C4 Therapeutics (CCCC) to Report Q4 Earnings: What's in Store?

When C4 Therapeutics, Inc. CCCC reports fourth-quarter and full-year 2023 results, investors will primarily focus on pipeline updates.

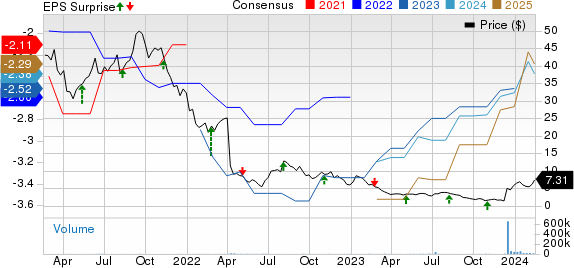

The company has a decent track record of beating on earnings in three of the trailing four quarters and missing in one, delivering an average surprise of 5.04%. In the last reported quarter, it delivered an earnings surprise of 15.38%.

C4 Therapeutics, Inc. Price, Consensus and EPS Surprise

C4 Therapeutics, Inc. price-consensus-eps-surprise-chart | C4 Therapeutics, Inc. Quote

Factors to Note

C4 Therapeutics is a clinical-stage biopharmaceutical company, advancing targeted protein degradation science to develop a new generation of small molecule medicines to transform the way a disease is treated. The company leverages its proprietary technology platform, TORPEDO (Target ORiented ProtEin Degrader Optimizer), to develop small-molecule medicines that harness the body’s natural protein recycling system to rapidly degrade disease-causing protein.

The TORPEDO platform is being used to advance multiple targeted oncology programs to the clinic.

Since CCCC does not have any approved product in its portfolio, the focus lies solely on pipeline progress. It only generates revenues through research collaboration and license agreements with bigwigs like Roche and Biogen.

The company’s most advanced product candidate, CFT7455, is an orally bioavailable MonoDAC degrader of protein targets called IKZF1 and IKZF3, currently in clinical development for multiple myeloma (MM) and non-Hodgkin lymphomas. The company is currently enrolling patients in the phase I dose escalation portion of the ongoing phase I/II study.

In December 2023, CCCC presented positive clinical data from the ongoing study in relapsed/refractory MM. The data demonstrated anti-myeloma activity, including International Myeloma Working Group responses in patients who have undergone numerous lines of prior therapy for MM, including BCMA therapies.

C4 Therapeutics is also developing CFT1946, an orally bioavailable BiDAC degrader, specifically to be potent and selective against BRAF V600 mutant targets to treat melanoma, non-small cell lung cancer, (NSCLC), colorectal cancer (CRC) and other malignancies that harbor this mutation. Patient enrollment is ongoing in the phase I dose escalation portion of the phase I/II study of CFT1946 for the treatment of BRAF V600 mutant solid tumors, including NSCLC, CRC and melanoma.

CCCC is also developing CFT8919, an orally bioavailable, allosteric, mutant-selective BiDAC degrader of epidermal growth factor receptor, or EGFR, with an L858R mutation in NSCLC. It has collaborated with Betta Pharmaceuticals for the development and commercialization of CFT8919 in Greater China, including Hong Kong SAR, Macau SAR and Taiwan.

The company expects to initiate clinical trial activities outside Greater China, following the completion of Betta Pharma's phase I dose escalation trial in the region.

CCCC is not advancing CFT8634 beyond the phase I dose escalation portion of the phase I/II clinical study.

Research and Development expenses are expected to have been higher in the to-be reported quarter due to the ongoing trials.

During the fourth quarter of 2023, CCCC sold approximately 13.7 million shares at an average price of $5.42, resulting in $72 million of new equity capital, net of commissions and fees.

Recent Updates

Last month, management announced strategic plans to prioritize its drug development efforts in 2024.

C4 Therapeutics seeks to prioritize the advancement of two of its pipeline candidates, CFT7455 and CFT1946, and support Betta Pharmaceuticals in the phase I development of CFT8919. The company will also streamline its internal discovery efforts. As a result of this prioritized portfolio, C4T is restructuring its operations and reducing workforce by approximately 30%.

CCCC reported about $330 million in unaudited cash, cash equivalents and marketable securities as of Jan 5. The company expects that cash, cash equivalents and marketable securities as of Jan 5, 2024, together with anticipated cost savings from the restructuring, will enable it to fund its operating plan into 2027.

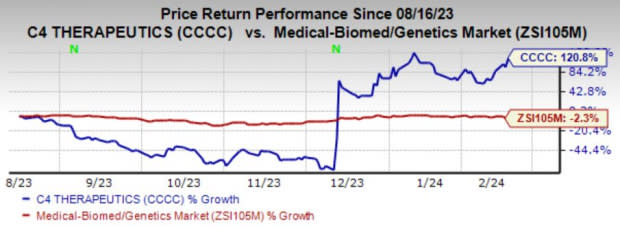

Share Price Performance

The stock rose 120.8% in the past six months against the industry's decline of 2.3%.

Image Source: Zacks Investment Research

What Our Model Predicts

Our proven model does not conclusively predict an earnings beat for CCCC this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is not the case here, as you will see below.

Earnings ESP: Earnings ESP for C4 Therapeutics is -7.69% as the Zacks Consensus Estimate is currently pinned at 67 cents per share and the Most Accurate Estimate is pegged at 72 cents. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank #3.

Stocks to Consider

Here are some drug and biotech stocks that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this reporting cycle.

Arcus Biosciences RCUS has an Earnings ESP of +6.76% and a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

RCUS beat on earnings in two of the last four quarters and missed the same in the other two, delivering an average surprise of 3.83%. Arcus Biosciences is scheduled to release fourth-quarter 2023 results on Feb 21. Its shares have risen 13.6% in the past three months.

Intellia Therapeutics NTLA has an Earnings ESP of +31.1% and a Zacks Rank #2 at present.

NTLA beat on earnings in two of the trailing four quarters, met in one and missed in the other, delivering an average surprise of 5.04%.

Ionis Pharmaceuticals IONS has an Earnings ESP of +11.8% and a Zacks Rank #3 at present.

Ionis beat on earnings in three of the trailing four quarters and missed the mark in one, delivering an average surprise of 28.07%. IONS is scheduled to release fourth-quarter 2023 results on Feb 21. Its shares have gained 22.7% in the past six months.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ionis Pharmaceuticals, Inc. (IONS) : Free Stock Analysis Report

Intellia Therapeutics, Inc. (NTLA) : Free Stock Analysis Report

Arcus Biosciences, Inc. (RCUS) : Free Stock Analysis Report

C4 Therapeutics, Inc. (CCCC) : Free Stock Analysis Report