C3.ai's (AI) Stock Is Soaring After Earnings But is it Time to Buy?

Among enterprise AI software providers C3.ai AI is in the mix and making this more apparent with its stock popping more than +20% in today’s trading session. Sparked by excitement for the company’s favorable quarterly results on Wednesday, C3.ai‘s software allows developers to operate large-scale AI, predictive analytics, and IoT applications with one of its closest competitors being BlackLine BL.

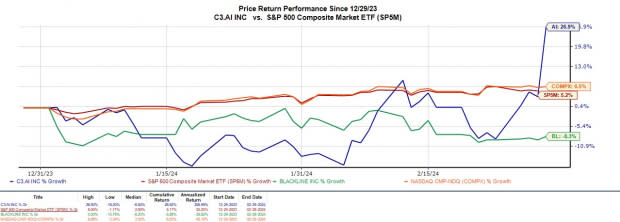

With that being said, let's see if it's time to buy C3.ai’s stock which has now climbed +27% year-to-date to easily top the broader indexes and BlackLine’s -8% dip.

Image Source: Zacks Investment Research

Revenue & Contract Growth Fuels C3.ai’s Post-Earnings Rally

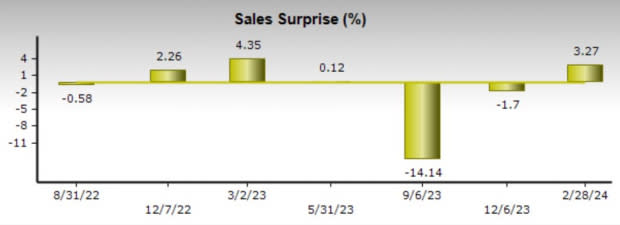

Striving for what it hopes is eventually immense profitability after going public in 2020, C3.ai's total sales grew 18% during its fiscal third quarter to $78.4 million. This topped Zacks estimates by 3% but it was the company stating its customer engagement grew 80% year over year that further excited investors. C3.ai closed 50 agreements which more than doubled from a year ago with 29 new pilots (AI test programs) and the list included many notable companies such as Boston Scientific BSX, T-Mobile TMUS, and AbbVie ABBV along with the U.S. Department of Defense.

Image Source: Zacks Investment Research

Furthermore, C3.ai's Non-GAAP gross profit of $54.7 million on a 70% gross margin was very reassuring although the company incurred a net loss of -$72.63 million and -$0.13 a share. However, the net loss widely exceeded expectations of -$0.28 per share despite dipping from -$0.06 a share in the comparative quarter. More appealing is that C3.ai has now surpassed its bottom line expectations for 12 consecutive quarters.

Image Source: Zacks Investment Research

Why C3.ai’s Suite is Intriguing

C3.ai’s strong bookings come as the company is creating an advantage in Enterprise AI with market interest and demand for AI accelerating. As the self-proclaimed leader in AI-powered predictive maintenance solutions, C3.ai’s suite provides five components of software solutions: C3 AI Application Platform, C3 AI Applications, C3 AI EX Machina (No-Code AI), C3 AI CRM, and C3 AI Data Vision.

This extensive suite is attracting enterprises from various industries with C3.ai’s third quarter bookings distribution chart shown below. It's also noteworthty that C3 AI EX Machina enables developers to scale and apply AI insights without writing code.

Image Source: C3.ai Earnings Release

Favorable Revenue Guidance

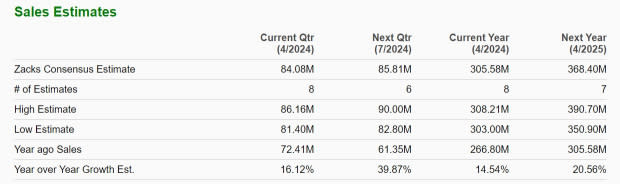

For its fiscal fourth quarter, C3.ai expects revenue to be between $82-$86 million which falls in the range of the Zacks Consensus of $84.08 million or 16% growth. For the full year fiscal 2024, C3.ai now forecasts total sales to be around $306-$310 million with Zacks estimates currently at $305.58 million which would represent 14% growth.

Image Source: Zacks Investment Research

Takeaway

C3.ai has certainly asserted itself as one of the more promising artificial intelligence companies and its stock currently lands a Zacks Rank #3 (Hold). The trend of earnings estimate revisions in the following weeks will play a large part in the potential for more upside in C3.ai’s stock and its trajectory of being able to turn a profit considering its attractive top line growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

C3.ai, Inc. (AI) : Free Stock Analysis Report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

T-Mobile US, Inc. (TMUS) : Free Stock Analysis Report

BlackLine (BL) : Free Stock Analysis Report