Cabot (CBT) Unveils REPLASBLAK Masterbatch Product Family

Cabot Corporation CBT has launched its new REPLASBLAK product range of certified circular black masterbatches. It has announced three products as the company's first-ever International Sustainability & Carbon Certification (ISCC PLUS) certified black masterbatch products powered by EVOLVE Sustainable Solutions with this launch.

The EVOLVE Sustainable Solutions technology platform is intended to offer products with sustainable content and dependable performance at an industrial scale. It will provide sustainable reinforcing carbons and other performance materials in three categories of sustainability — recovered, renewable and reduced.

Increased environmental challenges are driving increased demand for black masterbatch solutions that promote a circular, sustainable economy while lowering greenhouse gas (GHG) emissions in a variety of industries, including automotive, agricultural, packaging and construction.

This REPLASBLAK portfolio advances the sustainability journey by developing innovative products and processes that improve the environment. Cabot has the resources and knowledge to develop creative solutions that help customers solve their sustainability concerns while meeting Cabot's sustainability objectives as the leading global maker of black masterbatch.

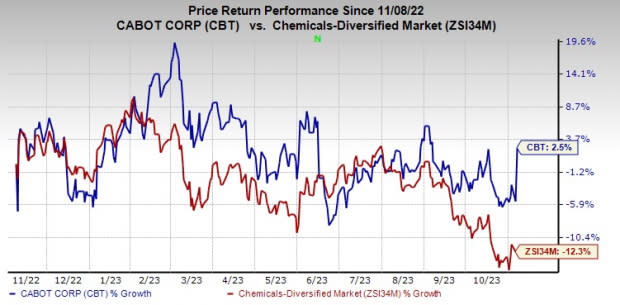

Shares of Cabot have gained 2.5% over the past year against a 12.3% decline of its industry.

Image Source: Zacks Investment Research

Cabot, on its fourth-quarter fiscal 2023 call, said that it expects the challenging macroeconomic situation to continue in fiscal 2024, particularly in the near term.

Despite the challenging environment, the company expects adjusted EPS in the range of $6.30-$6.80 in fiscal 2024, led by sustained growth in the Reinforcement Materials unit. Furthermore, assuming stable feedstock prices, the company projects solid operating cash flow driven by strong EBITDA.

Cabot Corporation Price and Consensus

Cabot Corporation price-consensus-chart | Cabot Corporation Quote

Zacks Rank & Key Picks

Cabot currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the basic materials space include Carpenter Technology Corporation CRS, Axalta Coating Systems Ltd. AXTA and The Andersons Inc. ANDE.

Carpenter Technology has a projected earnings growth rate of 213.2% for the current fiscal year. It currently carries a Zacks Rank #1 (Strong Buy). CRS delivered a trailing four-quarter earnings surprise of roughly 14.3%, on average. The stock is up around 69.1% in a year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Axalta has a projected earnings growth rate of 5.4% for the current year. It currently carries a Zacks Rank #2 (Buy). AXTA pulled off a trailing four-quarter earnings surprise of roughly 6.7%, on average. The stock is up around 17.3% in a year.

Andersons currently carries a Zacks Rank #1. The stock has gained roughly 37.7% in the past year. ANDE beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 64.4%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Cabot Corporation (CBT) : Free Stock Analysis Report

Axalta Coating Systems Ltd. (AXTA) : Free Stock Analysis Report