C4 Therapeutics Inc (CCCC) Reports Full Year 2023 Financial Results and Business Updates

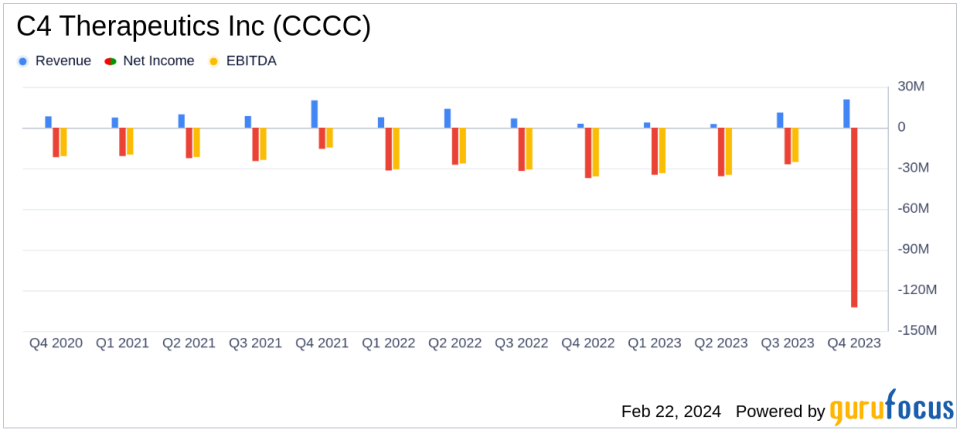

Revenue: Reported a decrease to $20.8 million for the year ended December 31, 2023, from $31.1 million in the previous year.

R&D Expenses: Remained relatively flat at $117.7 million compared to $117.8 million in the previous year.

G&A Expenses: Slightly decreased to $42.1 million from $42.8 million year-over-year.

Net Loss: Increased to $132.5 million, with a net loss per share of $2.67.

Cash Position: Ended the year with $281.7 million in cash, cash equivalents, and marketable securities.

Financial Guidance: Cash runway expected to fund operations into 2027.

Business Milestones: Progress in clinical trials and strategic collaborations set to drive future growth.

On February 22, 2024, C4 Therapeutics Inc (NASDAQ:CCCC) released its 8-K filing, detailing the financial results for the full year ended December 31, 2023, and providing an overview of recent business highlights. C4 Therapeutics Inc is a biopharmaceutical company that is pioneering the field of targeted protein degradation to develop novel small-molecule medicines for the treatment of various diseases.

Financial Performance and Challenges

The company reported a decrease in revenue to $20.8 million for 2023, down from $31.1 million in the previous year. This decline was primarily due to the end of a collaboration agreement with Calico and the completion of research activities for a target under the collaboration agreement with Biogen. Despite this, C4 Therapeutics Inc remains focused on advancing its clinical trials and has secured strategic collaborations that could potentially yield significant future payments.

Research and Development (R&D) expenses were relatively flat year-over-year, totaling $117.7 million, as the company transitioned CFT1946 to clinical development. General and Administrative (G&A) expenses saw a slight decrease to $42.1 million, attributed mainly to a reduction in professional fees. The company's net loss increased to $132.5 million, with a net loss per share of $2.67, compared to $128.2 million and $2.62 per share in the previous year.

Financial Achievements and Importance

Despite the increased net loss, C4 Therapeutics Inc has strengthened its financial position by extending its cash runway into 2027, thanks to strategic financing activities. The company's cash, cash equivalents, and marketable securities stood at $281.7 million as of December 31, 2023. This strong balance sheet is crucial for a biotechnology company like C4 Therapeutics Inc, as it ensures the ability to continue investing in R&D and advancing its clinical programs without the immediate need for additional financing.

Key Financial Metrics and Commentary

The company's President and CEO, Andrew Hirsch, commented on the year's achievements, stating:

2023 was an important year for C4T as we executed across three clinical trials, entered into two new collaborations, generated positive dose escalation data from our CFT7455 program for patients with relapsed/refractory multiple myeloma, and meaningfully extended our cash runway.

This statement underscores the company's commitment to its clinical programs and its strategic approach to financial management.

Analysis of Company's Performance

C4 Therapeutics Inc's performance in 2023 reflects a company in the midst of advancing its clinical pipeline while managing the financial challenges inherent in biopharmaceutical development. The company's ability to maintain a stable R&D expenditure and manage G&A costs effectively, coupled with its strategic collaborations and financing activities, positions it well for future growth and development. The anticipated data from ongoing clinical trials in the second half of 2024 will be critical for the company's continued progress and potential value inflection.

For detailed financial tables and further information on C4 Therapeutics Inc's financial results and business highlights, readers are encouraged to view the full 8-K filing.

Investors and stakeholders in the biotechnology sector will be closely monitoring C4 Therapeutics Inc as it continues to develop its innovative targeted protein degradation platform and advance its clinical pipeline.

Explore the complete 8-K earnings release (here) from C4 Therapeutics Inc for further details.

This article first appeared on GuruFocus.