Cabot (CBT) Announces Updates on Current Demand Scenario

Cabot Corporation CBT recently issued an update on the impact of the current market scenario on its business segments.

Sales volumes in the Performance Chemicals segment were year-over-year 13% lower in April and May 2023, with declines across all product lines except Battery Materials, where volumes climbed owing to an increase in electric car sales in China. While sales volumes in the Performance Chemicals operations are rising sequentially in the fiscal third quarter, the rate of increase is less than anticipated.

Following a challenging March quarter in the Performance Chemicals division, the company is not witnessing the expected rate of recovery in China. In addition to the slowdown in China, the company continues to observe weaker demand across several of its main end industries, including construction and consumer applications, on a global basis. Given these circumstances, CBT now expects EBIT in this segment to be slightly higher in the fiscal third quarter than in the second quarter.

Volumes in the Reinforcement Materials segment were down 8% year over year in April and May 2023, with declines across all regions, particularly in the replacement tire market. Despite the challenging demand climate, Cabot is experiencing the anticipated quarterly year-over-year improvement in pricing and product mix from its Reinforcement Materials customer agreements for the calendar year 2023. The company anticipates these pricing and product mix benefits will result in substantial year-over-year improvement in segment EBIT results in the third and fourth fiscal quarters.

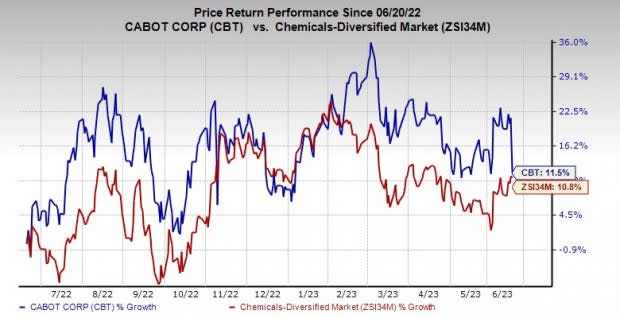

Shares of Cabot have gained 11.5% over the past year compared with a 10.8% rise of its industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

CBT currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks to consider in the basic materials space include Koppers Holdings Inc. KOP, AngloGold Ashanti Limited AU and Linde plc LIN. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Koppers currently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for current-year earnings for KOP is currently pegged at $4.40, implying year-over-year growth of 6.3%. It has a trailing four-quarter earnings surprise of roughly 13.64%, on average. KOP has gained around 55.3% in a year.

AngloGold Ashanti currently carries a Zacks Rank #2. The Zacks Consensus Estimate for AU’s current-year earnings has been revised 22% upward in the past 60 days. The consensus estimate for current-year earnings for AU is currently pegged at $1.94, suggesting year-over-year growth of 50.4%. AngloGold Ashanti’s shares have surged roughly 51.6% in the past year.

Linde currently carries a Zacks Rank #2. The Zacks Consensus Estimate for LIN’s current-year earnings has been revised 3.8% upward in the past 60 days. Linde beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 6.9% on average. LIN’s shares have gained roughly 29.1% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AngloGold Ashanti Limited (AU) : Free Stock Analysis Report

Cabot Corporation (CBT) : Free Stock Analysis Report

Koppers Holdings Inc. (KOP) : Free Stock Analysis Report

Linde PLC (LIN) : Free Stock Analysis Report