Cable One Inc (CABO) Reports Mixed Financial Results for Q4 and Full Year 2023

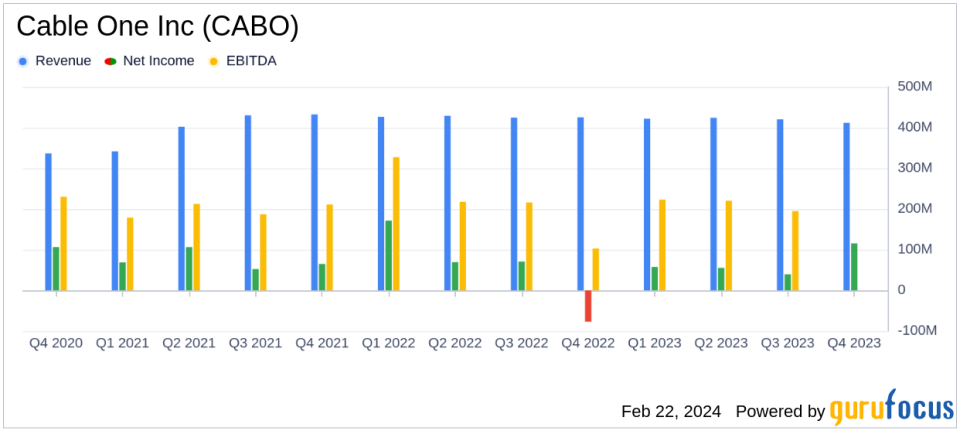

Revenue: Q4 revenue decreased by 3.2% to $411.8 million, and full-year revenue slightly down by 1.6% to $1.678 billion.

Net Income: Q4 net income significantly improved to $115.3 million, a 249.3% change, and full-year net income rose by 14.2% to $267.4 million.

Adjusted EBITDA: Q4 Adjusted EBITDA saw a minor decrease of 2.7% to $226.9 million, while full-year Adjusted EBITDA marginally increased by 0.6% to $916.9 million.

Operating Cash Flow: Cash flows from operating activities decreased by 9.9% in Q4 and by 10.1% for the full year.

Capital Expenditures: Capital expenditures increased by 8.2% in Q4, with a full-year decrease of 10.4%.

Debt Repayment: Cable One repaid $150.0 million under its revolving credit facility during 2023.

Share Repurchase: The company repurchased 141,551 shares at a cost of $99.6 million and had $143.1 million remaining in its share repurchase authorization as of year-end.

On February 22, 2024, Cable One Inc (NYSE:CABO) released its 8-K filing, detailing its financial and operating results for the fourth quarter and full year ended December 31, 2023. As a telecommunications company, Cable One derives its revenue primarily from broadband, voice, and video services, with a significant portion coming from data and video services. The company also offers Sparklight TV, an IPTV service, and earns advertising revenue from its video channels.

Performance and Challenges

Cable One's fourth quarter saw a decrease in revenues by 3.2% to $411.8 million, primarily due to declines in residential video, voice, and other revenues, which were partially offset by an increase in residential data revenues. Despite the revenue dip, the company reported a substantial turnaround in net income, posting $115.3 million compared to a net loss of $77.2 million in the same quarter of the previous year. This dramatic change was largely due to a non-cash gain on fair value adjustment related to equity interests in Mega Broadband Investments Holdings LLC.

For the full year, Cable One's revenues slightly decreased by 1.6% to $1.678 billion, while net income increased by 14.2% to $267.4 million. The company's focus on high-margin residential data and business services, which comprised over 77% of all revenues during the quarter, is a strategic move that aligns with industry trends favoring high-speed data services.

Financial Achievements and Importance

The company's financial achievements, including a net profit margin of 28.0% for Q4 and 15.9% for the full year, underscore its ability to maintain profitability despite revenue challenges. Adjusted EBITDA margins also improved, indicating effective cost management and a strong focus on profitability. These financial metrics are particularly important in the telecommunications industry, where competition and technological advancements require continuous investment and strategic focus on profitable service lines.

Key Financial Metrics

Adjusted EBITDA, a key metric for evaluating operational performance, saw a slight decrease in Q4 but increased marginally over the full year. This metric is crucial as it reflects the company's earnings before interest, taxes, depreciation, and amortization, providing a clearer picture of operational profitability. Cash flows from operating activities, another vital indicator of financial health, decreased in both Q4 and the full year, highlighting challenges in working capital management and higher tax payments.

"Our return to sequential residential high-speed data customer growth in the fourth quarter, as expected, is very encouraging," said Julie Laulis, Cable One President and CEO. "Along with our highest margin residential data and business services product lines comprising over 77% of all revenues during the quarter, we look forward to executing on our business plan for 2024.

Analysis of Company's Performance

Cable One's performance in 2023 reflects resilience in a competitive market. The company's strategic emphasis on high-margin data and business services is paying off, as evidenced by the growth in residential data revenues and ARPU. However, the overall decrease in revenues and operating cash flows suggests that Cable One faces challenges in its traditional service areas and must continue to innovate and adapt to changing consumer preferences.

The company's liquidity position remains strong, with $190.3 million in cash and cash equivalents at the end of 2023. The reduction in total debt and disciplined capital expenditure management also demonstrate Cable One's commitment to maintaining a solid financial foundation while investing in growth opportunities.

For value investors, Cable One's ability to grow its high-margin services and maintain a healthy balance sheet, despite industry headwinds, may present an attractive investment opportunity. The company's proactive measures, such as share repurchases and dividend payments, reflect confidence in its financial stability and commitment to shareholder returns.

For more detailed information, investors are encouraged to review the full 8-K filing and anticipate the upcoming annual report for a comprehensive analysis of Cable One's financial condition and results of operations.

Explore the complete 8-K earnings release (here) from Cable One Inc for further details.

This article first appeared on GuruFocus.