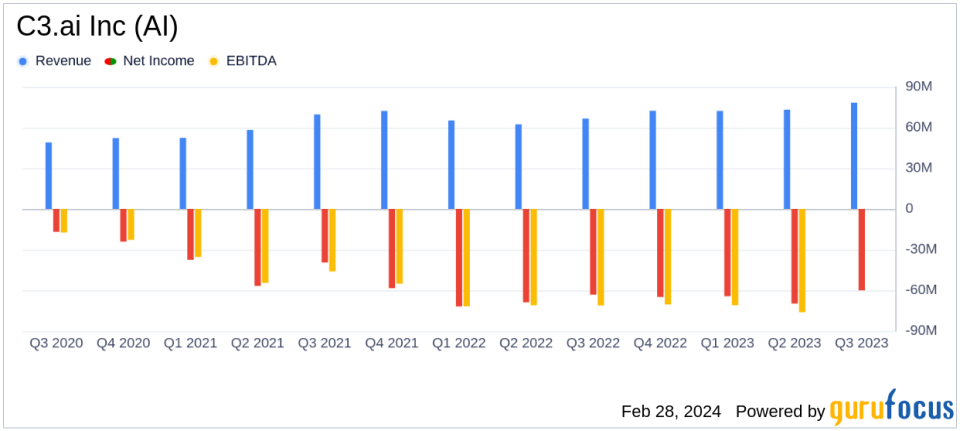

C3.ai Inc (AI) Reports Accelerated Growth and Revenue Surge in Q3 Fiscal 2024

Total Revenue: $78.4 million, an 18% increase YOY.

Subscription Revenue: $70.4 million, representing 90% of total revenue and a 23% increase YOY.

Gross Profit: GAAP gross profit at $45.3 million with a 58% gross margin; Non-GAAP gross profit at $54.7 million with a 70% gross margin.

Net Loss per Share: GAAP net loss per share at $(0.60); Non-GAAP net loss per share at $(0.13).

Cash Reserves: $723.3 million in cash, cash equivalents, and marketable securities.

Customer Engagement: 445 customers engaged, an 80% increase YOY.

On February 28, 2024, C3.ai Inc (NYSE:AI), a leading enterprise artificial intelligence (NYSE:AI) company, announced its financial results for the fiscal third quarter ended January 31, 2024. The company, known for its comprehensive suite of AI applications and solutions, reported a total revenue of $78.4 million, marking an 18% year-over-year growth and surpassing its guidance range. C3.ai Inc (NYSE:AI) released its 8-K filing, detailing the financial performance that reflects the company's significant first mover advantage in the rapidly growing enterprise AI market.

Financial Performance and Market Position

C3.ai Inc (NYSE:AI) has continued to leverage its position as a pioneer in the enterprise AI space, delivering a suite of scalable and deployable AI applications. The company's growth is attributed to increased customer engagement, which soared by 80% year-over-year, and the closing of 50 agreements, indicating a robust demand for AI-driven solutions. Subscription revenue, a critical indicator of the company's business health, constituted 90% of the total revenue, showcasing the company's successful transition to a subscription-based model.

Challenges and Opportunities

Despite the positive revenue growth, C3.ai Inc (NYSE:AI) reported a GAAP net loss per share of $(0.60), although the non-GAAP net loss per share was significantly lower at $(0.13), reflecting certain non-cash expenses and compensation-related charges. The company's ability to maintain a strong cash reserve of over $723 million provides it with a cushion to navigate market uncertainties and invest in strategic growth initiatives.

Customer Success and Business Diversification

C3.ai Inc (NYSE:AI) has reported significant customer success stories, such as Holcim's adoption of C3 AI Reliability across its cement plants and DLA Piper's creation of a generative AI application to streamline legal agreement analysis. The company's diversification across industries is evident from its bookings distribution, with state and local government leading at 29%, followed by federal, defense, and aerospace at 25%. This diversification strategy mitigates industry-specific risks and opens new avenues for growth.

Financial Outlook and Investor Relations

The company has raised its revenue target for the fourth quarter of fiscal 2024 to between $82.0 and $86.0 million, with a full-year fiscal 2024 guidance of $306.0 to $310.0 million. This optimistic outlook is supported by a 73% year-over-year increase in the qualified opportunity pipeline, with C3 Generative AI opportunities outpacing other products.

Conclusion

C3.ai Inc (NYSE:AI)'s third-quarter results demonstrate the company's continued growth trajectory and its ability to capitalize on the expanding enterprise AI market. While net losses remain a challenge, the company's strong subscription revenue growth, diverse customer base, and robust cash reserves position it well for future success. Investors and stakeholders can look forward to C3.ai Inc (NYSE:AI)'s upcoming C3 Transform 2024 conference for further insights into the company's strategies and product offerings.

For a detailed analysis of C3.ai Inc (NYSE:AI)'s financial performance and future prospects, investors are encouraged to review the full 8-K filing and join the upcoming earnings conference call.

Explore the complete 8-K earnings release (here) from C3.ai Inc for further details.

This article first appeared on GuruFocus.