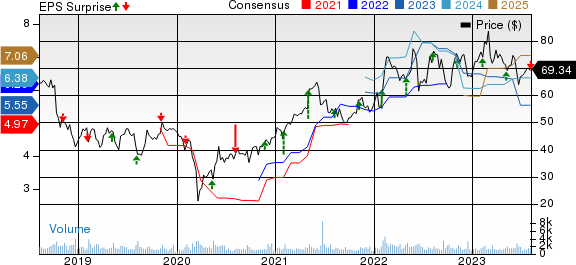

Cabot (CBT) Q3 Earnings & Revenues Miss Estimates, Fall Y/Y

Cabot Corporation CBT recorded third-quarter fiscal 2023 (ending Jun 30, 2023) earnings of $1.43 per share, down from the year-ago quarter's earnings of $1.69.

CBT posted adjusted earnings of $1.42 per share, down from the year-ago quarter's figure of $1.73. Adjusted earnings lagged the Zacks Consensus Estimate of $1.56.

The company’s net sales in the third quarter were $968 million, which missed the Zacks Consensus Estimate of $1,145.3 million. Net sales decreased around 15.8% from the prior-year quarter.

Cabot Corporation Price, Consensus and EPS Surprise

Cabot Corporation price-consensus-eps-surprise-chart | Cabot Corporation Quote

Segment Highlights

Reinforcement Materials’ sales decreased around 14.5% year over year to $624 million in the reported quarter. It lagged our estimate of $683.2 million. Earnings before interest and tax (EBIT) in the segment were $132 million, up around 17% from the year-ago quarter. The upside can be attributed to improved unit margins from higher pricing and better product mix in the calendar year 2023 customer agreements, which were partly offset by lower volumes.

In the reported quarter, sales in the Performance Chemicals division declined 18% year over year to $307 million, falling short of our projection of $443.2 million. EBIT also witnessed a substantial drop of approximately 49% to $32 million, primarily attributed to reduced volumes and an unfavorable product mix, largely stemming from challenges in key end markets. The most significant volume contraction was observed in the fumed metal oxides product line.

Financials

Cabot had cash and cash equivalents of $220 million at the end of the quarter, down around 5.7% year over year. The company’s long-term debt was $1,093 million.

Capital expenditures in the reported quarter were $80 million.

Cash flow from operating activities was $243 million in the quarter.

Cabot paid $23 million of dividends and repurchased shares worth $15 million in the reported quarter.

Outlook

The company expects steady sequential volumes and strong EBIT growth year over year in Reinforcement Materials due to pricing and mix benefits in customer agreements. For Performance Chemicals, it expects stable sequential volumes in major product lines, with moderate growth in battery materials and inkjet. Pricing pressure in China's EV value chain is expected to affect battery materials in the short term. CBT expects EBITDA results for fiscal 2023 to be lower than its earlier communicated guidance range. Fiscal fourth-quarter adjusted EPS is projected to be in the range of $1.40 to $1.55, leading to a full-year range of $5.13 to $5.28.

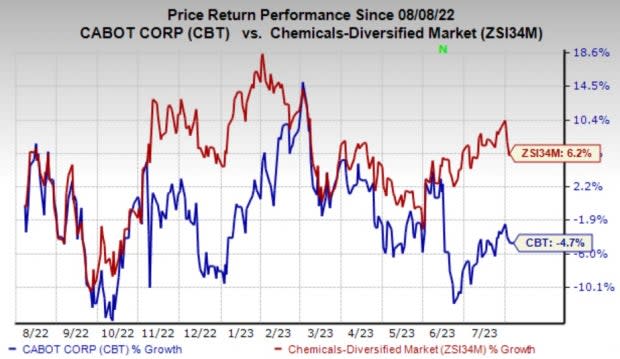

Price Performance

Shares of Cabot have lost 4.7% in the past year against a 6.2% rise of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Cabot currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Basic Materials space are Carpenter Technology Corporation CRS and PPG Industries, Inc. PPG, both sporting a Zacks Rank #1 (Strong Buy), and ATI Inc. ATI carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The earnings estimate for CRS’s current year is pegged at $3.36, indicating year-over-year growth of 194%. CRS beat the Zacks Consensus Estimate in all the last four quarters, with the average earnings surprise being 10%. The company’s shares have rallied 79% in the past year.

The Zacks Consensus Estimate for PPG’s current-year earnings has been revised 3.5% upward in the past 60 days. PPG beat the Zacks Consensus Estimate in three of the last four quarters. It delivered a trailing four-quarter earnings surprise of 7.3% on average. The company’s shares have risen roughly 11.7% in the past year.

The earnings estimate for ATI’s current year is pegged at $2.25, indicating year-over-year growth of 13%. ATI beat the Zacks Consensus Estimate in all the last four quarters, with the average earnings surprise being 3.4%. The company’s shares have rallied 54% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ATI Inc. (ATI) : Free Stock Analysis Report

PPG Industries, Inc. (PPG) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Cabot Corporation (CBT) : Free Stock Analysis Report